Rorschach on Economics

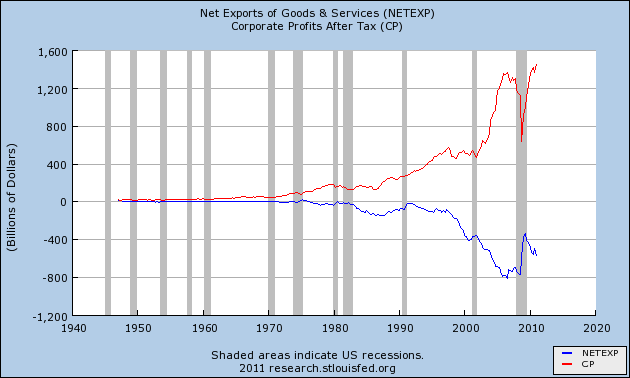

Someone (sorry I’ve forgotten who it was) emailed to get my reaction to this chart posted on Zero Hedge:

The obvious “fight the power” reaction to the above is to say, “Those traitorous One World banksters! They outsource manufacturing jobs in order to fatten their own bottom line.”

But that’s not necessarily what’s going on. Since 1991, I would say what’s happening is that we’re seeing two big boom periods–during which the trade deficit went up, as well as corporate profits–that then collapsed and reversed the patterns. (Notice how the lines move when they cross the gray recession bars.)

Keep in mind that a current account deficit (which is a broader notion than trade deficit, but you can use the terms interchangeably for our purposes) is the flip-side of a capital account surplus. So if the Fed fuels an artificial boom, such that assets prices in the US are rising, then foreigners want to get a piece of the action. On net they want to buy more US assets, than Americans want to buy of foreign assets. The only way that is possible is if the US runs a current account deficit. Intuitively, as US stocks, real estate, etc. are booming in market value, Americans are willing to sell off more of them (in absolute dollars) and use the proceeds to import more TVs, cars, and other goodies from foreigners as payment.

Great post Bob. You’re interpretation of the graph makes so much more sense than any other possible interpretation.

It was me who sent you that graph. Good analysis, by the way.

Oh yeah, I forgot. One of the concerns that I had when I sent you that graph had to do with current monetary policy, that what I am hearing from the mainstream is that a cheaper dollar will increase exports. However, if we take that policy, and it does increase exports, won’t that also increase the repatriation of dollars held by foreign nations, thus further decreasing the dollar’s purchasing power?

Joseph,

I think you are confusing a decrease in the quantity of dollars demanded (based on an increase in their supply) with a decrease in the demand for them. In the former case, the demand curve does not change, in the latter case the demand curve shifts.

It does not follow that an increase in the supply of dollars will cause the demand curve to shift (which I think is what you are getting at with your comment on the repatriation of dollars).

I was thinking more in terms of why countries hold foreign reserves, that they only do so to spend those reserves at some point, and that buying exports from the issuer’s country seems to be the most logical. Dollars from Y sitting in X country’s account don’t do much good to them unless they can spend them on goods from Y country. It isn’t like foreign nations have a great demand to hold dollars just for the sake of them being dollars, because dollars don’t provide utility in and of themselves; they have to spend them at some point. And, if we attempt to increase exports by shifting the current exchange rates (cheapening the dollar vs foreign currencies), then I can only imagine that that would be the optimum time for foreign nations to use those dollars to buy US goods.

This is not to say that I think making the dollar cheaper will necessarily translate into greater exports, only that current policy indicates that that is the plan, and that I see the tremendous dollar reserves held by foreign nations as a problematic to this policy (if it is successful in increasing exports).

Also, just a gut feeling and/or opinion, no facts to back it up. I think that it is more likely that foreign holders of US dollars will be more apt to purchase domestic assets and capital in greater proportions that US exports.

I’d argue that the graph as a whole is confusing. Firstly, when you consider inflation, the dollars in 1970 were a whole lot bigger than the dollars in 2010, so the right hand side of the graph artificially looks much bigger than the left hand side of th graph. If we could agree on a reasonable measure of inflation, then the graph would make more sense adjusted for inflation.

Beyond that, the US economy is genuinely bigger in 2010 than it was in 1970, even beyond the nominal expansion caused by inflation. Probably the best way to clean it up even further would be to make it per capita (i.e. divide by population).

“Those traitorous One World banksters! They outsource manufacturing jobs in order to fatten their own bottom line.””

This isn’t just about outsourcing. IBM introduced the PC to the world during this time period, pushing productivity higher. IBM deserves as much (or more) credit to the productivity gains and corporate profit gains than outsourcing. Of course, fiscal policy during this time period (higher taxes on labor, lower taxes on capital) distorted returns which accumulated more and more to capital at the expense of labor over this time period. But that’s a different topic for a different day.

“So if the Fed fuels an artificial boom, such that assets prices in the US are rising, then foreigners want to get a piece of the action”

This is nonsense and you have the relationship backwards. Foreign countries don’t accumulate trade surpluses so they can “get a piece of the action” of US asset bubbles. If this were the case, then why are most trade surpluses invested in treasuries? But hey, maybe the Fed started the Chicago fire as well.

“On net they want to buy more US assets”

Because otherwise their currency would rise if the trade dollars were repatriated back to local dollars, hurting exports. Export economies like to export. This is not sustainable.

“The only way that is possible is if the US runs a current account deficit”

And if the US private sector wants to save, the current account deficit must be offset by a public deficit.

http://blogs.ft.com/gavyndavies/files/2010/12/ftblog52.gif

This explains why the private sector credit bubble accelerated during the 90’s as the fiscal deficit moved closer and closer to balanced, and ultimately to a brief surplus.

“Americans are willing to sell off more of them (in absolute dollars) and use the proceeds to import more TVs, cars, and other goodies from foreigners as payment.”

You have this relationship backwards.

“then why are most trade surpluses invested in treasuries?”

Oh, you mean our largest export? Those treasuries? They have to do something with those dollars, they can’t sit on them forever.

AP Lerner wrote:

[Bob Murphy:] “Americans are willing to sell off more of them (in absolute dollars) and use the proceeds to import more TVs, cars, and other goodies from foreigners as payment.”

You have this relationship backwards.

So the reason the stock market and housing market collapsed, was that Americans suddenly decided they didn’t want to buy as many cars and TVs from foreigners?

Did you sell your house so you could buy a TV from Wal-Mart?

Wal-Mart goes to a Chinese factory and says build me 1 million TV’s at half the cost I can make them in the United States. The Chinese factory says sure, we have this large crop of folks that are willing to work for $1 a day. TV’s are cheaper thanks to cheap Chinese labor, so Americans have more funds to put to other productive uses, like Wal-Mart Stock. Yay! Productivity gains

The Chinese have all these USD’s, which are completely worthless in mainland China but if they convert them back to Yuan, their currency appreciates vis a vis the USD. So the Chinese must keep those USD’s as USD’s to subsidize the export industry with a lower currency and to keep its people poor but employed. So they decide to buy some Wal-Mart stock since they know the company so well. Yay! Higher stocks

Americans are very pleased by this arrangement since the higher productivity allows the price of TV’s and other goods to fall. Yay! Deflation

Uh oh, Bill Clinton raises taxes on middle class Americans shortly after Ron Reagan raised taxes on middle class Americans all because they have some phony fear of the US government becoming insolvent. Double boo on higher taxes and ignorance towards monetary/fiscal operations.

Americans buy fewer TV’s from China via Wal-Mart because their tax burden has increased. Boo, higher taxes.

Next, the US government cuts back on spending on goods and services that many Americans relied on for employment and income under Bill Clinton. Boo, evil Bill Clinton.

Now Americans have even fewer funds to buy not only TV’s from the Chinese via Wal-Mart but they also have fewer funds to buy Wal-Mart stock thanks to the evil Bill Clinton. Boo, evil Bill Clinton.

Now the Chinese have fewer USD’s since Americans are buying fewer TV’s from them via Wal-Mart. Boo, evil Bill Clinton.

After having his taxes raised for nearly a decade and not seeing any productivity gains accumulate to him thanks to a fiscal policy that heavily favors capital over labor, middle class American becomes fed up and decides to increase his income the only way he can: he borrows to buy more TV’s from China via Wal-Mart. The American consumer, Wal-Mart stock, and the Chinese are all very pleased by the consumer borrowing Yay! Greenspan

The higher tax burdon and lower (negative) consumer savings goes on for so long that eventually the public sector deficit turns into a surplus, partially due to higher middle class taxes. Boo, surplus.

By now evil Bill Clinton is out of office and there are high hopes for George Bush to lower middle class taxes so they can have more funds to consume TV’s from China via Wal-Mart and to buy more Wal-Mart stock and not have to borrow so much. Yay! George Bush.

However George Bush does nothing for middle class folks and does little to relieve middle class tax burdens. Boo, George Bush.

Middle class American loses all hope for getting a raise and a high paying job since he as no political connections to get subsidized by the federal government or on Wall Street, but who cares, he can just borrow some more. Yay! Bernanke

But of course, at some point middle class American can’t borrow anymore, and can’t buy anymore TV’s from China via Wal-Mart. And since middle class American can’t buy anymore TV’s from China via Wal-Mart, and since he can’t buy anymore Wal-Mart stock with his excess funds, and since China has fewer worthless USD’s to buy Wal-Mart stock with, Wal-Mart stock falls. Boo, lower stocks.

How did I do?

🙂

“Did you sell your house so you could buy a TV from Wal-Mart?”

Well, plenty of people took loans out against their appreciating houses so they could buy TV’s from Walmart.

Another reason to abolish the fiat funny money system. The only reason housing prices rose was because they were bid-up with new funny money. When the MMTers say surpluses cause depressions, they would be better off saying high taxes cause depressions or at least they impair wealth accumulation. Without the funny money to borrow, the borrowers’ relative poverty would have been plain to see by both the borrowers and the lenders and the loans would not have been made. The funny money made it seem as if everyone was richer than they actually were and people acted accordingly until reality set in later.