Final Thoughts on MMT

[UPDATE below.]

I kept telling myself that I didn’t have a problem, that I could stop reading the comments in this post whenever I wanted. Well I think I need to go cold turkey. So let me make three main concluding points:

POINT #1: The accounting identities don’t prove the things that the MMTers think they prove, at least not by themselves. They must be supplemented with a particular macroeconomic theory. Rival theories, which yield the opposite conclusions, are just as consistent with the accounting identities.

That was of course the main point of my Mises article, but in the comments at the blog discussion, “MamMoTh” unwittingly illustrated it beautifully. Commenter Eli was arguing with Mammoth, saying that regardless of the government’s behavior, the private sector could save more if it just reduced its consumption.

Mammoth disagreed, saying: “Any individual can adjust his/her saving/consumption ratio. But the whole private sector can reduce consumption, which will reduce income but leave savings unchanged.”

To drive home the point with math, rather than mere words, Mammoth then wrote:

Income:

Y = C+I+GSavings:

S=Y-C-T

=I+(G-T)So consumption does not affect aggregate savings.

But in Eli’s framework, when consumption goes down, investment goes up, and Y stays the same. That is totally consistent with the first equation above. Mammoth looks at Y = C+I+G and thinks a drop in consumption is handled by a drop in Y, but it could just as well be handled by an increase in I.

And so then in the reduced form, where S = I + (G-T), when I goes up, savings can go up on the left hand side to keep the equation balanced.

POINT #2: Neither the Austrians nor the Keynesians deny that the Fed could print whatever amount of money is necessary, in order to avoid a technical default on government bonds. We are saying that it’s possible this would cause large price inflation, and that’s why it’s dangerous for the government to run huge deficits year after year.

In several places, the MMTers took umbrage when I (repeating Krugman) said that they believed “deficits don’t matter.” They came back and said yes government budget deficits do matter, but not because of “solvency” issues, rather because of the purchasing power of the USD.

If that’s really the argument, then we can all shake hands and go home. Krugman acknowledges that in his critique of MMT:

[O]nce we’re no longer in a liquidity trap, running large deficits without access to bond markets is a recipe for very high inflation, perhaps even hyperinflation. And no amount of talk about actual financial flows, about who buys what from whom, can make that point disappear: if you’re going to finance deficits by creating monetary base, someone has to be persuaded to hold the additional base.

If you don’t believe me, I encourage you to go back and re-read his post. Krugman isn’t saying, “Deficits eventually matter, once we get out of the liquidity trap, because Uncle Sam might default if he gets in over his head.” No, Krugman specifically concedes that the Fed could just monetize all the debt. His point is, that could lead to runaway price inflation.

Now maybe Krugman is wrong for thinking that, but you don’t advance the argument by saying, “A government issuing its own currency can’t go insolvent.” Nobody is denying that.

POINT #3: Even in its textbook version, “crowding out” is consistent with higher private sector saving. What is being crowded out is private investment.

In a completely unrealistic, everybody-is-a-rational-robot Chicago School model, when the government [UPDATE: A few minor edits because it matters whether the government deficit is due to a tax cut versus a spending increase…] doesn’t raise taxes and yet increases deficit spending maintains its current spending level but gives a deficit-financed lump sum tax rebate, that will cause taxpayers to save more, in order to pay for the higher taxes down the road needed to finance the additional debt. OK, so MMTers aren’t at all scoring points against the “crowding out” hypothesis by showing that private sector savings rates went down during the Clinton surplus years, and up during our recent period of massive government deficits.

Now if we relax the perfect Ricardian equivalence, a more real-world scenario in which “crowding out” occurs, goes like this: The government runs a deficit and thus increases the demand for loanable funds. This pushes up interest rates higher than they otherwise would be. People expect higher taxes, and so they save more, which partially offsets the interest rate hike. However, the effect isn’t perfect, and on net interest rates are higher than they otherwise would be. Therefore private business invests less. In effect, the government has diverted some of the private sector savings that would have gone into private investment, and instead it is being spent as G, not I.

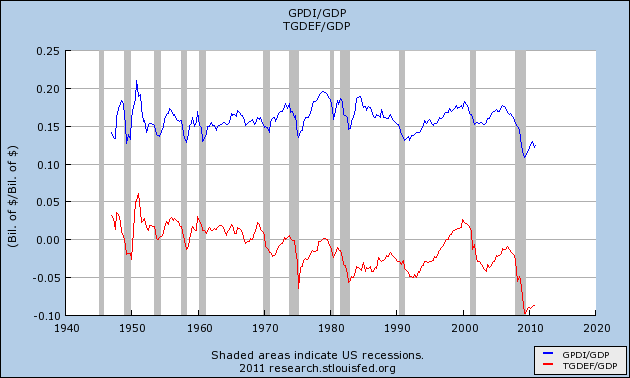

The data are totally consistent with that interpretation. The following chart shows Gross Private Domestic Investment as a share of GDP (top line), versus “net government saving” as a share of GDP (bottom line). Note how they move in close tandem. When the government deficit shrinks, private sector investment goes up. When the government deficit balloons, private sector investment collapses.

So look, I can use the same sectoral balance equations, and I can point to empirical data going back decades, which incorporates periods of government surpluses and massive deficits. The MMT crowd should stop thinking they have a monopoly on accounting truisms and historical evidence.

Bob Murphy,

Thanks for the posts BTW. I think it’s a shame that the discussion has to be so heated, can’t we all just get along?

I should add the following disclaimer: I’m not an MMTer, I’m just a student who is sympathetic to MMT views.

>The accounting identities don’t prove the things that the MMTers think they prove, at least not by themselves. They must be supplemented with a particular macroeconomic theory. Rival theories, which yield the opposite conclusions, are just as consistent with the accounting identities.

I agree. The accounting identities do not say anything by themselves. You need theory to interpret them, and decide the significance of them, whether they make sense, and the causality.

>Mammoth looks at Y = C+I+G and thinks a drop in consumption is handled by a drop in Y, but it could just as well be handled by an increase in I.

Is this how you interpret the equation Bob? This is my interpretation, I’d be interested in reading what you and others have to say.

I would argue that a decrease in C may initially not see a drop in Y due to an increase in I, but this is not a stable situation as those investments will invalidate those expectations of profit, which will lead to a reduction in investment in the future. Eventually Y will decrease.

On a related point to this, MMTers argue that the private sector is current deleveraging (repair its balance sheet). If this is in fact occurring and assuming a closed economy, what impact would a government surplus have upon this adjustment process?

>Now maybe Krugman is wrong for thinking that, but you don’t advance the argument by saying, “A government issuing its own currency can’t go insolvent.” Nobody is denying that.

Then why is there is outcry that the US government may default? Why isn’t the political discourse dominated by the actual impact that the deficit is having upon the real economy and the possibility of inflation? Related to this is that government financing is dependent upon bond markets, and that without their commitment the ‘finance’ government spending, then the US government would default. What MMT says is that, the US government is the monopoly issuer of its currency, the terms ‘financing’ spending is inapplicable because the government isn’t a user of currency. Bonds do not function to ‘finance’ government spending, rather than are used to assist the central bank in maintaining its target rate. The government may believe that it is vulnerable to bond markets, but MMT sees it in reverse, the US government is providing corporate welfare by providing a place where entities can park their ‘reserves’ and earn interest on a risk-free financial asset.

>The government runs a deficit and thus increases the demand for loanable funds. This pushes up interest rates higher than they otherwise would be.

I’d like to first add that MMTers (and Post Keynesians) reject the ‘loanable funds theory’ of interest rate determination.

Allow me to get express a few MMT points. Mistakes are my own:

1.The central bank has a monopoly on reserves, it can either set the quantity and allow the price to float, or set the price and allow the quantity to float. In practice central banks set the short-term price and they allow the quantity to float, this is why central bank papers will say something along the lines of “the central bank set the short-term rate and provides the necessary amount of reserves to maintain that rate.

2.the banking system cannot create nor destroy reserves, it can only shift them around.

3. If the banking system is deficient (excess) in reserves, then the overnight rate will drop to zero (increase indefinitely, with no way for the system to clear). On this last point, banks are interest-rate inelastic, they will continue to bid up the price, in order to clear their accounts, if there is insufficient reserves, then the price will be bid up until it spills out into the payment system.

4. Banks are not constrained by the quantity of reserves, rather they are constrained by access to creditworthy customers, and in the short term capital. When a bank creates a loan a watching deposit is also created.

5.When a government runs a deficit this has the potential to put the banking system in an excess reserve position. Coordination with the central bank and treasury is necessary to offset the ‘reserve effect’ on the overnight rate. The same situation applies when the government runs a surplus, there is potential for the banking system to be deficient in reserves, to prevent the upward pressure on the overnight rate, the central bank provides the necessary amount of reserves. In practice this coordination between the treasury and central bank occurs almost daily. Another tool that the central bank has is in manipulating Tax and Loan accounts.

6.In a corridor system which is currently in operation in the US and has been in operation few a year in other countries. There is arguably less of a need to engage these operations.

7.When announcing a new target rate central banks in practice simply announce a new rate, and the private sector follows, there is no manipulation of the quantity of reserves (unless the central bank is defending its rate).

In this framework there is no fixed pool of savings which governments borrow and hence push up interest rates. So long as the central bank wishes to maintain its target rate, it will accommodate whatever potential impacts this may have. keep in mind to that the exact same argument can only be made about government surpluses.

If we are in a situation where the economy is operating at or close full capacity, then we can expect government spending to crowd out private investment, but this situation is referred to as ‘real resource crowding out’ and differs from the ‘financial crowding out’ that you have mentioned.

>The data are totally consistent with that interpretation.

The exact same arguments surrounding the identities and need for theory to interpret them applies here. All you have shown is a correlation in the data. Theory is required to interpret what is actually happen, whether the correlations are spurious and the causality.

I can interpret that data to say:

When the private sector recovers, expectations on the profitability of investment plans resume. The successful realisation of these investments, causes income to increase, which increases government revenues and which causes the government deficit to reduce or turn to surplus.

It seems as if you’re assuming that the government budget is solely at the discretion of the government. I would argue that the government budget is predominantly an endogenous variable, so when private sector conditions improve (increased investment) we would expect the government budget deficit to reduce and return to surplus.

re: A quick point on the crusoe model:

If you want to convince MMTers that they are wrong you may need to use another model. The crusoe model is not going to go down well, firstly, because MMTers distinguish between barter models and monetary production models, and secondly, because in the crusoe model you are implicitly assuming a long-run equilibrium where resources are fully utilised. MMTers start from a point where the economy is not operating at full capacity, there are idle resources, such as labour, and more importantly at this point the direction of causation changes for a number of variables, for instance, they assume that causality of investment and savings, goes from investment to savings. They don’t assume that there is a coordination mechanism which will automatically bring the economy to full capacity. In saying that, they do accept that a credit expansion in the private sector may push the economy towards full capacity, but that this leveraging has the potential to be unsustainable – particularly when that credit is directed towards unproductive activities and investments.

Sorry about the length. I’ll try and digest your previous post, but keep in mind I’m not an economist, so it may all go over my head. The other point too is that there’s been a few other posts on MMT by various economists, which are ‘crowding out’ yours 🙂

mdm, see below.

I didn’t say a drop in C leads necessarily to a drop in Y.

Eli did say that you could lower C to keep your saving under the mattress.

That’s what leads to a drop in Y.

Somehow Bob chose to misrepresent both positions. He is the one who has to tell us why.

Here’s the original thread:

http://consultingbyrpm.com/blog/2011/05/my-critique-of-mmt.html#comment-15838

Amazingly, I actually agree with you. MMT is a light religion. It’s far more intelligent than Austrianism and at least tries to be empirical and is adhered to by some real economists, but it’s just an accounting identity posing as a theory.

Some stupid, crazy economic theories listed in order of ridiculousness:

1. Austrian

2. Marxism

3. Real Business Cycle Theory

4. MMT/Chartalism

1. and 3. at least have redeemable, usable elements to them.

4, may but I have yet to be informed of what those elements are.

If you want to be informed about it, this is definitely not the right place.

Nobody is stopping you from enlightening us.

I am not the right person to enlighten anyone.

Check:

http://moslereconomics.com/mandatory-readings/

Surely you can name an element of MMT of redeemable value on your own – you don’t need to point me to a reading list for that. Not all Austrians are able to enlighten me about the Austrian school, but if I asked “what is a redeemable element of the Austrian school” every one of them ought to be able to answer “a time structure of production”.

lol Time structure of production? What exactly is that model, or give me an example of one, the data that supports it, and why it’s useful.

Do these conversations ever go anywhere?

>Surely you can name an element of MMT of redeemable value

Some redeemable feature of MMT would be their description of the operations which occurs between the central bank, treasury and the banking system, and bank operations, the loan creation process.

The stock-flow models of MMT (which you can find in a book by Godley and Lavoie called Monetary economics) is a huge break away from the current models being taught.

What I personally like is their descriptive approach to monetary operations.

A quick intro is:

http://moslereconomics.com/2010/04/04/tom-hickey-on-mmt/

And a deeper one:

http://pragcap.com/resources/understanding-modern-monetary-system

That was too snarky – sorry.

Let’s leave aside this accounting identity stuff and presume that you think there ought to be more to it than G-T=S-I. What is redeemable that I can take away from you guys?

These idiots are wasting your time with accounting identities and you apologize?

This is a big reason why economics is in awful shape. Economists are too kind to kooks, idiots, and idiotic kooks, who don’t even take an empirical approach. What can you do with someone who doesn’t understand science?

Would the average physicist even pretend to have a serious conversation with someone who rejected general relativity or quantum mechanics, without any scientific reasoning and presented instead some kind of anti-scientific “theory” as an alternative? Worse, what if the kook in question had the nerve to be arrogant his his/her ignorance? lol

Let’s stop pretending like it’s okay to rehash the same old discussions about whether prices are sticky and the implications, for example. At what point do we say that we can move on in the conversation?

Idiot, kook, moron, blah blah blah, idiot, moron, kook.

I thought I would save you some time for your future posts. You can just copy and paste that now.

Oh, and with MMT, the only thing I have to say is, show me your model and data. I’m not interested in anything else.

What MMT literature are you familiar with? Have you looked at their stock-flow consistent models?

Daniel,

Give me one example of a uniquely useful element of Austrianism?

Stealing is bad for the economy.

What units of ‘ridiculousness’ are you using?

why are you immersing yourself in stupidity? We are talking about crazyness and stupidity, not just ignorance. Don’t you know that stupidity is incurable?

re: “But in Eli’s framework, when consumption goes down, investment goes up, and Y stays the same.”

And this is the sort of instance where I might start agreeing with the MMTers in pointing out that this is an atrocious assumption to make.

The point remains, of course – accounting identities are not behavioral laws.

Why is that an “atrocious” assumption?

Suppose Mr. X currently invests half his income, and consumes the other half. Now suppose he consumes less, and invests equivalently more, heck to make it easy imagine him consuming $1 less and investing $1 more.

Is this really an “atrocious” scenario? It’s not mathematically possible? It violates some absolutist equation?

Nothing atrocious about the assumption itself. Just that he kept changing assumptions in the thread.

That’s not what Daniel said. He said, unequivocally, and without caveats, that it was an atrocious assumption

That’s why I say there is nothing atrocious with the assumption itself. I disagree with Daniel.

My comment was directed at Daniel’s comment. I am not sure what you are adding here.

Because it doesn’t always hold true! Sometimes it does. There’s nothing necessary about it. We ought to be able to countenance a circumstance where it is true, but we ought not assume it is.

Because it doesn’t always hold true! Sometimes it does. There’s nothing necessary about it.

Granted, but Eli never actually said it was necessary. He merely gave a possible scenario.

Daniel,

Bob’s paraphrasing of my argument is a bit misleading.

Obviously an exogenous shock can cause a fall in Y, C, and I. My point was that with a given income, what doesn’t get consumed gets saved. MamMoTh was arguing that income depends on consumption, I was arguing that it is the other way around.

If you disagree, let’s hear why.

No Eli. I was arguing that in the case YOU gave of someone consuming less in order to stash it under the mattress, then all other things equal, income falls. And that is a fact.

Money income would fall, but not necessarily “income”, ebacuse “income” is not well defined.

Daniel,

re: “But in Eli’s framework, when consumption goes down, investment goes up, and Y stays the same.”

And this is the sort of instance where I might start agreeing with the MMTers in pointing out that this is an atrocious assumption to make.

Suppose my income is 100 and I consume 40 and invest 60. If I reduce my consumption by 20, I will be consuming 20 and investing 80. Y will be unchanged.

Obviously if I’m fired from my job, Y, C, and I will all fall. My point is that a fall in C does not cause a fall in Y as MamMoTh was arguing, because that portion of income no longer consumed will be saved and invested.

Please point out what you think is “atrocious”.

No, *I* wasn’t arguing that a fall in C causes a fall in Y necessarily.

*You* gave an example where you lowered consumption in order to save, not to invest.

I showed you how that didn’t affect overall savings and net savings.

Then you said but wait, I could invest that money I am not consuming.

And I told you in that case Y would stay the same, overall savings will rise, but net savings will stay the same.

No, *I* wasn’t arguing that a fall in C causes a fall in Y necessarily.

Here are a couple quotes of yours from the previous thread:

But the whole private sector can reduce consumption, which will reduce income but leave savings unchanged.

and:

[Me]Reducing consumption does not reduce aggregate income.

[You]Yes it does all other things equal.

Income = C+I+G

You understand what all other things equal mean?

Do you understand how causality works?

I’ll make this simple because you seem to be having trouble with the concept: A fall in Y can cause a fall in C, or some exogenous factor can cause a fall in Y and C, but a fall in C cannot cause a fall in Y. This is why it’s important to understand functional relationships, not just accounting identities.

Give up.

You were the one stating that reducing consumption will increase overall savings.

You imposed the causality.

And you were and still are wrong.

You imposed the causality.

Actually *you* imposed causality when you said:

But the whole private sector can reduce consumption, which will reduce income but leave savings unchanged.

and:

[Me]Reducing consumption does not reduce aggregate income.

[You]Yes it does all other things equal..

I was simply correcting you.

No Eli. Here’s your original claim again. Everything else just follows. That”s what causality means.

The government doesn’t need to print more dollars for people to save more. People can simply choose to spend less of their income and put more of it under the mattress.

And I proved you wrong.

No Eli. Here’s your original claim again. Everything else just follows. That”s what causality means.

To reiterate for the 10th time:

You argued, in several places, that a reduction in consumption will reduce income. This is incorrect.

And I proved you wrong.

Again, if we define “private savings” as “private savings” you are wrong. Check any standard macro textbook.

Y-C-T is defined as private savings. Consult p59 of this Mankiw textbook if you don’t believe me:

http://books.google.com/books?id=B-iNoOEoSnkC&printsec=frontcover&dq=macroeconomics+mankiw&hl=en&ei=fsTKTfvoKIPZgAeP14nJDg&sa=X&oi=book_result&ct=book-preview-link&resnum=1&ved=0CFcQuwUwAA#v=onepage&q&f=false

Y = C+I+G

A reduction in consumption all other things equal causes a reduction of income by the same amount.

This is what happens with the example you gave.

Savings using Mankiw’s definition which is the same I used, remain unchanged nevertheless if you lower consumption all other things equal:

S = Y – T – C = I + (G-T)

A reduction in consumption all other things equal causes a reduction of income by the same amount.

No, it doesn’t. Explain to me, in words, how it is possible for a reduction in C to CAUSE a reduction in Y. Yes, I see your “all else equal” stipulation, but you don’t get that it is impossible, even in theory, for all else to remain equal. Income is either consumed or invested (because savings=investment as any macro textbook will tell you). Any (post-tax) income that you don’t spend on consumption gets saved and invested.

The only thing that could cause C and Y to fall simultaneously is an exogenous shock, in which case the shock — not C — would be the cause of the fall in Y.

Savings using Mankiw’s definition which is the same I used

You at several points made use of “S-I” as “net savings”, which is a meaningless concept because savings equals investment. Again, check the Mankiw book.

You gave the example of how a fall in C causes a fall in Y: someone spending less than previously from a constant income and keeping it under the mattress.

That is not an external shock. It is endogenous and it happens in the economy. It’s called a recession.

And it doesn’t affect savings.

You gave the example of how a fall in C causes a fall in Y:

My example was that a fall in C causes an increase in S, leaving Y unchanged.

someone spending less than previously from a constant income and keeping it under the mattress.

That is not an external shock. It is endogenous and it happens in the economy. It’s called a recession.

And it doesn’t affect savings.

Putting the money under the mattress increases your savings. That’s what saving means. You’re saving your money.

My example was that a fall in C causes an increase in S, leaving Y unchanged.

And you are wrong. It causes a fall to Y leaving S unchanged as proved.

Putting the money under the mattress increases your savings. That’s what saving means. You’re saving your money.

It increases YOUR savings. Not overall savings which remain unchanged.

That’s why macroeconomics is important.

And you are wrong. It causes a fall to Y leaving S unchanged as proved.

No, it doesn’t, as I already explained above.

It increases YOUR savings. Not overall savings which remain unchanged.

I can save more without someone else saving less. Consider a 2 person economy where each person has $10. Each person purchases $5 worth of goods from the other, and saves $5. The next day, each person spends $2 and saves $8. Private savings has increased without the government increasing the deficit.

OK, I see your problem is you are confusing flows and stocks.

The stock of savings remain unchanged: $10 each.

The flow of savings is 0:

S = Y-C-T

0 = 5-5-0

0 = 2-2-0

No one’s savings have ever increased.

OK, I see your problem is you are confusing flows and stocks.

The stock of savings remain unchanged: $10 each.

The flow of savings is 0:

S = Y-C-T

0 = 5-5-0

0 = 2-2-0

No one’s savings have ever increased.

The stock of *money* remains the same. The amount of it that is saved vs spent on consumption changes.

Obviously no one would dispute that in order for the private sector to have more money, the government needs to print more money. The point is that with a particular quantity of money, the private sector can reduce consumption and increase its savings without the government increasing the deficit.

What happened to the 5

last line is a typo.

I insist you are still mixing flows with stocks and that’s where the misunderstanding come from.

You are using savings as stock of savings – flow of consumption.

However the definition of savings in the flow equations is a flow!

S = Y – C – T

Means in such period my (new) savings is equal to my income – consumption – taxes for that period.

So as I showed above, savings (flow) in each period net to 0 regardless of whether you spend 5 and receive 5 or you spend 2 and receive 2.

Savings is the change in the stock of savings during the period.

So when MMTers say “private savings=public deficit”, they mean that in order for there to be more dollars in existence, the dollar-creating agency needs to create more dollars. Okay. What are the meaningful implications of that?

MMTers do understand that people can reduce their consumption and stockpile resources or invest in the production of capital goods to expand their productive capacity in the future and thereby increase their real wealth without the gov running a deficit, right?

Just for the record, this was your original claim Eli:

The government doesn’t need to print more dollars for people to save more. People can simply choose to spend less of their income and put more of it under the mattress.

Then I showed that you are wrong.

You proved him wrong only if you change the definition of saving that almost everyone else uses.

No, I used the standard definition of savings/i>.: S=Y-C-T=I+(G-T)

Savings do not depend on consumption.

Net savings do not depend neither on consumption nor on investment.

So if I take my paycheck and spend less than I take in that isn’t savings in your world? Most people on this planet would say spending less than you take in will result in savings.

It is savings.

Your savings increase but the same amount the savings of the others decrease.

Overall savings remain unchanged.

Two questions.

Why does my saving money reduce the savings of others?

You said the cure to stagflation in the previous post’s comments was “Getting rid of indexed wages and lowering taxes.”. Can you explain how that would lower unemployment and inflation at the same time?

Just to be sure we are not getting into a circular argument again, I am assuming you are referring to Eli’s original example of someone spending less in order to save more under your mattress.

However you want. I personally wouldn’t save my money in this manner but that’s not important. I’m actually more curious about the second question though.

It is quite important Dan. It makes a difference whether you just lower your spending or shift your spending from consumption to investment.

About the second question I don’t really know. Warren Mosler’s site would be a better place to ask.

It doesn’t bother you that you are supporting MMT and you don’t know how it handles stagflation? I’m not trying to be insulting but if I couldn’t find an answer to stagflation (why it happens and it’s cure) in the Austrian economics literature I would have a huge issue with the theory. I’ll check out Moslers site and see if I can find an answer.

I am not supporting MMT. Just attacking how people misrepresent it in order to discredit it.

I think there lack of an answer to stagflation does a fine job discrediting themselves.

http://mmtwiki.org/wiki/Stagflation

This was all I could find about MMT’s take on stagflation through google and Moslers site. Hopefully there is more but I wasn’t able to find anything in a quick search to even sink my teeth into. Sad, if that’s all they got.

This conversation is a masterpiece of confusion.

“Your savings increase but the same amount the savings of the others decrease.”

This is wrong. Saving (flow of) means not consuming income. Therefore savings (stock of) must also depend on consumption, both current and previous.

vimothy, the flow of savings in aggregate does not depend on consumption.

where is the confusion?

“the flow of savings in aggregate does not depend on consumption.”

The flow of saving (saving is a flow, savings is a stock) on aggregate is the aggregate flow of income less the aggregate flow of consumption.

vimothy, yes S = Y-C-T.

but Y=C+I+G

so S = I + (G-T)

the flow of savings does not depend on consumption, nor does the stock of savings.

MamMoTh,

Go and ask an MMTer who you respect to explain this to you.

The flow of saving absolutely depends on the flow of consumption. Saving is not consuming income. Aggregate saving is not consuming aggregate income.

vimothy, I showed you why it didn’t. if you disagree, show me where’s the mistake or prove me how does the flow of aggregate savings depend on the flow of consumption.

MamMoTh,

Yes, that’s why I suggested that you ask someone who understands this stuff and whose opinion respect to explain it to you. All you did was rearrange an identity.

Look, I can “prove” the exact same thing in reverse:

S = I + (G-T)

But Y=C+I+G

So S = Y-C-T.

Ta-da!

The equations are ex post identities. They don’t tell you about causality. For instance, (S = I + (G – T)) says that savings can be used to finance business investment or govt consumption. That’s all.

I don’t need to ask anything since I am sure I am right until proved wrong.

Any change in the flow of consumption as spending is equal to the change in the flow of consumption as income. That’s why the flow of savings does not depend on the flow of consumption.

The equations are neither ex-ante nor ex-post anything. They hold all the time

Fair enough. But your argument is popularly, and correctly, regarded by all schools, including MMT, as fallacious.

In fact, if I didn’t know better, I might think that you were an Austrian operated sock puppet, designed to make MMTers look bad by advancing straw man arguments.

vimothy, where is the fallacy? can you give me a counter-example?

actually the flow equations describe the flows in the economy, they don’t belong to MMT or AE.

These people don’t understand what monies are, what savings are, or what constitutes a trade.

It’s like a blind quadraplegic telling me that I don’t run well because the road is muddy.

I think this post is what’s known in Econ speak as ‘confirmation bias’

I’ll, again, give you credit for the effort Mr. Murphy. But it’s pretty clear your ideology prevents you from seeing the reality. Your charts above show this. Thanks again for the effort…you solidified the MMT position…and since you wont be checking the comments of the other post, I don’t need to comment as well…even though I’d still like to see some empirical evidence of crowding out at some point (your econ 101 text does not count!)

AP Lerner wrote:

even though I’d still like to see some empirical evidence of crowding out at some point (your econ 101 text does not count!)

What about the chart I put in this very blog post? It turned out better than even I was expecting.

If you think I’m moving the goal posts, go skim again that section of my original Mises Daily. Back then–before I had seen this chart–I was saying that the problem (if it be a problem) with “crowding out” was *not* about private sector saving; even the Robert Lucas guys think a higher government deficit can lead to more private saving (because taxpayers have to buckle down for higher future taxes).

Rather, I said that the alleged problem was that the government would be siphoning resources away from private consumption and investment. So there ya go, I showed you that relationship with a nice chart going back several decades.

Are you admitting that private sector investment will indeed go way up if the Tea Party gets its way, but that “net private saving” will go down because of the redemption of government bonds? If so, please keep that clause in all future statements. I think Tea Party people would like to know that you agree with me that their actions will cause private investment to shoot way up, as the government pays off its debt.

What about you misrepresenting my discussion with Eli Bob?

Part of the issue here Mr. Murphy is you are stuck in a loanable funds frame of mind that is taught in Econ 101 but does not apply in a fiat system. This is another example of being stuck in a gold standard mentality.

What MMT’ers realize is the banking system is never constrained by loans. Loans always create additional deposits, and deposits are never needed for a bank to make a loan. A bank will always make all loans it deems profitable up to its CAPITAL position. The reserve position is irrelevant prior to loan decision, because the bank always knows the reserve requirement will be met in a fully functioning inner bank market. This is how the banking system works in the current monetary system. I’m sure you like to call it making loans out of thin air, and sure, that’s what it is. Under the gold standard, not possible. Under today’s system, its reality. Under today’s system with a banking system not constrained by reserves and a public sector that must spend BEFORE it taxes and/or borrows the entire idea “that the alleged problem was that the government would be siphoning resources away from private consumption and investment” is simply false.

Since banks are never constrained by reserves, then how can crowding out occur?

If crowding out was occurring today, then why aren’t rates higher? Why is there such demand for corporate AND treasury bonds are oversubscribed by 3x?

All your chart above shows is private sector investment falls when tax revenue falls, which makes perfect sense since tax revenues always fall during a recession.

“Are you admitting that private sector investment will indeed go way up if the Tea Party gets its way, but that “net private saving” will go down because of the redemption of government bonds?”

No

All due respect Mr. Murphy, but your analysis is completely flawed by your lack of understanding of how a modern banking system operates under a floating fiat monetary regime. I get it; you hate fiat money almost as much as you hate taxes. And that’s great. But that’s not the reality we live in. In the reality we live in, all the Econ 101 gibberish about crowding out, Ricardian Equivalence, the money multiplier etc all held under the gold standard…but that disappeared a few decades ago. Time for updated thinking. Until Austrians understand

You claim you read up on Mosler. You must have missed this.

http://moslereconomics.com/mandatory-readings/soft-currency-economics/

incomplete sentance:

Until Austrians understand the modern banking and monetary systems, I do not see how they have anything to add to the current fiscal and monetary debate.

So if we end up in stagflation or worse you will concede defeat, right?

I’m sure that the Austrians will concede if the economy fully recovers and the Bernank can prevent high inflation while continuing to create huge sums of money.

AP

Rates are low because of the FED and QE2, the FED is buying up over 75% of new gov’t debt. So low rates are not because of a real demand for t bills, they are a result of phony demand on behalf of the FED. Take the FED out of the bond market and rates will likely go higher.

I’ll add one last comment. Time will tell the winner of this debate. Austrians believe austerity is beneficial to the economy. MMT recognizes during a balance sheet recession such as the one we arel living in today, it is not. We’ll see what happens in the UK. Austrians believe all that ‘money printing’ at the Fed will lead to (hyper)inflation, MMT recognizes the Fed does not have the authority to print money and create new financial assets (they swap assets, not create new ones). MMT sees no evidence of crowding out; Austrians have no empirical evidence.

Time will tell. Obviosly, my money (literally) is on the MMT view…the only question left in my mind is a few years from now, who is intellectually more honest to admit fault.

Again, thanks for the effort.

Austrians believe austerity is beneficial to the economy.

1. Yes but. Stopping this giant metastasized spending and printing spree will be like stopping Dark Helmet going at ludicrous speed:

http://www.youtube.com/watch?v=EuFAFPjbdy4

There would be some pain.

2. However, there is no chance that we are going to put anything resembling “austerity” into effect. Whatever happens will not be a “test” of Austrian School anything.

3. The main reason we will have inflation is because the government has and will continue to promise too much in goods and services which will not and cannot ever exist. It will attempt to satisfy these obligations with funny money because, as we all know, the government can never go broke. The MMTers think they have discovered the key to abolishing the law of scarcity.

4. The MMTers still haven’t a clue about the basic concepts of the Austrian School, a fact that I still cannot comprehend.

5. Abba Lerner is still a commie.

About 4, may I politely suggest that maybe because a moron like you put them off?

1. His side having been obliterated in this little “debate” of ours, MamMoTh appears to be grumpy this morning.

2. Here’s proof that MamMoTh does not understand (and has no familiarity with) either the concept or problems of economic calculation:

Bob Roddis says:

Economic calculation will be seriously impaired by fiat money expansions and contractions. This will more seriously impact long term projects. Basic ABCT.

Reply

MamMoTh says:

My calculations aren’t. If people are too thick and get their calculations wrong so be it.

http://consultingbyrpm.com/blog/2011/05/my-critique-of-mmt.html/comment-page-1#comment-15925

You are just making my previous point Bobby.

Actually he just showed yours is wrong.

So you let your personal feelings get in the way of trying to find truth? Yikes.

Truth? Spare me your religious views, I’m not interested.

Did you miss the graph at the bottom showing how private investment is highly correlated with net government saving?

..thanks for the effort.

Austrians believe austerity is beneficial to the economy.

Complete and utter rubbish, Austrians believe no such thing, I can’t disagree strongly enough.

Each and every individual makes their own personal decision about austerity. That is to say, they decide how hard they want to work, how much they want to consume and what their relative priorities are re. saving & investment as compared to consumption.

The concept that reducing government deficit spending somehow equates to austerity is so wrong headed it is laughable. Austrians believe that reducing government intervention in the economy is beneficial, but that is quite a different matter to austerity.

When the government deficit shrinks, private sector investment goes up. When the government deficit balloons, private sector investment collapses.

I feel like an idiot, Bob, can you (or anyone else) explain how this conclusion can follow from the information in the graph?

The blue line represents private sector investment as a percentage of GDP. The red line represents whether the budget is in deficit or surplus and by how much. When the blue line goes up, that means there is more private domestic investment per GDP; when it goes down, that means there is less. For the red line, up means the deficit is getting smaller (or the surplus larger, depending on whether you are below or above the 0 point on the chart); down means the reverse.

Now, in the above chart, the two lines tend to track each other. When the blue line is going up, usually the red line is too. When the blue line is going down, usually the red line is too. And the changes tend to be roughly proportional. Thus, as Bob said “[w]hen the government deficit shrinks, private sector investment goes up. When the government deficit balloons, private sector investment collapses.”

Thanks BA. My problem was that I thought “ballooning deficit” necessarily had to appear as an upward trend if charted in a graph, when on this graph, “ballooning deficit” means the red line trends downwards.

Yeah MF (I still think that’s funny…) I wish FRED had a series for “Government Deficit” but instead they just have “Net Government Saving.” Sort of like someone graphing “Politicians’ honest” or something…

So yeah, when the net government saving goes down, that’s the deficit going up. You can just see how the line moves (into positive territory under Clinton, and way way down under late George W. and Obama) to get your bearings.

I wish FRED had a series for “Government Deficit” but instead they just have “Net Government Saving.” Sort of like someone graphing “Politicians’ honest” or something…

That’s funny, it’s kind of what I was thinking too.

It’s like charting (in the upwards direction) how well the government can get away from not totally screwing up. “Look everyone! We were successfully able to only somewhat make your lives and the lives of your children worse off. We’ll even draw you a graph that trends upwards to show you! See? The line is moving up. That’s good, right? USA! USA!”

So yeah, when the net government saving goes down, that’s the deficit going up. You can just see how the line moves (into positive territory under Clinton, and way way down under late George W. and Obama) to get your bearings.

This reminds me. I wonder if FRED has a way to separate from it’s “Net Government Savings” the amount of money the Treasury borrows and then spends out of the Social Security Trust Fund, which makes the overall deficit look smaller than it really is. You MAY find that the trend lines match even better, plus you’d get the added bonus of showing that Clinton really didn’t run a true surplus during the 1990s.

Not checking the comments is a good way to admit one is short on arguments.

Bob can’t defend his dogma. Cullen Roche tore his argument to bits and pieces today. He proved that Murphy has no idea how the banking system works. And Bob won’t respond because he has no defense.

Cullen Roche just repeated the same fallacies.

He writes

The goal of Mr. Murphy’s initial article was to show that a modern fiat monetary system need not involve government spending in order for the private sector to save. This is nonsensical for reasons that are apparent to MMTers.

This is not nonsensical at all. The private sector can save regardless of whether or not the government is spending. As long as the government isn’t taxing people’s incomes 100%, then there is enough money available to save and invest.

Yes, the quantity of money and volume of spending would decline over time as the government taxes but spends less, or none at all, but that is not why the government is spending, and that is not what enables private savings to take place. You, and Cullen, are taking an accounting equation and you are ascribing to it a causality interpretation that doesn’t necessarily follow from the accounting equation itself.

Murphy’s economic story IS consistent with the accounting tautology. You MMTers don’t have an answer to it, so you merely poo poo it, dismiss it, and say things like “Well that is just absurd” in response to Murphy’s correct arguments that, contrary to MMT, consumption can go down while investment goes up, leaving Y unchanged, and private savings can still take place even in an economy with a gradually declining quantity of money and volume of spending, as the government runs a surplus. You MMT guys are fallaciously treating net private savings as equal to government debt.

Furthermore, the government is not spending so as to ensure the private sector can save at all, nor is it even necessary that they do run a deficit, or spend in general, in order for the private sector to save. First, the government is spending (and taxing) in order to survive, to even exist. Second, even if they did stop spending and somehow magically survived, the private sector will still be able to save out of the incomes that are earned.

It is silly to say that without the government spending, the private sector could not save. The reason why Bob used the example of a Robinson Crusoe island was to ISOLATE the pertinent actions that generate savings at all.

Cullen continues:

More importantly, those $22 dollars can ONLY come from one place – they must be spent into existence by the government of the USA. If they are never spent into existence then they never exist in the first place.

This is silly. The government doesn’t have to spend money in order to put money into existence. The Fed can create money, and then give that money to the banks in exchange for, say, worthless mortgage backed securities. The banks’ reserves will go up, and the banks can keep expanding loans themselves out of thin air using their operational capital assets as a backstop, dipping into the overnight loan market should they need additional funds because the money is continually increased by the Fed.

The Treasury cannot keep running a deficit unless the Fed keeps increasing the money supply. The causation goes Fed then Treasury, not Treasury then Fed. If the Treasury ran a constant deficit, and borrowed the difference, and the Fed stopped creating new money, then at some point, the Treasury will have accumulated so much debt that the interest payments alone will consume the entire government’s budget. Once that point is reached, the Treasury will have to stop running a deficit, or else they will go insolvent in the full sense of the term.

At that point, when the Treasury’s budget consists of 100% interest on the debt they owe, then the money supply as you MMTers fallaciously believe is controlled by the government’s spending, will cease increasing. The Treasury will thereafter not be able to spend a single nickel more. The money supply has stopped increasing, but not because the Treasury stopped increasing its spending. It’s because the Fed has stopped creating new money that the Treasury depends on to finance its deficits. If the Fed stops increasing the money supply, then the government deficits you MMTers believe is necessary to put money into the economy, will eventually collapse the government and we’d not be talking about government at all creating any money.

At the point of no more borrowing, the government will not be able to run any more deficits either. 100% of the taxes the government collects is used entirely to finance the outstanding debt whose principle sum can therefore never decline, and so they would physically only be able to spend what they take in by taxes. If the government then starts to spend less than they take in and run a surplus, then they will not only NOT stop private investment (it can still take place on a base of falling nominal prices and nominal incomes), but they will also be able to start paying off their debt principle.

The only way the Treasury could start running deficit again would be if the Fed started monetizing the Treasury’s debt again.

Cullen continues:

We don’t agree at all according to Mr. Murphy’s own commentary. First of all, the Fed doesn’t print money. And hyperinflation is a rejection of state money (the same state money that Mr. Murphy rejects the existence of – contradiction there – yes).

For the millionth time, the statement typically made by Austrian that the Fed “prints money” is a EUPHEMISM. It is a metaphor. It is not literal. Since Austrian economics is rational and logical, not dogmatic like MMT, we tend to be more understandable to those not well versed in economic theory, like the media, high schools, etc. We say the Fed “prints money” instead of “The Fed credits primary dealer accounts with additional reserves while engaging in expansionary monetary policy” because most people understand the former instead of the latter. But the meaning of both are the same. The Fed is creating new money out of thin air, which most people would, rightfully, consider counterfeiting. “Printing money” drives that fact home to avoid any doubt. Yes, it’s not technically true, but words are words, and meanings are meanings, and EUPHEMISMS are EUPHEMISMS. Cullen is criticizing Austrians on this point as if Austrians really did think the Fed printed money.

Moving on:

In an interview that is prominent on his website with Fox Business Mr. Murphy compared the US government to a shopper in a grocery store who can’t pay for all of his food and asks the store for a line of credit to be extended. This proves that Mr. Murphy is being disingenuous in his comments or just flat out doesn’t understand the fiat monetary system.

A currency issuer can never become insolvent in the currency that it issues if its debt is denominated entirely in that currency.

Here, Cullen completely misunderstand’s Murphy’s analogy. Murphy was not on Fox News arguing that the Treasury can’t pay it’s bills. He was using the grocery store analogy to represent the hubub over raising the debt ceiling and how that would allegedly cause the government to go insolvent. Murphy was countering the fear mongering claims made by Geithner and his ilk that without raising the debt ceiling, the government will default on its debt. The issue with the debt ceiling is that Congress is, rightfully in my view, stalling raising the debt ceiling. This in turn is preventing the Treasury from borrowing more from the public. IN RESPONSE to this stalling, Geithner has extended the window of paying back maturing debt to August. That is what Murphy was talking about is his analogy. In effect, as Murphy points out, all Geithner did was start running a tab with creditors, where they keep lending to the US, the Treasury doesn’t officially raise the debt ceiling, and the Treasury will start to pay back the maturing debt later on once Congress approves Geithner’s profligacy.

Murphy is not saying, contrary to Cullen’s accusation, that the Treasury can become “insolvent.” He pointed out in the video that there is more than enough tax revenue coming in to pay the interest on existing debt. He said the debt ceiling doesn’t have to be raised in order to avoid insolvency. He was taking the opposite argument at face value and then refuting it on its own terms. He wasn’t accepting the premise that the Treasury can go insolvent. It’s called the Socratic method, MMTer.

Moving on:

I covered this in the original post so I won’t belabor the point, however, Mr. Murphy attempts to prove his point by falling back on the loanable funds market.

Cullen totally misunderstands Murphy AGAIN. Murphy’s argument does not depend on, explicitly or implicitly, on the loanable funds market theory. Even if it did, that still wouldn’t make it wrong, because the loanable funds theory is correct. Cullen claims it is wrong and he cites Scott Fullwiler’s claim that

“This model (loanable funds market) is simply inapplicable to our current monetary system in which bank loans are created “out of thin air” without the requirement of prior reserve balances or deposits to “fund” the loan’s creation. Completely contrary to the loanable funds model, in fact, the vast majority of bank liabilities have been created by banks simply growing their balance sheets through loans and asset purchases.”

The bolded part is FALSE. Fullwiler, as most who are confused as to how the banking system works, conflates the operational procedures of the banks (capital asset reserve determining their size and scope of bank lending) with the effective procedure of what is enabling constant growth in lending.

The error Fullwiler and Cullen are making is that they fail to understand that the market value of capital assets is a function of their prices, and the prices of the capital assets are themselves a function of the quantity of money and volume of spending.

If the Fed stopped increasing bank reserves, then the banks cannot keep increasing their demand to buy assets to then use as their capital base, after which they then keep expanding loans out of thin air. At some point, the money the banks have to use to demand capital assets will level off. Once it levels off, they cannot then loan more money to themselves in order to use that additional money to finance the purchase more capital assets! Once the money the banking system has on deposit stops increasing by the Fed, then the banking system’s demand for everything will level off. At that point, the only way for capital asset prices to go is downward, which means the operational procedure the banks use to issue new loans will effectively result in the banks ceasing to expand any more credit.

Cullen, like you, like all MMTers, have no clue how the banking system works, because you’re all fixated and focused on government and money and only government and only money. You have an accounting tautology equation, and you think you can discern the entire monetary system from it. You guys are committing a textbook fatal conceit Hayek warned us about.

Cullen concludes:

In a modern banking system banks are never reserve constrained

This is still the same myth.

Cullen seems to not be able to think rationally enough to be able to trace out the effects of economic actions.

If the Fed stopped increasing bank reserves, then guess what? At some point, even banks continued to expand more and more credit out of thin air, using capital assets as their operational backstop, then guess what? Each bank’s redemptions, expenses, and obligations will start to threaten their ability to acquire more funds from the market. In order to continue to expand more loans, each bank will be, by economic law, forced to begin selling their capital assets, or offering lower prices for the assets they do buy, or a combination of the two. At that point, and each bank will be different in terms of size and when that point is reached, but it will be reached in equilibrium, THE PRICES OF CAPITAL ASSETS WILL EVENTUALLY START FALLING IN THE LONG RUN.

Procedurally then, banks will reduce and then eventually stop expanding credit as the market values of their capital assets stops rising. No more credit expansion is possible after that.

And WHY did this take place? It’s because the Fed stopped increasing bank reserves, that’s why. You MMTers are just too blinded by your myopic thinking that you cannot trace out economic effects over the long run. You hear bankers say they don’t care about reserves, and that seems to be enough for you to stop thinking. But Austrians don’t stop thinking, and that’s why we understand the monetary system whereas you MMTers are totally out to lunch.

You just don’t get it. Your whole argument can be debunked with one simple thought experiment.

If the US government never creates and US currency then there is no money in the banking system for anyone to use.

Think about that long and hard before writing another comment that proves you have no idea what you’re talking about.

You wasted all that time writing some neoliberal nonsense. At least try to understand the MMT position before you go wasting your entire day spewing the same dogma.

No MMTer, you’re STILL confused.

If the government never created any currency, then it would not be able to spend any currency, and the government will collapse, because without money to finance its operations, it will have to shut its operations down.

At that point, the free market will SPONTANEOUSLY generate its own currency, most probably precious metals.

Your mind is totally warped by a fallacious understanding of who depends on who. We don’t depend on the government, even if the government has control over the money supply. The government depends on us to legitimize it. Without the government spending money on weapons, their legitimacy would collapse because their entire legitimacy is based on threats of violence.

So to even contemplate a scenario of the government never spending one nickel of money into existence is patently illogical.

Economic laws overrule even governments MMTer.

You don’t get why MMT is absurd, because your worldview rests on contradiction, fallacy, and anti-economics.

MMTer,

You just don’t get it. Your whole argument can be debunked with one simple thought experiment.

Suppose there are 100 units of currency in the economy. 50 units are spend on consumption and 50 units are saved. The next day, 25 units are spent on consumption and 75 units are saved.

Bam! Increase in private savings without the government increasing the deficit.

Regarding the scenario you presented, if there were no USD, people would of course still be able to save, just not in USD. If the government stopped monopolizing currency we would probably return to a private gold standard. People would be able to freely increase or decrease how much of their gold they spent on consumption vs how much they kept in a safe or put in a bank account. Also note that when a private bank issues a commodity-backed banknote, it is not running a deficit. The bank receives gold and issues a claim for that gold redeemable on demand. The new liability is matched by a new asset, both of which are money (the banknote is actually a money-substitute, but it trades as money in the market place).

“If the US government never creates and US currency then there is no money in the banking system for anyone to use.”

You don’t need money of any description (narrow or broad) in order to save.

Not only do you not need money top save, you don’t need govt spending to create money.

I understand that there are some….shall we say, overeager…guys on the Austrian side who get a little combative in the comments too. But seriously guys, I spent some time reading several things by Mosler etc., and I stayed in the thick of the fight through about 160 comments on the other post. At this point we are moving in circles. I even post a chart illustrating my claim beautifully, and I’ve got AP Lerner saying, “I’m still waiting for evidence Bob.” So yeah, I’ve decided it’s time to move on.

Bob,

But if you stop reading the comments on the prior post, how will you know who won the “I know you are but what am I?” war Mammoth and Major Freedom are having?

Didn’t we both win? Or was it a zero-sum game?

I think it’s actually one of those “you lose just by playing” situations.

Sh*t. At least he lost.

Nah, you lost.

Hahaha

Sorry Bob, I am seriously astonished that you read all the comments in the previous posts and still didn’t get it. You studied economics right? I thought you were a smart guy. My bad. One last free lesson.

The standard definition of savings is:

S = Y – C – T = I + (G-T)

that is, income minus consumption and taxation, and it’s independent from the level of consumption.

MMT definition of net savings is:

S-I = Y – C – T – I

that is, total income minus total expenditures

Investment is someone’s expenditure, as much as consumption after all.

Hence: S-I = G-T, that is, net savings of the private sector equals the government deficit.

As agreed the flow equations are about money flows and savings not with the coconuts that grow in your backyard.

S = Y – C – T = I + (G-T)

that is, income minus consumption and taxation, and it’s independent from the level of consumption.

Do you not see how badly you’re contradicting yourself? You admit that savings depends income, consumption, and taxation, and in the same sentence say that it doesn’t depend on consumption. S=Y-C-T. If you reduce C you will increase S.

No, it doesn’t. There is no contradiction. Y depends on C so S doesn’t. That”s basic algebra. If you don’t get it go back to school..

You have the causality reversed. You are now repeating the very argument you claimed that you weren’t making several posts above.

Perhaps you should go back to school and talk to any economics professor because they will all tell you that C is not an exogenous variable, but in fact it depends on Y.

No Eli, the causality is there in the thread I linked to for anyone to check, including you.

You stated overall savings can increase if you just spend less and keep under the mattress.

It’s false, whether you accept it or not.

No Eli, the causality is there in the thread I linked to for anyone to check, including you.

You’ve clearly stated that you think a fall in C can cause a fall in Y. I’ve demonstrated numerous times why this is wrong.

You stated overall savings can increase if you just spend less and keep under the mattress.

It’s false, whether you accept it or not.

Only because MMTers have their own peculiar definition of savings. You define savings as “S-I” instead of “S”, the way everyone else does. With your definition, “net” savings will always equal zero. Even if you stow money under the mattress, you are investing it as insurance against an uncertain future.

Sure, the private sector can’t hold government bonds on net unless the government issues bonds. But it is entirely possible for the private sector to grow the purchasing power of its savings, stock up on resources, and invest in capital goods without government running a deficit.

No Eli.

You considered the example when you remove spending from consumption and stash it under your mattress.

THAT lowers aggregate income, all other things equal.

In which case overall savings remain the same using the standard definition, which is what I’ve shown you.

Ohhh, I finally understand now why you are saying I misrepresented you, Mammoth. You mean that you were only talking about a case where the saving consists of stuffing cash under the mattress?

But if that’s the case, why were you trying to beat Eli over the head with the accounting identities? Go look again and the quotations I have from me. You weren’t just saying, “This holds for cases where people save in cash balances.” You were making statements about S not being dependent on C because of the equations.

S = I + (G-T) does not depend on C, all other things equal.

Eli was the one stating you can increase savings by just withdrawing spending and stashing it under the mattress.

Of course if other things are not equal then you can’t say anything.

I am saying you misrepresented me because you did. The thread is there for anyone to check, that includes you and Eli.

MamMoTh, you’re totally confused.

The standard definition of savings is:

S = Y – C – T = I + (G-T)

that is, income minus consumption and taxation, and it’s independent from the level of consumption.

MMT definition of net savings is:

S-I = Y – C – T – I

that is, total income minus total expenditures

Investment is someone’s expenditure, as much as consumption after all.

Hence: S-I = G-T, that is, net savings of the private sector equals the government deficit.

As agreed the flow equations are about money flows and savings not with the coconuts that grow in your backyard.

All this nonsense rests on the fallacious claim that savings is cash hoarding. Savings is not cash hoarding. Saving is just not consuming. Whether or not that results in a higher cash preference is secondary. After all, one can also hold more cash by reducing their investment, and maintaining the same consumption.

Secondly, the fact that the equation shows that private net savings is equal to government deficit does not imply that government deficits are necessary for savings, investment, and economic growth to occur. “Private net savings” in the MMT world is really just another way of saying “constantly increasing government debt in nominal terms”, which by way of Federal Reserve inflation, makes it possible to even maintain a positive “net” figure in the first place, which will then result in an overall increase in the running total of debt over the long run. Without the Fed creating new money and buying government debt, the Treasury could not run a deficit in the long run. At some point, the Treasury’s increased borrowing, which finances deficits, will eventually raise interest rates, and that will start to take up more and more of the government’s budget. At some point then, they will not be able to borrow more. At that point, they will no longer be able to run a deficit, and if they ever want to reduce their interest obligations, they will have to start running budget surpluses to pay off the principle.

There is nothing fallacious.

We already agreed with Rob Murphy that the sectoral balances are about financial net assets.

If you think it is unimportant so be it. But there is no point in denying that when the government runs a surplus then the private sector loses government issued IOUs.

There is nothing fallacious.

Yes, there is, and it has been shown. Merely denying it doesn’t constitute an argument.

We already agreed with Rob Murphy that the sectoral balances are about financial net assets.

Which you totally don’t understand because the prices and hence market values of those assets themselves depend on the quantity of money and volume of spending.

You’re going in circles chasing your own tail.

If you think it is unimportant so be it. But there is no point in denying that when the government runs a surplus then the private sector loses government issued IOUs.

Nobody is denying that. It would be a good thing to have less government IOUs, because that means more private market IOUs can be had.

Okay, MamMoTh, I think Bob has already explained his reservations about them, and since I agree, I’ll state them in a different way:

Yes, you can have accounting identities that are technically true, but these don’t actually give macroeconomic insight, because any of the theories can satisfy them while still disagreeing with the core MMT thesis.

So, forget about the “saving” vs. “investment” terminology. Skip to the fundamental questions we all care about:

1) Is it possible for people to defer consumption into the future without government issuing debt? Austrians claim it is, trivially, as you can see from the coconut example. You don’t need government finance in order to save coconuts for the future. Therefore, the same should be possible in a monetary economy.

2) Is it possible for people to amplify their productivity through deferral of consumption and prudent business decisions without the government issuing debt? Austrians claim it is, through the extended Crusoe example. And in a modern economy, some of the private sector can lend to other parts of it to facilitate productivity-enhancing arrangments, even though this doesn’t show up as net “savings” outside this sector.

MMTers seem to raise ears by using terms in ways that connote things people don’t think of when they hear those terms. MMTers say, “The private sector can’t save unless the government runs a deficit.” But when you expand that claim out via MMT definitions, it is less exciting: it just means, “The private sector can’t hold government bonds on net unless the government issues bonds.”

Well, yeah, but who cares? As Bob notes, you can just as well say, “The non-Google sector can’t hold Google liabilities on net unless Google issues liabilities.” It doesn’t matter. The non-Google sector can still defer consumption into the future, no matter what liabilities Google does or doesn’t issue. The non-Google sector can still amplify its productivity through exchanges involving consumption deferrals, regardless of what Google issues.

So MMTers and Austrians agree on a few trivial things, but MMTers believe these have relevant implications for policy, while Austrians do not. Sound right?

(I’m ignoring some other important points against the MMTers here, of course, about how the bonds are paid back through taking money from the bondholders.)

Interesting points that deserve to be discussed.

Unfortunately, because of the intellectual dishonesty Bob Murphy has shown in quoting, and Eli keeps showing, I am not interested in getting into another debate however interesting it might be.

Hopefully someone else will.

These were the same points Bob originally made in his article. I certainly *hope* you already give them their deserved discussion!

I did. Bob is advising his clients to save coconuts now.

Don’t be petty. Bob did no such thing — he just pointed out, as a sort of worst-case existence proof, that it’s possible to save and invest *in the sense people care about* even if the government doesn’t run a deficit. That certainly doesn’t mean that saving or investing within a monetary economy must be in that form, just that it’s trivially possible, and hard to make impossible.

Please, extend some courtesy to those you disagree with.

Bob and I agreed that in terms of net financial assets which is what the flow equations are about I was right. and that in terms of coconuts he was right.

Turns out that would have been great advice. The price of coconuts has been soaring.

http://www.growthcompany.co.uk/news/1309913/lees-warns-of-rising-coconut-prices-.thtml

Indeed, I told him he was right. I’ve been long on coconuts for quite some time.

Interesting points that deserve to be discussed.

Unfortunately, because of the intellectual dishonesty Bob Murphy has shown in quoting, and Eli keeps showing, I am not interested in getting into another debate however interesting it might be.

I actually produced quotes from you showing your dishonesty, but all you can do is hurl accusations. And as Silas pointed out, the points he makes here are the points Bob was making in his article, which clearly went over your head.

We win again!

Salon does its noo-substance name-calling routine on Richard Ebeling, teacher of Bob Murphy.

http://www.salon.com/technology/how_the_world_works/2011/05/11/republicans_and_ludwig_von_mises/index.html

Oh yeah, congratulations. You’re replacing a totally debunked school of thought with something pretty similar. You guys are on the chopping block and you’re slowly being proven as a bunch of irrational kooks.

Time will tell. I look forward to the days when we don’t have to worry about people who dream about a coconut world.

You’re replacing a totally debunked school of thought with something pretty similar.

The Austrian school has not been debunked at all. It actually debunks MMT as nothing but dogmatic nonsense.

Maybe you can answer me this since I’ve been able to find an answer from MMT on stagflation.

What would MMT do if we have high unemployment and high inflation at the same time? I’m very curious as to how you resolve this issue.

Should’ve read, I’ve been unable to find….

Stagflations result from supply shocks – like the 70s oil embargo. That is, the inflation part of stagflation is not about “too much money” but about “too few goods”. As such, monetary or fiscal policies are both powerless to do anything about such price adjustments.

So the MMT answer to stagflation is there is nothing you can do about it? So if we have stagflation now you guys will be telling the government and the fed that they should do nothing? If so, that’s pretty close to our remedy although we would disagree with the cause. Somehow I doubt MMTers will say do nothing if we do have stagflation but here’s to hoping.

Well actually MMT would say that you can always tackle the stag part of it with a mischievous Job Guarantee to eliminate involuntary unemployment.

Seriously, you should ask that question at Warren Mosler’s site. That’s where you are likely to get an answer, not here.

Here is my problem then. If someone asked me, Blackadder, MF, DK, Eli, we could at the very least link to some body of work that would give an answer for our respective schools of thought.

Seriously, google stagflation and Keynesian, Austrian, or Chicago School economics. I can find lots of info to sink my teeth into on the matter from many different people in those schools of thought. Then when it comes to MMT I find nothing at all. Is Warren Mosler hiding the MMT answer as a closely guarded secret?

I’m not even saying that MMT doesn’t have a response at all but that I can’t find it and none of the MMT guys can point me to any body of work or just explain it themselves. How are people supposed to take MMT seriously when it’s followers can’t answer this question without saying “I don’t know, ask Warren Mosler”?

The MMT guys don’t read this site

any more. I am not one of them,

I agree MMT people should improve presence on the web if they want to be taken seriously.

Now here’s my problem. If it’s still clear from Murphy’s post and Eli’s unending mistakes with his own example that you can’t get an extremely simple flow equation, that you mix flows and stocks. why would I care if you point me to some work on stagflation which is infinitely more complex than the sectoral balances?

APL and MMTer both should be able to answer my question or at least point me in the right direction.

Thanks for all the advice. I have just dumped my entire savings into coconut ETFs!

Moser on stagflation

Despite Nixon’s statement, Galbraith’s Keynesian views

lost out to the monetarists when the “Great Inflation” of the

1970s sent shock waves through the American psyche. Public

policy turned to the Federal Reserve and its manipulation of

interest rates as the most effective way to deal with what was

coined “stagflation” – the combination of a stagnant economy

and high inflation.

…

I saw the “great inflation” as

cost-push phenomena driven by OPEC’s pricing power. It had

every appearance of a cartel setting ever-higher prices which

caused the great inflation, and a simple supply response that

broke it. As OPEC raised the nominal price of crude oil from

$2 per barrel in the early 1970’s to a peak of about $40 per

barrel approximately 10 years later, I could see two possible

outcomes. The first was for it to somehow be kept to a relative

value story, where U.S. inflation remained fairly low and

paying more for oil and gasoline simply meant less demand

and weaker prices for most everything else, with wages and

salaries staying relatively constant. This would have meant a

drastic reduction in real terms of trade and standard of living,

and an even larger increase in the real terms of trade and

standard of living for the oil exporters.

The second outcome, which is what happened, was for

a general inflation to ensue, so while OPEC did get higher

prices for its oil, they also had to pay higher prices for what

they wanted to buy, leaving real terms of trade not all that

different after the price of oil finally settled between $10 and

$5 per barrel where it remained for over a decade. And from

where I sat, I didn’t see any deflationary consequences from