AP Lerner Explains Alleged Crowding Out Chart

Well, if it had turned out the other way, I certainly would have blogged it, so I feel compelled to report that frequent commenter and MMT defender “AP Lerner” poked a big hole in the comments of my previous post.

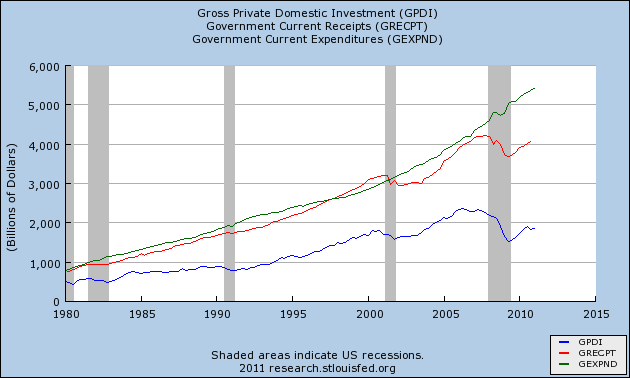

Recall that I had posted a chart showing that Gross Private Domestic Investment tracked the (inverse of the) government budget deficit very closely. So it seemed to support the standard “crowding out” argument, whereby a government deficit siphons off resources from private-sector investment.

AP Lerner thought this was a bogus interpretation of the chart, saying:

If crowding out was occurring today, then why aren’t rates higher? Why is there such demand for corporate AND treasury bonds are oversubscribed by 3x?

All your chart above shows is private sector investment falls when tax revenue falls, which makes perfect sense since tax revenues always fall during a recession.

I looked into his latter claim, and yeah it seems he is right:

To be sure, one doesn’t need to abandon the “crowding out” hypothesis on the basis of the chart above. But AP Lerner is right that the tight correlation between government surpluses and private investment, can in turn be explained by a relatively constant trend of rising government expenditures amidst volatile revenues that are tightly correlated with private investment.

You you admit to a problem with your interpretation of a graph when corrected by an adherent to flaky MMT, but don’t admit to the obvious problems others point out regularly? Have you ever addressed why it is that yield curves and the dollar regularly move with lower NGDP metrics in such a way as to suggest disinflation/deflation? You know, that’s the opposite of high inflation the story you always want to tell.

I haven’t seen you address flat wages, or other metrics such as the Billion Prices Project numbers that Krugman mentions tonight. Why is it that adherents to good fundamental new Keynesianism and Freidmanites are getting so many things right?

What about inflation swaps, TIPS spreads, break evens, various deflator metrics, etc. that show only mild inflation?

>Have you ever addressed why it is that yield curves and the dollar regularly move with lower NGDP metrics in such a way as to suggest disinflation/deflation? You know, that’s the opposite of high inflation the story you always want to tell.

Price inflation is high. By PRIVATE sources, inflation peaked at almost 9% in late 2008, and has since fallen to around 6% (if the same method of inflation tabulation pre-1990 is used, instead of the “steak is now too expensive so let’s buy hamburger instead and report zero inflation” kind of method).

>I haven’t seen you address flat wages

Wages aren’t flat. They have been rising:

http://research.stlouisfed.org/fred2/series/ECIWAG

>or other metrics such as the Billion Prices Project numbers that Krugman mentions tonight.

BBP doesn’t include services. US is a service oriented economy. Not a strong indicator.

>Why is it that adherents to good fundamental new Keynesianism and Freidmanites are getting so many things right?

Why is it that adherents to good fundamental Austrian economics are getting so many things right?

Hey, this game is fun.

>What about inflation swaps, TIPS spreads, break evens, various deflator metrics, etc. that show only mild inflation?

Because the market priced in the housing collapse before it happened, right?

An unnamed private source. That’s a total fail.

Then you link to the employment cost index, which includes benefits packages. Healthcare inflation’s high, for example.

http://www.bls.gov/news.release/cpi.nr0.htm

Here are data specifically on wages:

http://www.bls.gov/news.release/pdf/realer.pdf

Another fail.

Then you apparently just assume the inflation rate for services must be high, even though I’ve never even heard an Austrian complain about inflated prices for services. Of course, you offer no data. Huge fail there too.

Then you mention Austrian economics getting things right, but offer no examples. Of course not, since they may not be even one. Do I have to say it?

Then, there’s this from you:

>What about inflation swaps, TIPS spreads, break evens, various deflator metrics, etc. that show only mild inflation?

“Because the market priced in the housing collapse before it happened, right?”

lol Apparently you think I think markets are immortal. That demonstrates a total lack of understanding of econ, markets, and even capitalism in general. Why would markets have expected helicopter Ben to let money get so tight in late ’08? lol

Okay, you aren’t intellectually qualified to exchange comments with me.

An unnamed private source. That’s a total fail.

Oh, sorry, you’re not in the know. When people say private source for inflation stats, they mean shadowstats.

Then you link to the employment cost index, which includes benefits packages. Healthcare inflation’s high, for example.

No, the wages does not include benefits.

The chart that includes benefits is this one:

http://research.stlouisfed.org/fred2/series/WASCUR

>Then you apparently just assume the inflation rate for services must be high, even though I’ve never even heard an Austrian complain about inflated prices for services.

I never assumed service inflation specifically must be high. I just said that the BBP doesn’t include services, even though the US is a service oriented economy. That makes the BBP data weak.

>Then you mention Austrian economics getting things right, but offer no examples.

You mean your statement:

“Why is it that adherents to good fundamental new Keynesianism and Freidmanites are getting so many things right?”

which was not backed by any examples, is permitted? Laugh.

“Because the market priced in the housing collapse before it happened, right?”

lol Apparently you think I think markets are immortal.

It’s the exact opposite. YOU think they are immortal. You said:

“What about inflation swaps, TIPS spreads, break evens, various deflator metrics, etc. that show only mild inflation?”

You said this as if the market were omnipotent (I think you meant to say omnipotent, not immortal).

I sarcastically asked the rhetorical question:

“Because the market priced in the housing collapse before it happened, right?”

to tell you that the markets are not omnipotent, so if you see low inflation in TIPS, that doesn’t necessarily mean there is low inflation coming. The market couldn’t price in the housing bubble and collapse. The market is not omnipotent.

Why would markets have expected helicopter Ben to let money get so tight in late ’08?

I’m not omnipotent either.

Okay, you aren’t intellectually qualified to exchange comments with me.

You’re right. I can’t debate with dense people.

I point out to anyone else following this now defunct exchange that the it is my understanding that the Employment Cost Index does reflect benefits compensation.

I also note that that the first link from MF clearly shows flat wage growth anyway, and rates of change far below trend versus pre-crisis baseline. You can click on % change link for convenience:

http://research.stlouisfed.org/fred2/graph/?chart_type=line&s%5B1%5D%5Bid%5D=ECIWAG&s%5B1%5D%5Btransformation%5D=pch

The second link MF offers shows growth of less than 2%. For convenience, just click on % change.

http://research.stlouisfed.org/fred2/graph/?chart_type=line&s%5B1%5D%5Bid%5D=WASCUR&s%5B1%5D%5Btransformation%5D=pch

lmao

That’s why this conversation’s over.

I also note that that the first link from MF clearly shows flat wage growth anyway,

Flat growth? How Orwellian.

The second link MF offers shows growth of less than 2%

Wait, wages aren’t increasing very much, so that means inflation isn’t either? Wages aren’t the only incomes earned that can increase the demand for goods.

Inflation is not evenly distributed either.

That’s why this conversation’s over.

Over because you got proven wrong? OK, whatever floats your boat I guess.

I know this is gonna hurt, but I also have to point out that Krugman’s been pointing out since the beginning of the crisis that most of the increase in the deficit is due to the reduction in revenues.

I hate to hurt your argument, but deficits are a function of TWO variables. BOTH explain the deficit at any given time. If one moves a lot, but the other does not, say revenues fall a lot but spending does not, then that could be interpreted as saying the deficit was caused by the government not cutting enough spending.

All your chart above shows is private sector investment falls when tax revenue falls

Actually it’s the other way round.

Yes. Agreed.

David S,

Aren’t most of the things you mention (inflation swaps, TIPS, break evens) based on the CPI? From what I have read, it seems they are, but I could be wrong.

Those items you mentioned are, certainly, but I do mention other metrics.

I seriously though you were just making some kind of sarcastic and ironic statement about empirical evidence being useless or something like that. “Hey, I have a chart too and can give it any meaning I want so it fits my purposes! Correlation not implying causation and whatnot.” I didn’t think you actually thought it was proof of crowding out. The explaining seemed too obvious to me for you to be making that mistake, especially since Krugman mentions the falling revenue line to explain the deficit in pretty much every other post of his and I know how you’re such a loyal reader of his.

I know Krugman has explained a big chunk of the deficit in the last few years as due to falling revenue (it’s not simply about revenue; spending really is way up too). But I didn’t know off the top of my head that that was such a good explainer of the deficit going back several decades, through ups and downs.

I mean look, Krugman also says that a big reason for the runup in debt is that Bush gave huge tax cuts to the rich and started two wars. So it’s not true (as you and DK seem to be suggesting) that if I had just read my Krugman, I would have predicted the above chart.

And then, of course, there’s the matter of debt/GDP, which is up in no small part to GDP having suffered in since late ’07.

Now, what about inflation?

Now, what about inflation?

10% according to independent sources.

Do they include the price of hallucinogenic drugs in their index?

Does the high some people get through government power and “official legitimacy” count?

lmao Sure. And no sources mentioned.

I don’t get it. Sure, in a fiat currency environment there is no crowding out in the standard economical sense. But, what does this prove other than the ability of the further creation of money given a particular amount of goods and services within the economy at any given time? What net gain is there to be had? Have resources all of the sudden become less scarce as a result of the government’s ability to spend more?

It recruits idle resources when there’s an output gap. It isn’t rocket science.

That’s crowding out as well. You need to understand praxeology. No resource can be idle and put at work at the same time. So government recruiting idle resources is crowding out the private sector’s idle resources. You should appreciate how evil it is.

You’re joke would have been funny, if it weren’t for the fact that such jokes have to ring some truth for them to even be funny.

Government cannot recruit ONLY the idle resources. No resource operates in a vacuum. The use of a particular resource requires mobilization of complimentary resources and labor, which are not idle, but are affected by the targeting of the idle resource.

It’s like using a nuclear bomb to cook an idle piece of beef that should not have gotten produced.

Don’t particle accelerators operate in the vacuum?

There is actually no such thing as a vacuum. Latest research shows that even totally “empty” space has quantum jitters.

I have always been of the belief that the universe is full rather than empty, that what we see and are able to perceive is what we call matter and energy, but that what we call empty is actually full of things that we have not yet been able to perceive. If the universe is expanding, then it is only logical that something is taking its place as it expands.

Spending and inflating cannot target ONLY idle resources, because all resources require complimentary labor and resources that may not be idle but are nevertheless affected.

Idle resources are a sign that their production shouldn’t have been carried out.

Cripes, if zero interest rates distorted the market so much that a zillion houses were built, and housing construction equipment and labor were all devoted to housing, and all the other industries that are affected by a booming house market, after which the bubble pops and the housing market collapses, your observation of empty homes combined with the Keynesian idle resources doctrine must lead one to conclude that the solution is for the Fed to put interest rates below zero, to inflate even more money, as if doing so will overturn economic laws and create resources from nothing that make a housing boom sustainable.

This doctrine of idle resources is like believing the government is an exact sharp shooter with omniscient knowledge, when really they’re drunk in a bar, blindfolded, and shooting darts at a dartboard with pictures of random roads and military contractors.

Don’t underestimate randomness. Human life, and hence human action, were created by randomness.

No, they weren’t. Natural selection is NOT random.

And even one does not accept evolution, then it is still the case that human action is not random. Human action is purposeful.

You don’t drive to the bookstore because you wanted to drive into the ocean and you randomly ended up at the bookstore. You drive to the bookstore because that was your intended goal.

I really have no clue how your comment is even relevant. It obviously went way over my head.

Natural selection comes from randomness.

I often walk randomly and end up in a bookshop.

People meet their favourite other by chance.

Life and death are often a matter of chance.

Randomness is everywhere. And people don’t understand it.

No, natural selection is not random at all. I suggest you read evolutionary biology.

You are not walking randomly up and down the bookstore either. You are purposefully going from one end to the other.

Chance does not imply randomness.

Randomness is not everywhere. And you don’t understand it.

Natural selection might not be random, genetic mutations are.

I don walk up and down randomly bookstores and supermarkets to avoid their evil economics of control inspired marketing strategies which arise in the free market.

I actually carry dices with me all the time to fool them.

Randomness is everywhere and boy how we are fooled by it!

Natural selection might not be random, genetic mutations are.

They are not random either. They are caused by definite chemical reactions caused by definite properties of the interactions between various molecules. Randomness is just a shorthand way of dealing with facts we do not know.

I don walk up and down randomly bookstores and supermarkets to avoid their evil economics of control inspired marketing strategies which arise in the free market.

The lack of absence of one reason doesn’t mean there are no other reasons.

If you walked up and down the bookstore, there was a reason for it.

Randomness is everywhere and boy how we are fooled by it!

I don’t get it, you read one book by Nick Taleb and now we’re all supposed to ignore science?

Randomness is a shorthand for anything we cannot predict deterministically.

Maybe it’s a lack of knowledge, or a lack of appropriate mathematical tools.

But genetic mutations or the result of throwing a dice are all random to us.

So randomness is everywhere.

So randomness is everywhere.

Natural selection is not random. You have to understand this point.

When I see a theory of deterministic genetic mutations I will.

Until then it will be random, like much of our life.

When I see a theory of deterministic genetic mutations I will.

Until then it will be random, like much of our life.

That’s just argument from ignorance.

By that thinking, if I cannot predict deterministically who will walk into a library, then I should conclude that people randomly walk into the library. But people don’t walk into the library randomly. They do purposefully.

You can’t see people act. You have to infer they are acting by self-reflection.

Nassim Taleb’s thesis is based on epistemological nihilism.

That’s not difficult to imagine, considering the silly statement you just made about behavior. lol

Which silly statement?

lol Slap basic econ in the face and offer no evidence to support the extreme assertion.

Deep, deep analysis.

You might as well have said “poopyhead!” and it would have had the same contribution.

What did I say that violates basic economics?

It’s important to focus on why the resources are idle. People don’t just leave resources idle for the heck of it, they do so because the expected cost of utilizing them is greater than the expected benefit. Price and capital structure adjustments need to take place before those resources can be put to net value-contributing uses.

For example, suppose there was a boom and bust in the auto industry, and during the depression there is a car-manufacturing plant sitting idle. The government could spend money to buy materials and hire people to build cars, but this would not be wealth-enhancing for society. The reason the plant is idle in the first place is because entrepreneurs do not find it profitable, at current prices, to put the plant to use. So it may be the case that the variable costs (labor, car parts, etc) exceed the revenue the entrepreneur could expect to gain from operating the plant. But again, this doesn’t mean the plant will be idle forever. If the price of labor and car parts falls, it may become profitable at which point entrepreneurs would invest in it. Or the price of the factory itself might fall low enough such that it becomes profitable to buy the plant and completely redesign it into something else that society values more.

These adjustments take time. The best uses for idle resources is not something that can be known a priori. When the government jumps in to circumvent the process, all they are doing is postponing the market’s ability to allocate resources effectively, because they are putting resources to work in ways where the expected costs exceed the expected benefits.

“It recruits idle resources when there’s an output gap.”

Your statement completely ignores why these resources are idle in the first place, that the capital structure was distorted by increased capital investment of which whose product cannot have substantial demand to satisfy (dis-coordination between investment and consumption) . Also, you cannot target resources in money creation. So, stimulating does nothing but exacerbate the distortion and not allow the market to clear. We are seeing this very mechanism in action right now.

And correct me if I’m wrong, but it’s not like this demonstrates there is no crowding out. It just suggests that all we’re really looking at is that one line is a function of the other line. I can’t speak for post-Keynesian/MMTers but the assumption usually isn’t that there’s always crowding in all the time. The assumption is that in a lot of circumstances there IS crowding out, and of course crowding out is still consistent with your original graph, even if AP Lerner has ably demonstrated that the tight correlation is probably a revenue story.

Daniel,

I’m looking for your first post where you admit a mistake like Prof. Murphy did with no nuances, conditions, etc.

Bob, this should be a (Austrian) lesson that one cannot “prove” any economics principle by observing past data. Do you not appreciate the power of praxeology anymore? It’s like you went right into the positivist trap. You can’t play with rattlesnakes and expect not to get bit.

You’re right that “crowding out” takes place. However, this cannot be discerned from observing past data. Past data is complex, and many factors influence a given dataset. You think you have a story, but then you realize that you ignored other variables that could only be understood via “a priori” reasoning, and, ironically in this case, via “a priori” reasoning utilized by anti-Austrian AP Lerner, who utilized it when he criticized you! He didn’t even produce any data or charts, he just used Austrian style reasoning, specifically, if in a recession people are physically unable to keep spending the same amount of money in the same way as before the recession, due to recalculation, lay offs, and resource re-allocation, then exchanges using money will necessarily fall, and, combined with government maintaining its trend of gradually increased spending, and these are the only principles we consider, then it logically follows from these principles that private investment will move in tandem with the deficit.

Oh the irony on this one, tis thick enough to stop a bullet! An Austrian was out-Austrian’d by an anti-Austrian!

All economic principles can only be arrived at via praxeological understanding. Mises was right about this. AP Lerner just kind of emphasized it. Resources are scarce, money is scarce (despite the Fed being able create it out of thin air, since one can do only one thing with a given dollar but not two things at the same time with the same dollar), and making one choice and one action immediately implies all other choices and actions are sacrificed. We can discern crowding out by praxeological reasoning. If the government spends money, then that ALWAYS crowds out everyone not the government, because one act of government spending makes all alternative actions, including those of the private market, impossible. The more the government spends, the less the market can spend.

This is the case even with an “unlimited” ability of the government to print money. Since money can only be money if it is scarce at any given time, then at any given time, increased government budget deficits will necessarily crowd out private investment. You won’t be able to see this in any graph of past data, because you can’t see unobserved events that did not take place. We can’t SEE what the private market did not do!

So when we see a very strong correlation, I know how hard it is NOT to join the rattlesnakes and rattle your own positivist tail. I do it all the time, but every time I do it, I’m wrong. But when there’s only rattlesnakes in the den, it would be wiser to become an Austrian mongoose, rather than an Austrian Mongoose trying to pretend to be a rattlesnake, only to be outwitted by another Mongoose dressed up as rattlesnake who thinks he is in fact a rattlesnake.

You nailed it. We got *moFing* snakes on this thread!

Resources are scarce, money is scarce (despite the Fed being able create it out of thin air, since one can do only one thing with a given dollar but not two things at the same time with the same dollar), and making one choice and one action immediately implies all other choices and actions are sacrificed. We can discern crowding out by praxeological reasoning. If the government spends money, then that ALWAYS crowds out everyone not the government, because one act of government spending makes all alternative actions, including those of the private market, impossible.

By parity of reasoning, air is scarce, since when I inhale no one else can use the air I am using at the same time I am using it. Therefore, whenever Major Freedom inhales, he is crowding out other people’s breathing.

Really dumb arguments go in the Austrian win column.

For purposes of breathing on earth at the moment, air isn’t particularly scarce. However, if one is on a spacecraft losing power, air would be very scarce. Crowding out must always occur and the particular items seized or commandeered are necessarily scarcer than would have been the case even if one cannot find an alleged correlated price increase. THE SEIZED ITEM MAY NEVER SHOW UP IN STATISTICS BUT IT CANNOT BE TWO PLACES AT THE SAME TIME. If my apple has been commandeered, it’s not in my mouth. This is why it is so fruitless to debate statists because this kind of game-playing with simple definitions takes up about 93% of the effort and at the end of the day if any clarity has been reached, the statists will simply move on to a new reason to be obtuse and to obfuscate.

Further, the resources being commandeered by the mindless government belong to someone else. They are idle either because the owner likes it that way or because the interventionist government has so destroyed the investment climate with taxes, funny money dilution, interest rate manipulation and regulation that there are no real world investment opportunities.

Further, these Keynesian concepts provide a pseudo-scientific excuse for courts to fail to protect the property rights of the victims. And they insidiously suggest that there really is such a thing as a “national” resource. The government can grab and manipulate everything because everything is a national resource and the government, of course, knows what’s best.

And, of course, government spending is bad economics. It simply cannot employ resources in an intelligent manner:

http://mises.org/daily/5123/Government-Spending-Is-Bad-Economics

For purposes of breathing on earth at the moment, air isn’t particularly scarce.

Correct. The problem is that MF’s argument implies that air is scarce (and that his breathing is crowding out other people’s breathing). Therefore, the argument is a bad one (do really dumb arguments still go in the Austrian win column when they are made by Austrians?)

No BA, atmospheric air isn’t a scarce economic resource. It is not an object of purposeful action.

Money is a scarce economic resource because it is an object of action.

Should atmospheric air ever become economized, and made an object of action, then it would indeed follow that one person breathing a volume of air would imply that another person could not breathe that same air.

Scuba divers are a good example. A scuba diver who has a tank of compressed air on his back, swimming underwater, does in fact make it impossible for everyone else to breathe that same volume of economized air. This is why compressed air has a market price. It is an object of economic action.

Atmospheric air is not an object of action. That is why is not a scarce economic resource.

MF,

You have it backwards, I think.

It is always the case that my breathing a volume of air implies that another person cannot breathe the same air. It’s just that in normal circumstances this doesn’t matter because air isn’t scarce. There’s more than enough for everyone to have all they want.

It is always the case that my breathing a volume of air implies that another person cannot breathe the same air.

Yes, that part is true, but that is a consequence of the law of identity. But economically speaking, it’s not the case, because atmospheric air is not an object that is acted upon, like money is acted upon.

In the context of economics, which is the context if the topic is government deficits “crowding out” private investment, then scarcity arises, much like scarcity arises in the economized scuba tank of compressed air.

Air, of course, is free until you want to exhale CO2, at which point THE ECONOMICS OF CONTROL must come into effect.

Air, of course, is free until you want to exhale CO2, at which point THE ECONOMICS OF CONTROL must come into effect.

I’m probably going to regret this, but what is the “ECONOMICS OF CONTROL”?

It’s when you stand up with a megaphone in a crowded movie theater and yell stuff about economics and nevertheless put them all to sleep?

By parity of reasoning, air is scarce, since when I inhale no one else can use the air I am using at the same time I am using it. Therefore, whenever Major Freedom inhales, he is crowding out other people’s breathing.

By scarce resource, I meant scarce economic resource, and by scarce economic resource, I meant it in Menger’s definition.

Air is not an economic resource in the Austrian conception because it is not an object of action the way physical matter in the Earth is an object of action. Air is a natural given, like the heat from the Sun.

See http://mises.org/rothbard/mes/chap1a.asp#3._Further_Implications

MF wrote:

He didn’t even produce any data or charts, he just used Austrian style reasoning, specifically, if in a recession people are physically unable to keep spending the same amount of money in the same way as before the recession, due to recalculation, lay offs, and resource re-allocation, then exchanges using money will necessarily fall, and, combined with government maintaining its trend of gradually increased spending, and these are the only principles we consider, then it logically follows from these principles that private investment will move in tandem with the deficit.

No, that doesn’t necessarily follow. Private consumption could fall to take the brunt of it.

Look, your opening remarks were fine (paraphrasing): “Bob, don’t get sucked into the positivist trap. If you start trying to use empirical evidence to buttress your arguments, then you might be wrong.”

But then you somehow try to argue that AP Lerner used an a priori method to come up with an empirical prediction. No he didn’t; if he did, he would be doing the same illegitimate thing you criticized me for.

He had a guess that an empirical relationship between private investment and the government budget deficit (in the US over the last 35 years or so) was actually largely explained by a tight relationship between private investment and government tax receipts.

By itself his point doesn’t rule out the possibility of “crowding out,” but it certainly took the power away from the graph I presented earlier.

I agree with all of the Austrians who are saying we know a form of crowding out necessarily occurs; I have written explicitly on how idle resources are idle for a reason. (I.e. I think I was the caricature that MamMoTh was mocking–whether he knew I wrote that article or not.)

But that fact doesn’t mean you would necessarily see measured private investment move in tandem with the deficit. So I was surprised when I saw the first chart.

No, that doesn’t necessarily follow. Private consumption could fall to take the brunt of it.

Sure, that could occur, but then we’d be assuming a change in time preference. I assumed that no mention of time preference possibly changing means time preference doesn’t change. I thought that the assumption of a “fall in spending” was a fall in spending as such, so that every kind of spending would fall in the same ratio, leaving the original time preference ratio unchanged.

So yes, if we’re talking the real world, then we have to take into consideration, and allow for the possibility that a rise in time preference will result in the aggregate fall to be concentrated in consumption spending.

But then you somehow try to argue that AP Lerner used an a priori method to come up with an empirical prediction. No he didn’t; if he did, he would be doing the same illegitimate thing you criticized me for.

Oops, that wasn’t my intention actually. I didn’t intend to argue that AP was trying to come up with an actual empirical prediction using logic. I just thought I saw him use logic and only logic to point out that what you said doesn’t follow from the graph.

He didn’t point to any data, or graphs, or anything. He just said hey wait, if such and such took place in the past (private investment and deficits moving in (opposite) tandem), then this and this could have been the case, and not necessarily the that and that you said before.

We’re all looking at the same past data and we’re all using particular theories to interpret it.

He had a guess that an empirical relationship between private investment and the government budget deficit (in the US over the last 35 years or so) was actually largely explained by a tight relationship between private investment and government tax receipts.

Sure, but that’s not a prediction. It’s economic history.

I agree with all of the Austrians who are saying we know a form of crowding out necessarily occurs; I have written explicitly on how idle resources are idle for a reason. (I.e. I think I was the caricature that MamMoTh was mocking–whether he knew I wrote that article or not.)

I hope everyone reads that article. That article is actually where I first learned that government spending cannot ONLY target idle resources.

But that fact doesn’t mean you would necessarily see measured private investment move in tandem with the deficit. So I was surprised when I saw the first chart.

Cobra BITE!

Bob I too raised an issue with your data and your interpretation (first post in ‘final thoughts on MMT’). I would be interested in your thoughts on the matter.

“I looked into his latter claim, and yeah it seems he is right:”

I have a whole new level of respect for you Mr. Murphy. Thanks!

My next goal is to show the banking system is never constrained by reserves 🙂

You won’t be able to do that, because they ultimately are constrained by reserves.

Suppose the Fed stopped increasing bank reserves, i.e. the Fed ceased buying assets.

What would happen in the long run? Could the banks keep increasing the volume of credit ex nihilo forever? Certainly not.

At some point, the banking system as a whole will have to stop increasing the volume of loans. This is because each expanding bank, at their own time, will eventually reach a point where their redemptions and withdrawals will encroach upon their ability to finance them.

For example, a bank that has $1000 on hand will not be able to satisfy redemptions and withdrawals that exceed $1000. Today, banks can do this because they can just dip into the overnight loan market that the Fed keeps topping up with inflation of reserves, if they need any additional funds. But remember, we’re in a context of the Fed not doing that anymore, so it must be assumed that the overnight market will be capped in terms of the supply of overnight funds. After all, the total supply of overnight funds is the money banks have available to loan to other banks that they don’t need in their daily financing.

At some point, a given expanding bank will not be able to offer any loans to other banks in the overnight market, because they find that their redemptions and withdrawals for the deposits they have granted their clients, is approaching the amount of money they have on hand with them.

If you on a given day have $1000 on hand, then you won’t be able to satisfy redemptions and withdrawals that exceed this amount. You can’t grant a new loan to finance this, because the calls for redemptions and withdrawals are not loan requests, but cash requests. They don’t want to borrow money, they want to withdraw their own money.

Now, at this stage, you’ll no doubt object and say something about capital assets. You might say that banks can keep expanding loans by expanding their capital base. But this argument fails, because it ignores the fundamental fact that capital assets are priced in dollars. Remember, expanding banks will, in the absence of a central bank, will find that their withdrawals and redemptions from their clients and other banks to keep increasing until they approach the amount of money they have on hand at all. Alongside this fact, as this process of squeezing takes place, banks will of course have a maximum amount of money available to buy capital assets. The maximum amount of money they will have available to buy assets will decrease as the quantity of credit they created and hence the quantity of cash redemptions and withdrawals increased. A bank that continues to expand new loans will find that it has less and less money to use to buy assets.

Taking the banking system as a whole then, it follows that if banks together tried to buy an increasing supply of capital assets on a foundation of a declining money available to buy them, then what will happen to the PRICES of capital assets? They will of course start to FALL.

If the prices of assets starts to fall as more capital assets are produced and made available for the market, then it is absurd to think that banks can keep expanding loans on a foundation of increasing capital assets. A pool of capital assets that keeps falling in their prices will mean that the quantity of new loans banks can create will not, cannot, keep increasing. At some point, the banking system as a whole will cease being able to create new loans out of thin air.

And why is this? It’s all because the Fed stopped increasing bank reserves. Thus, banks ARE in fact ULTIMATELY constrained by bank reserves. Period. QED. Game over. Austrians win.

People are not turnips to be squeezed for every last drop of GDP.

And your prize is the Fed will keep loaning reserves to the banking system so that banks are not constrained by reserves but by capital.

>And your prize is the Fed will keep loaning reserves to the banking system

The Fed doesn’t just loan reserves to the banking system. They effectively increase the size of reserves the banks own thereafter by buying assets the banks own.

>so that banks are not constrained by reserves but by capital.

You mean banks would be visibly constrained by reserves had it not been for the Fed increasing bank reserves, such that increasing bank reserves enable banks for strategic reasons to use capital asset requirements instead, even though capital assets are themselves a function of increase/decrease in reserves?

Thanks for agreeing me I guess?

What I agree with is that reserves can only come from the Fed or Tsy.

In our system, no, they cannot come from the Treasury. The Treasury’s actions can influence the Fed to increase reserves, by borrowing money from the market through issuing debt securities, then spending the money back into the economy, after which the Fed then buys the debt securities with newly created money, which thus increases the total amount of (reserve) money in the system.

When Bernanke says that if people have a problem with inflation, they should blame the Treasury, what he is really saying is that he denies responsibility for being “forced” into buying Treasury debt to keep interest rates artificially low to their arbitrary target, where the more the Treasury issues, the higher the interest rates will go if the Fed just stands there and does nothing.

But the Fed has a “dual mandate”, so they think they’re doing their job and thus absolving themselves of responsibility by buying as many Treasury securities (and now private securities) as is necessary to “keep interest rates low.” If the Treasury issues a kajillion dollars worth of debt securities, which will otherwise make rates plummet, then the Fed will buy that many more Treasuries to keep rates low.

The Fed is saying “Hey Treasury, we can’t keep these rates as low as your Congressionally authorized permission allows us to do, if you keep this borrowing and spending up. The more you borrow and spend, the weaker the dollar gets given our dual mandate which includes keeping interest rates low.”

Since the “dual mandate” is price stability and maximizing employment, the best Fed policy would obviously be self-immolation. We just need to flle a lawsuit to enjoin the Fed from further funny money activities and attach an affidavit from Bob Murphy.

MMTers differentiate between self inflicted constraints by the government on itself (such as a legal reserve requirement) and the unconstrained wonder of an unconstrained government. To explain their basic concepts,

here is a quote from “Modern Monetary Theory—A Primer on the Operational Realities of the Monetary System” by Scott Fullwiler, Associate Professor of Economics at Wartburg College:

Having said that, MMT’ers are keenly aware that governments can and do write laws that their treasuries’ operations be legally bound in certain ways. For instance, the Fed is constrained by law to only purchase Treasury securities in the “open market,” is thereby forbidden from directly lending or providing overdrafts to the Treasury. In other words, “specific” cases can and do differ from the “general” case MMT’ers describe for a sovereign currency issuer under flexible exchange rates in the sense that self-imposed constraints specify particular operations.

Further, the banking system may not be constrained by reserves at the moment. See:

http://blog.mises.org/16911/the-errors-of-inflation-hawks-cnbc-on-austrian-article-in-libertarian-papers/

I think these are side issues. Whether we agree or disagree with their version of the plumbing system of the fiat money regime, the MMT program will cause the same problems of economic calculation, malinvestment and distortion of the price, investment and capital structure as caused by the Krugmanites. That’s the argument they can never win and will always seek to avoid.

AP Lerner,

Maybe in a few months we can hash out the banking system and reserves. I don’t have the stamina right now for it.

In general, there is likely very little crowding out. Treasury bonds of any country, provided they are denominated in the local currency, provide a valuable security for people with little tolerance for risk. Without so-called risk-free bonds, people would likely hold sub-optimal amounts of money, or choose unsuitably risky portfolios of securities. The popularity of sovereign debt (i.e. people are willing to hold it in their portfolios) more or less shows the value of the existence of such securities. Moreover, all asset pricing methods of which I’m aware require some proxy for the natural rate of interest, and the risk-free rate is about the best such proxy available. So the utility of sovereign debt, as an asset class, seems unquestionable.

Now, using the current situation to make any strong statements regarding U.S. Treasury debt specifically is dubious at best. In a non-QE world, banks and other primary bond dealers would only add Treasury debt to their portfolios if they thought the yield was worthwhile. If they thought the yield was too low, Treasury wouldn’t be able to place their debt until they lowered the price, thereby increasing the yield. But, in a QE world, banks and bond dealers will subscribe to all the new debt because they know the Fed is waiting on the other side to purchase those securities. So, the spread is the most valuable thing now, between the auction price and selling price to the Fed. It is likely the securities are only being held for a few days. Essentially, the banks and bond dealers are front-running the Fed. This has made demand for Treasury inelastic.

Further, any arguments regarding a crowding-out effect on investment right now are predicated on the idea that demand for financing has not changed. This is clearly untrue. One observes the high levels of internally-generated cash flows that are not being invested and may conclude that the demand for external financing is low. Crowding out means demand is not being met. I doubt that the demand is there to be met.

Now, Mr. Daniel Kuehn and I probably disagree as to why internal cash flows are not being invested, but I doubt if we disagree that they are not being invested. (Just busting chops, DK). In fact, we probably agree on the factors, but not the weights on the factors.

Excellent comment.

Agreed. Great comment. Why would anyone invest in the present climate of regime uncertainty and these horrible low interest rates?

I agree that if aggregate demand depressed as it is demand for loans will remain low.

But why would higher interest rates increase it? You are still thinking backwards.

To avoid being pressed up against the right wall, I’m posting my response at the bottom of the comments.

The nuts and bolts of this disagreement is the efficacy of Keynesian aggregate demand management vs. laissez faire. But AP Lerner specifically denies that catallactics, the study of interpersonal exchange and the basis of Austrian Economics, is relevant in the post 1971 magical world of fiat money. However, under the MMT scenario, humans must still supply goods and services and exchange them on the market. Allegedly, the study of those relationships is now irrelevant. How can that be? Of course, AP Lerner provides no informed explanation, just a blanket denial.

You can verify all this pretty easily using Burns-Mitchell diagrams. Investment is more volatile than GDP and coincides with the cycle. Govt consumption is acyclical. Net taxes is procyclical. Hence we see investment falling in a recession and the deficit increasing.

But why would higher interest rates increase it? You are still thinking backwards.

Interest rates should be what they turn out to be on the market. Interest rates are prices, perhaps the most important prices. When loans are in short supply, their price should rise. Current low rates do not in any way reflect what rates would be in the market and are the CAUSE of the dislocation and malinvestment. In a 1975 speech, Hayek stated:

“The primary cause of the appearance of extensive unemployment, however, is a deviation of the actual structure of prices and wages from its equilibrium structure. Remember, please: that is the crucial concept. The point I want to make is that this equilibrium structure of prices is something which we cannot know beforehand because the only way to discover it is to give the market free play; by definition, therefore, the divergence of actual prices from the equilibrium structure is something that can never be statistically measured.

****

In contrast, the modern fashion demands that a theoretical assertion which cannot be statistically tested must not be taken seriously and has to be discarded. As a result of this belief, a theory which, in my opinion, is the true explanation has been discarded as not adequately confirmed, and a false theory has been generally accepted merely because it happens to be the only one for which statistical evidence, even though very inadequate evidence, is available.”

A bureaucrat can never replicate what that interest rate should be.

Further, Rothbard explained:

“[F]or Böhm-Bawerk went on to show how time preference determined the rate of business profit in the same way: in fact that the “normal” rate of business profit is the rate of interest.”

http://mises.org/resources.aspx?Id=3081&html=1

Since you have no familiarity with Austrian concepts at all, a good beginning is ‘The Essential Von Mises” found at the above link.

Bob Murphy explains why banks should raise rates in a recession:

http://mises.org/daily/3327

OK I thought you were saying higher rates will increase investment, which is backward. But what you want is to interest rates to increase considerably so the economy collapses even further and it is reset.

For anyone truly concerned about the wasting of resources on unsustainable paths, we have the fiat money-induced housing boom. Think of all of the forests and farms that were paved over up and the roads with their gas-wasting polluting traffic resulting from building all of that unsustainable housing on the fringes of cities.

Like most things, it’s all Krugman’s fault.

http://blog.mises.org/10153/krugman-did-cause-the-housing-bubble/