Are You Scared Yet?

[UPDATE below.]

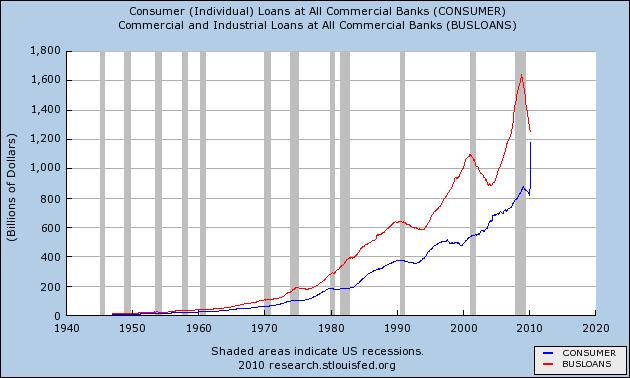

Alasdair Macleod wants to know what I think about this:

Since I’m not a Keynesian, and actually believe in a structure of production, this is what I think.

UPDATE: Mark Wise–whom I used to work with in the financial sector–talked me down from the ledge. He linked me here, and said:

This is the April 9th H.8 release from the Fed. Basically on this date FASB 166 and 167, which were passed at the height of the financial crisis finally came into force, requiring banks to recognize a bunch of off balance sheet A + L on their balance sheet. The main category affected was consumer loans.

“As of the week ending March 31, 2010, domestically chartered banks and foreign-related institutions had consolidated onto their balance sheets the following assets and liabilities of off-balance-sheet vehicles owing to the adoption of FASB’s Financial Accounting Statements No. 166 (FAS 166), Accounting for Transfers of Financial Assets, and No. 167 (FAS 167), Amendments to FASB Interpretation No. 46(R). Domestically chartered commercial banks consolidated $377.8 billion in assets and liabilities. The major asset items affected were: other securities, mortgage-backed securities, -$5.6; other securities, non-MBS, -$15.9; commercial and industrial loans, $32.3; real estate loans, revolving home equity loans, $5.8; real estate loans, closed-end residential loans, $21.5; real estate loans, commercial real estate loans, $1.2; consumer loans, credit cards and other revolving plans, $323.9; consumer loans, other consumer loans”

Basically its an accounting gimmick. If you adjust the data to remove the added loans, you actually see that consumer loans continue to fall rather than spike up. Hope this helps.

I don’t have the time to do any more research on this, but Mark seems to have solved the mystery. I would believe that total debt shot up like that, thanks to Obama & Friends, but I couldn’t believe consumers and banks would be that crazy (hence my horror).

Incidentally, to explain my original reaction: The drop in business loans is good, that’s what should happen after an unsustainable boom. But I thought it was being mostly offset by an increase in debt-fueled consumption. So that would have meant the last year showed “artificial prosperity” (!!). Hence the scream.

Naturally, Krugman and Cowen ignore the truism that people getting new fiat money are spending SOMEONE ELSE’S purchasing power, which is a form of theft, fraud and embezzlement. Increases in investment and consumer spending is consistent with this. Second, ALL PRICES (including interest rates) are distorted by this process and no one really knows if one is actually trading stuff for stuff or stuff for funny money. Economic calculation is made much more difficult than it already is, and proper economic calculation is always essential. Why wouldn’t people be buying the wrong things and investing in the wrong things under this regime? Third, they ignore the fact the correction from the funny money boom can only be effectuated by the painful re-pricing of everything (for purposes of essential economic calculation), including interest rates and mortgage loans, which they will simply not allow to occur. 20 year stagflation, here we come.

I would be curious what Alasdair’s opinion is regarding what is the composition of the “consumer loans” data.

Does this include credit cards? Are banks just giving HEL’s again, or just straight up personal loans?

This is totally new info to me and I am trying to understand. Are people making up for shortfalls in their income by borrowing to pay the mortgage and to continue to consume? Do people do this just to keep up with their pre-crash standard of living and are counting on an economic recovery to occur before they go bankrupt?

Why are they borrowing in the recession, and what form is the borrowing? I am pretty sure if I went to a commercial bank today and asked for a $10,000 loan (unsecured) to buy consumption goods the bank would laugh at me! Are we saying they have so much ‘liquidity’ that they are making dumb loans again to people for consumption?

In response to von Pepe, and according to FRED, they are individual consumer loans at all commercial banks. I believe credit card data is separate but have no hard evidence to offer.

The only reason I can think of for these consumer numbers is distress borrowing. By this I mean that the interest on these loans is now rolling up. I hope and pray I am wrong, meanwhile I’m screaming as loudly as Bob.

Alasdair

Looking at the Fed data here: http://www.federalreserve.gov/releases/h8/current/default.htm

That’s quite startling. I’m puzzled as to why credit card and “other” revolving debt have shot up so much – not quite doubling – from March to April. To me, it almost feels like a redefinition in the data, it’s so extreme – but, I can find no evidence of that.

The data is constantly revised and the revisions are at http://www.federalreserve.gov/releases/h8/h8notes.htm#notes_20100521

People can blather all they want about how we’re in recovery, but stats like this remind us Austrian folks* of what theory already makes us certain of: that increased government intervention consistently yields inferior gains, and that trying to fix easy money troubles by pumping money into the economy in counter-productive.

(*By self identifying as one of the “Austrian folks,” I’m only declaring my belief in the theory, not expertise. I’m not an economist or something like that.)

Gentlemen

On further investigation it turns out that from March 31 under FASB rules off-balance sheet vehicles were incorporated in the reported figures. There was therefore a one-off jump in the numbers, which affects mostly consumer lending statistics.

I am sorry for setting this hare running, but am relieved there is a simple explanation.