Why the Editor of The New Republic Hasn’t Quieted My Inflation Fears

Bob Roddis sends me this short video of TNR Senior Editor Noam Sheiber explaining why Allan Meltzer was wrong to worry about inflation:

When I get some time, I want to return and pick apart the fallacy in the Phillips Curve–the alleged tradeoff between unemployment and price inflation. My starting point will be Brad DeLong’s recent class notes which omit a key period from his historical scatter plots; someone please remind me if I forget to come back to this during the next week.

But for now, here are some points I’d like Sheiber to explain:

* If we can’t have inflation now because of an output gap, then what happened in the 1970s? (I don’t mean that as a finishing move; if the Keynesians have a story to explain away stagflation, I’d like to know what the story is.)

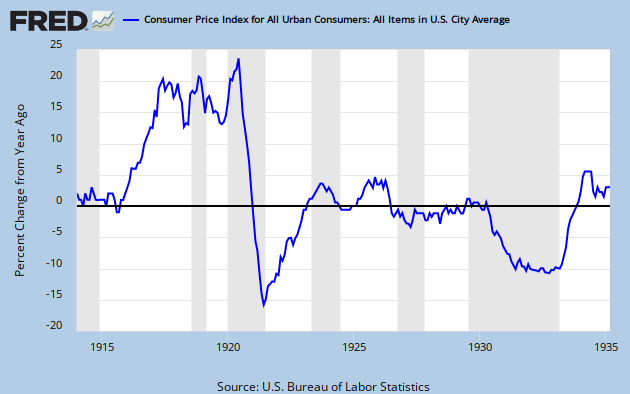

* If the 25% unemployment of 1933 (and yes it was just in that year, not throughout the 1930s as Sheiber implies) were due to a deflationary spiral, then why wasn’t unemployment higher during the much more severe deflation during the 1920-1921 depression?

* If the worst thing in the world would be falling prices–since they lead people to postpone purchases, etc.–then what happened during the late 1920s, when prices fell every year from 1926-1928? I’m pretty sure businesses made a lot of sales during this period.

==> I predict that Sheiber’s video here is going to make him look as ridiculous as all the analysts (like Ben Stein etc.) who told us not to worry about the housing boom and to go buy stocks. (And yes, I made my own mea culpa here, in case newcomers think they are going to bust me for hypocrisy.) And to make my own position falsifiable, here you go: If the non-seasonally adjusted CPI rises at less than a 5% annualized rate in 4q 2009, I will admit I have been a fool for my warnings, and that I clearly don’t know what I am talking about. I am going to be extremely surprised if all of the money printing and unbelievable deficit spending don’t start pushing up US prices this year.

(Note that I may have made more aggressive inflation predictions elsewhere; this is not to be seen as backing away from them, I just don’t want to look them up right now.)