The Policeman Is Not Your Genitals’ Friend

This isn’t pornographic or anything but it’s pretty graphic.

One Last Post on Russ Roberts and Me Commenting on Krugman vs. Barro

The only reason I am posting this is that several people seem genuinely unaware of what point Russ Roberts and I were making in the recent blog war. (Here’s a summary in case you’ve stumbled upon the present post.) Let me try one last time to explain. If I can save just one reader, my 20 minutes will not have been spent in vain.

First: We all agree that when it comes to the policy issue of extending unemployment insurance, the important, scholarly issue at stake in terms of the pure economics is whether an extension of unemployment benefits will increase or decrease employment. There are standard, textbook supply-side arguments about why such a move will increase unemployment. There are standard Keynesian demand-side arguments for why such a move will decrease unemployment. So the question now is: Which effect is stronger?

Now then, we all know that Robert Barro came down on the side of the former, while Paul Krugman came down on the side of the latter. But let’s look and see how they actually presented their respective cases to the public, Barro for the WSJ readers and Krugman for the NYT readers.

Here’s Barro in his 2011 piece (the one that Krugman linked in his recent critique):

The overall prediction from regular economics is that an expansion of transfers, such as food stamps, decreases employment and, hence, gross domestic product (GDP). In regular economics, the central ideas involve incentives as the drivers of economic activity. Additional transfers to people with earnings below designated levels motivate less work effort by reducing the reward from working.

In addition, the financing of a transfer program requires more taxes…These added levies likely further reduce work effort…

Yet Keynesian economics argues that incentives and other forces in regular economics are overwhelmed, at least in recessions, by effects involving “aggregate demand.” Recipients of food stamps use their transfers to consume more. Compared to this urge, the negative effects on consumption and investment by taxpayers are viewed as weaker in magnitude, particularly when the transfers are deficit-financed.

Thus, the aggregate demand for goods rises, and businesses respond by selling more goods and then by raising production and employment. The additional wage and profit income leads to further expansions of demand and, hence, to more production and employment.

And of course, Barro then goes on to explain why he thinks the incentive side wins the argument.

Now let’s look at how Krugman handles this tradeoff between incentives versus demand-side effects:

But I thought I could squeeze out a few minutes to talk about something I’ve been thinking about a lot lately: the remarkable extent to which powerful groups, including a fair number of economists, have rejected intellectual progress because it disturbs their ideological preconceptions.

What brings this to mind is the debate over extended unemployment benefits, which I think provides a teachable moment.

There’s a sort of standard view on this issue, based on more or less Keynesian models. According to this view, enhanced UI actually creates jobs when the economy is depressed. Why? Because the economy suffers from an inadequate overall level of demand, and unemployment benefits put money in the hands of people likely to spend it, increasing demand.

You could, I suppose, muster various arguments against this proposition, or at least the wisdom of increasing UI. You might, for example, be worried about budget deficits. I’d argue against such concerns, but it would at least be a more or less comprehensible conversation.

But if you follow right-wing talk — by which I mean not Rush Limbaugh but the Wall Street Journal and famous economists like Robert Barro — you see the notion that aid to the unemployed can create jobs dismissed as self-evidently absurd. You think that you can reduce unemployment by paying people not to work? Hahahaha!

You guys really don’t see the difference between Barro’s treatment and Krugman’s? In particular, do you still not see how it’s hilarious that Gene Callahan thought he was defending Krugman by writing, “I’m sorry [David Henderson], but [Krugman] does not “disown” his previous argument AT ALL: zero, zilch, nada. You have not even shown him mentioning it!”

Last thing: The only defender of Krugman of whom I am remotely sympathetic in all of this is Scott Sumner (here and here).

I Was Less Than Clear on My Problem With Krugman’s Unemployment Insurance Post

[UPDATE below.]

Productively using our time, Daniel Kuehn and I have been arguing at his blog about the recent unpleasantness which resulted in the war-crime of Krugman calling me (and Russ Roberts) “idiots.” (Krugman’s intentional strikethrough raises it from a petty insult into a cool elbow-throw.) So here’s the progression:

(1) Russ Roberts complained that Krugman, in a post about unemployment insurance, led his readers to believe that supply-side arguments against it (such as the ones that the WSJ deployed) were goofy and ignored standard economic theory. This was ironic, since Krugman’s own textbook laid out such supply-side arguments. Russ was very clear that he was NOT accusing Krugman of an outright contradiction:

There’s nothing wrong with arguing that extending unemployment benefits is a good idea. There’s nothing wrong with arguing that extending unemployment benefits might reduce unemployment benefits by increasing aggregate demand. But how do you argue that your opponents are ideologues because they believe the opposite–that paying people to be unemployed increase unemployment when you yourself have conceded that that idea is true? [Bold added by RPM.]

(2) I followed up on Russ’ post, because I wanted to point out precisely how slippery Krugman was being. Krugman made it look like he was trying to be fair and get inside the mind of a person who disagreed that extending UI would create jobs, and the only thing Krugman came up with was “it would increase the deficit.” Krugman didn’t say, “Now of course, a perfectly plausible objection is that there are supply-side incentive issues–I explain this in my textbook. But I happen to think that such effects are swamped right now because of a shortfall of aggregate demand.” No, instead Krugman said the WSJ and Barro were throwing out decades of economic theory and ignoring the “standard view.” Like Russ, I too explicitly made sure to say that the issue was NOT whether someone could think demand-side effects outweighed supply-side ones:

To be sure, a Keynesian like Krugman could argue that in the middle of a big economic slump that such supply-side issues are of only minor importance, and get trumped by demand-side factors. But that’s not at all the argument Krugman is making in this latest blog post. Instead, he is making it sound like Barro et al. are grasping at straws, and not even relying on a coherent argument (such as fear of bigger deficits) when trying to oppose extension of unemployment benefits.

(3) Chris Dillow wanted to weigh in on Krugman’s side, and opened up his post by writing, “Paul Krugman is being accused of hypocrisy for calling for an extension of unemployment benefits when one of his textbooks says “Generous unemployment benefits can increase both structural and frictional unemployment.” (It was Dillow’s post that inspired Krugman to call Russ and me idiots.) No no no, that is obviously not what Russ and I were saying.

(4) David R. Henderson chimed in to explain that Dillow completely missed the boat. Russ Roberts also confirmed that Dillow had missed the point.

(5) So it looks like a pretty open-and-shut case, right? Russ and I both said, in the original posts (i.e. not just after the fact), that we were NOT saying Krugman was forbidden from thinking demand-side considerations could trump supply-side incentive effects. Rather, we were pointing out that he was doing a great disservice to his readers by painting the supply-side perspective as nutty (indeed by not even spelling out what it was). Dillow misstates our complaint, a sharp guy like David R. Henderson uses textual analysis to show Dillow (obviously) misstated it, and then–just for kicks–the original authors (Russ and I) publicly confirm that Dillow misstated our point.

(6) Ah, but now in looking back, I have to be more merciful, because the title I chose for my Mises Canada blog post was, “Krugman Can’t Understand How Someone Could Be So Stupid as to Believe What He Used to Believe.” And in the conclusion I wrote, “Rather, my point is that Krugman frequently accuses his opponents of being stupid and/or evil, when they present a view that he himself advanced in other circumstances.” So, I can see why Dillow thought that I was accusing Krugman of an outright contradiction.

(7) Last thing: Be kind to Daniel Kuehn in the comments, he has been undergoing a sadistic sleep deprivation experiment.

UPDATE: Oh, I can’t believe I forgot: The most unintentionally hilarious epitome of how both sides are talking past each other in this dispute comes from Gene Callahan. In response to David R. Henderson saying that Russ and I were complaining about Krugman disowning the point he had made in his textbook, Gene wrote: “I’m sorry [David], but [Krugman] does not “disown” his previous argument AT ALL: zero, zilch, nada. You have not even shown him mentioning it!”

At this point, I’m not going to explain why Gene’s comment is hilarious. I think everyone who has agreed with Russ and me all along will literally laugh out loud. Everyone who has agreed with Krugman all along will say, “Right on Gene! I can’t believe what idiots these guys are!”

My Presentation on Austrian Economics at “Save Long Island” Forum

This was truly a great event; I learned a lot from the other speakers. Here was what I told the crowd:

P.S. I also debated “The Money Masters” man, Bill Still, the day before the above talk. I will post on that separately.

Two New Posts

At Mises Canada I have two posts up:

==> The first gives yet another illustration of my claim that Bernanke has been the FDR of central banking. This time, I discuss a HuffPo writer calling on Janet Yellen to “save the planet” (his term).

==> In this post, I endorse Russ Roberts’ complaint about Krugman’s discussion on unemployment insurance.

Let me elaborate here with a different example. Back during the Krugman/Sumner showdown, some of Krugman’s defenders were absolutely puzzled about why so many people were thinking 2013 was a great test of Market Monetarism vs. Keynesianism. Did Krugman’s critics really think it was that obvious, such that anyone who denied it was a good test was therefore an idiot?

No, that is completely beside the point. The reason so many of us flipped out is that Krugman wrote this in January 2014: “Incidentally, these other factors are why I don’t take seriously the claims of market monetarists that the failure of growth to collapse in 2013 somehow showed that fiscal policy doesn’t matter.”

How in the *world* could a person write such a sentence, when that same person back in April 2013 had written:

The central debate over macroeconomic policy is, of course, between Keynesians and Austerians. And at this point the Keynesians have overwhelmingly won the debate everywhere…

There have, however, been a couple of side shows, with what I guess now constitutes mainstream Keynesianism…subjected to non-austerian criticism on both flanks. On the left are the Modern Monetary Theory types…On the right are the market monetarists like Scott Sumner and David Beckworth, who insist that the Fed could solve the slump if it wanted to, and that fiscal policy is irrelevant.

Now, there won’t and can’t be any current-events test of MMT until we get out of the slump, because standard IS-LM and MMT are indistinguishable when you’re in a liquidity trap. But as Mike Konczal points out, we are in effect getting a test of the market monetarist view right now, with the Fed having adopted more expansionary policies even as fiscal policy tightens.

And by the way, THE TITLE of that April 2013 Krugman post was, “Monetarism Falls Short.”

So the issue isn’t, “Was 2013 a good or bad test of Keynesianism vs. Market Monetarism”? The issue isn’t even, “Krugman changed his mind from April to January, how convenient.”

No, the issue is, Krugman is making it sound like only an idiot could possibly think that 2013 was a good test. One would have no idea from his January 2014 post that it was a position he himself endorsed back in April.

And the same thing with the unemployment insurance debate: The issue isn’t whether demand-side effects trump supply-side effects during a liquidity trap. No, the issue is that someone reading Krugman’s commentary on Barro would have no idea that Krugman endorsed Barro’s analytical framework in his (Krugman’s) own textbook.

Last thing: One might be tempted (as DeLong did) to dismiss such observations merely as “Krugman derangement syndrome.” Imagine that, some of us focus on the personal foibles of some guy, rather than the issues. But if that’s the case, what would you call it when DeLong and Krugman focus on the moral failings of the people who live in a Dark Age of Macro? (And of course, what kind of medical condition is it, when they spend more than one post each discussing a wager between some punk in Nashville and David Henderson?)

Potpourri

==> Reisenwitz vs. Borowski, settling things the way libertarians always do: through voting.

==> Why your iPhone footage from Europe has a weird strobe light effect.

==> John Carney looks at a Fed paper that (implicitly) challenges Austrian business cycle theory.

==> NYT on Edward Snowden (from a couple of weeks ago, I just haven’t posted it yet). I think some in even the mainstream media realize the danger in letting government crack down on whistleblowers.

==> Some in the Bitcoin controversies asked me to read this essay (by Niels L.). They claimed that Rothbard botched things, and needed to go back to Menger, when it came to understanding the demand for media of exchange. The only real issue I see in this article, is the claim that when a commodity comes to be demanded as a medium of exchange, this wouldn’t actually increase the total demand for it. (In the standard Rothbardian treatment, there is a snowball effect as more and more people increase their demand for it.) The reason, according to Niels L., is that you would just be substituting one person’s demand for another. For example, if I acquire a goat not because I want to consume it, but because I will trade it away down the road, then sure, my demand went up by “one goat” but then the person to whom I trade it will now reduce his demand from the rest of the community by “one goat” (since he’s getting the goat from me).

I see what the issue is here, but I don’t think it works. People hold media of exchange for a length of time, and sometimes not having specific future exchanges in mind. Think of it this way: If the whole community is walking around with gold coins in their pockets, and this was facilitated in part because there are a fraction of them who wear gold as necklaces, it is nonetheless true that the community is holding more total gold than would have been the case had gold not been adopted as money. It’s not the case that each gold coin is merely a shifting forward of that gold’s destiny as a commodity.

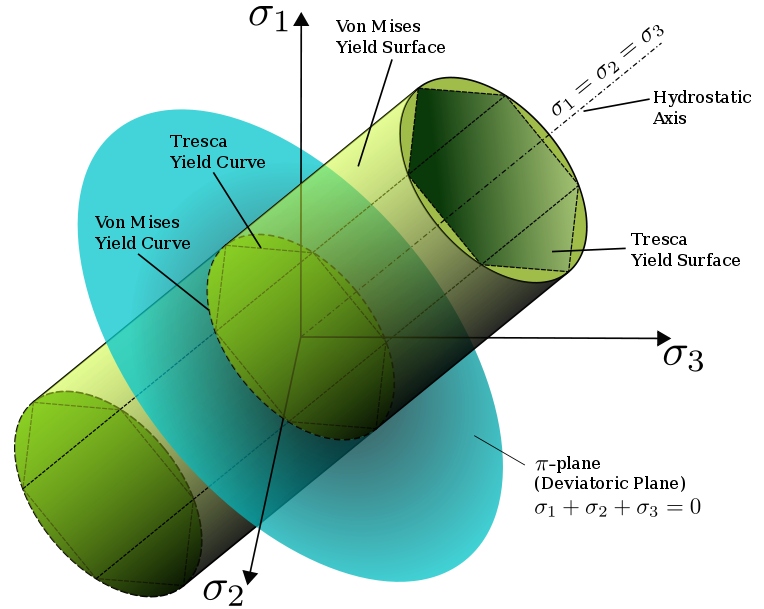

Three-Dimensional Representation of von Mises’ View on the Yield Curve

No joke, von Pepe sends me this right from Wikipedia:

I suppose some of you purists will insist on seeing the context. But I am not kidding, that diagram is taken right from Wikipedia. It showcases the von Mises Yield Curve.

“A Century of the Fed”

Next week I’ll be starting a 4-week online course offered through Mises Canada. Details here.

Recent Comments