The Fed and Conspiracies

One of the quickest ways to assess a person’s worldview is to ask, “How do you feel about conspiracy theories?” Murray Rothbard considered the very term to be loaded, used to discredit what were often sober and factual analyses of why certain government policies were actually implemented. In a recent post, Austrian economist Steve Horwitz takes the completely opposite tack, telling his readers that there is no need to invoke “conspiracy” when discussing the Federal Reserve. I think Horwitz’s argument falls flat, however; I still think there was a conspiracy behind the Fed, and that it’s not enough to merely discuss the technical problems of monetary policy and its “unintended consequences.”

For our purposes, I can summarize the strength and weakness of Horwitz’s post with this single paragraph:

Like other legislation of that era, the Fed was a government intervention supported both by ideologically-motivated and well-meaning reformers and by the industry being regulated. Rather than being this as some sort of unique conspiracy to take control of the US monetary system, it was a story very similar to those found in the history of everything from railroad regulation, to meatpacking regulation, to the regulation of monopolies and trusts as historians from Gabriel Kolko onward have documented. Unique historical factors in the monetary system affected the particular form the Fed took, but its broad history places it squarely in the tradition of the Progressive Era. If the Fed is the product of some nefarious conspiracy, so is a whole bunch of other legislation passed around that time. [Bold added.]

The last sentence–which I have put in bold–will not placate those who suspect skullduggery, and it shouldn’t. It is an odd strawman that Horwitz sets up in this paragraph; I don’t know of anyone who says the Fed is “some sort of unique conspiracy.” Indeed, the very thing that supposedly discredits the stereotypical conspiracy theorist is that he thinks “they” are behind everything, and sees connections and patterns between major events throughout history. So it would hardly put to bed the notion that a conspiracy is behind the creation of the Fed, to note that similar forces would describe the passage of the 16th Amendment, the Food and Drug Administration, and so on. I mean, if an elite group of international aristocrats wanted to run the world, sure they would want to control the money, but they’d also want to be able to seize upstarts’ incomes and to control the food supply.

But even taking Horwitz on his own terms, we can say no, there is something qualitatively more sinister about the Fed, even on purely structural grounds. The Federal Reserve is an organization that regulates the banking sector. And yet, the Federal Reserve banks are literally owned by the commercial banks they oversee, and key personnel decisions for the Fed are made by these same subjects of their regulation. This isn’t a conspiracy theory; you can read about it at the Fed’s own website.

To appreciate just how diabolical this arrangement is, imagine if two-thirds of the managers of various branch offices of the FDA were quite openly picked by the major agricultural and pharmaceutical companies, which literally owned shares of stock in the FDA. That would be analogous to the naked corruption of the Federal Reserve System. To point this out isn’t to excuse the way the FDA (or EPA, DHS, etc.) are set up, it’s just to underscore how incredible the Fed is.

Horwitz is right when he points out that the problem with the Fed isn’t that it’s “private,” and Horwitz is also correct that the Fed is a very odd type of “private” entity where the “owners” can’t keep their surplus earnings (the Fed remits its profits to the Treasury) or sell their shares. But nonetheless, something is qualitatively more corrupt about the Fed than the typical government agency, putting the Fed in a category by itself.

I can remember being disappointed many years ago when I first read Murray Rothbard’s slender volume, The Case Against the Fed. At the time, as a young scholar I had wanted an abstract, timeless critique of the very nature of central banking. Yet what Rothbard gave was mostly a specific historical account to show that in practice this particular central bank–the Federal Reserve of the United States–was indeed the product of insidious insiders, and not at all the accidental outcome of well-meaning college professors.

But now that I’m older (and wiser, I hope!), I see why Rothbard wrote his book the way he did. Different people respond to different types of arguments, and I think the “man on the street” cares very much about the types of details that Horwitz considers irrelevant. To give a personal anecdote, since 2008 I have been touring the country, giving dozens of talks to the public about the dangers of Ben Bernanke’s (and now Janet Yellen’s) policies. It’s true that people are horrified when I show them charts like this (the “monetary base” as displayed at the Fed’s own website):

But I have to say that the single most infuriating thing to most audiences is when I tell them that the Fed began paying commercial banks in the fall of 2008 to not make loans to people. Even though, in the grand scheme, this policy of “paying interest on excess reserves” is probably not that big of a deal, it infuriates people to hear it because it proves that Henry Paulson, Ben Bernanke, Timothy Geithner, and all the other suits on TV were lying through their teeth: The bailouts had nothing to do with “keeping credit flowing to Main Street.”

Yes, the objective consequences of monetary policy are the same, and the Austrian theory of the business cycle is correct, whether or not the people in charge are nice guys or villains.

But it still helps to remind people that they are villains, for the record.

Supply & Demand

For my Mises Academy class I got stuck on a runway in Little Rock, and missed the live lecture, which was to be on Supply & Demand. Since it’s such a timeless topic, I decided to make the lecture publicly available by hosting them at my YouTube channel. For convenience I’ve broken the lecture up into 6 digestible chunks. Note that the discussion closely follows Chapter 11 from my textbook, Lessons for the Young Economist.

Don’t Ask George Selgin to Dance

In a post full of his trademark pugnacity, George Selgin explains why he doesn’t consider himself an Austrian economist:

I don’t want to belong to any economic school of thought, or to “do” any sort of economics. I just want to “do” my own sort of economics.

And what sort of economics is that? I can’t tell you–I’ve never thought much about it. But perhaps that’s just it: I don’t “think” about writing any “sort” of economics. I don’t want to have to think about whether what I’m up to qualifies as “praxeology” or not, or whether Mises would mind my using terms like “money” and “inflation” the way most contemporary economists use them, instead of the way Mises himself used them a century ago. Nor am I any more inclined to trouble myself over whether my work fits neatly into any other economic school’s pigeonhole.

OK, but then I wonder: Does Selgin consider himself an economist? I mean, what if his scholarly interests take him into areas that fall outside the traditional boundary lines of this field? I wouldn’t want Selgin to get tripped up in the midst of a great flurry of writing, worrying about whether it qualifies as “economics” as opposed to “the great American novel.”

Then Selgin drives home his position with this flourish:

But if there’s one thing I truly believe concerning the “methodology” of economics, it’s that thinking about it is as helpful to actually doing economics as contemplating one’s steps is to dancing the rumba. In short, having to look over my shoulder while I think or write, at any methodological strictures at all, cramps my style.

Huh? That sounds hilarious, unless you actually think about it. (But maybe that’s the point? Selgin’s post is an ode to not having to consciously reflect on what it is we’re writing…)

If somebody is a newcomer to dancing, he sure as heck has to contemplate his steps in order to dance the rumba. And if even a professional dancer starts doing the foxtrot, and someone says, “Umm, I thought you were going to do the rumba?”, what recourse do we have except to contemplate the steps and see if the dreaded “label” fits?

But don’t worry kids: Even if you can’t dance, Bryan Caplan has the game theoretic tools by which you can avoid the deadly Friend Zone.

P.S. This post itself is pugnacious, but that’s because George and Bryan are big boys. I comfort the afflicted, and afflict the comfortable. Wherever there is a smug economist, I’ll be there! (And you can reverse it too: Wherever I’ll be, there will be a smug economist.)

Loyola University President Impresses With His Critique of Walter Block

I truly wasn’t going to get involved in this issue, primarily because it will undoubtedly sow seeds of discord in the comments. In the NYT article on Rand Paul, the writer claims that Walter Block thinks slavery “wasn’t so bad.” If you know Walter and how he talks, and then you read that phrase in context, you will understand that the writer completely mischaracterized him–Walter was rhetorically trying to emphasize just how bad the involuntary nature of slavery was. (It’s possible that libertarianism is so foreign to the NYT writer that he didn’t think he was misrepresenting Walter.)

Regardless of whether it was fair or not, Walter said those words, and they ended up in the NYT. So of course the president of Loyola University (where Walter teaches), Kevin Wildes, is going to throw Walter under the bus. (Just like Steve Landsburg was all alone during the Rush Limbaugh “slut” incident.)

Yet the guy surprised me. Wildes’ letter to the school newspaper was so ridiculous in its criticism of Walter that I have to draw your attention to it. Tom Woods does a magnificent job blowing it up, but I want to focus on one line in particular that Tom didn’t address. Here’s Loyola’s president explaining what was wrong with Walter’s views about slavery:

Dear Editors,

One of our goals as an academic institution is to encourage people to cultivate critical thinking. You can imagine my dismay when reading the Sunday New York Times and I found remarks by Dr. Walter Block.

In the Jan. 25 article “Rand Paul’s Mixed Inheritance”, Dr. Block made two claims, one empirical and one conceptual, that are simply wrong. First, he made the claim that chattel slavery “was not so bad.” “Bad” is a comparative measure that, like every comparison, is understood in a contrast set. My initial question was where is the evidence?

Dr. Block makes an assertion but gives no evidence for his assertion. [Bold added.]

I am speechless; I am without speech. The guy’s acting like Walter wrote a Letter to the Editor of the NYT. No, Dr. Wildes, Walter was quoted (very briefly) by a reporter writing an article on Rand Paul.

To complain that Walter “gives no evidence for his assertion” is like me saying, “Dr. Wildes says he opposes slavery but never fought for the Union.”

Oh yeah, then Wildes goes on to point out that Walter should oppose slavery, what with his being a libertarian and all. But I don’t want us to lose focus on his first complaint. That’s way more impressive.

Science vs. Religion: Framing Effects

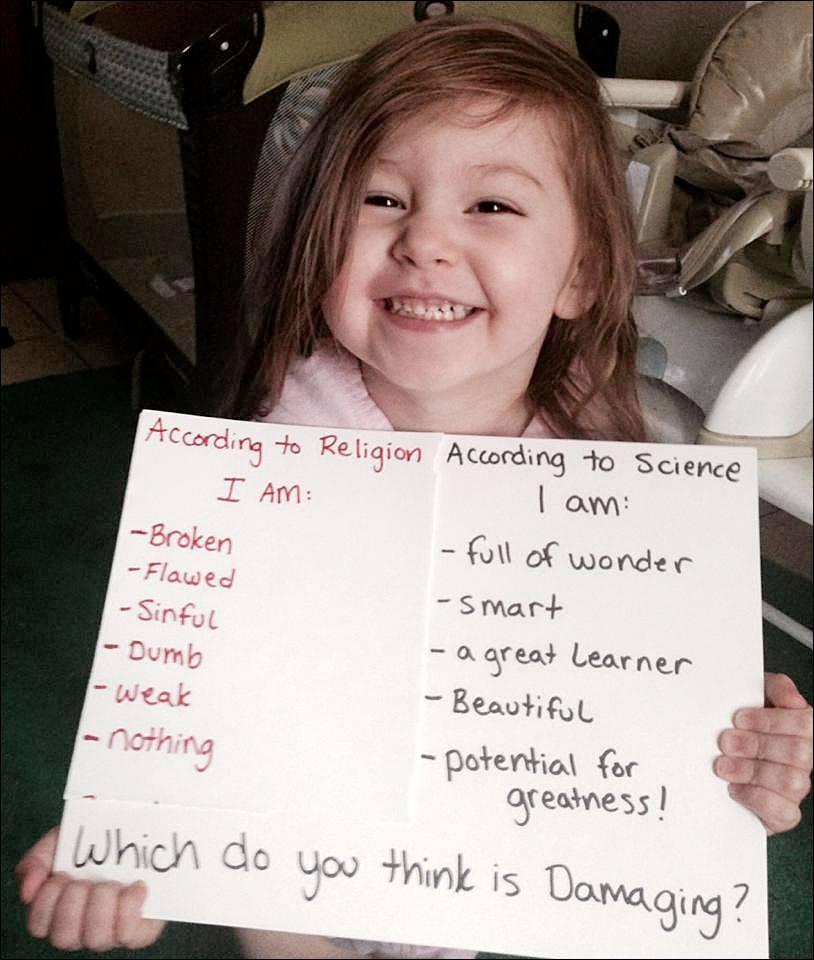

I saw this photo floating around Facebook; I am pretty sure it was originally posted to an Atheism group:

As a former atheist, I totally understand where this is coming from–and why the atheists on Facebook thought it was great. But I want to point out that the stuff on the right doesn’t flow from “science” at all.

Indeed, some (not all) atheists wear the “depressing” mantle of science as a badge of honor. They’ll say things like, “Christians have never recovered from the blow to their pride, when science taught them that the earth isn’t at the center of the universe, or that man is no more ‘special’ than a slug.”

And yes, there are aspects of Christianity for which the left hand side has some justification, but Christianity also teaches that everyone is a child of God, every aspect of which–down to the individual hairs–was deliberately designed as part of His perfect plan. Furthermore, we are so lovable that God sent His only Son to die for us, so that we could spend eternity with Him.

The people who think Christianity makes you feel crappy about yourself should come to my church in Nashville and listen to the opening music.

India’s Child Labor Ban: Can Someone Draw Me a Picture?

James Schneider, the new guy at EconLog, has an interesting post on an unintended consequence:

Some take it as a matter of faith that increasing taxes will dull people’s desire to work. However, higher taxes can sometimes cause people to work more. When higher taxes reduce the after-tax wage, people are poorer for any given number of hours worked. When they become poorer, many people are more anxious to earn extra money. Economists call this the “income effect.” (Although in this context, I like to call it the “poverty effect.”)

Increasing tax rates is not the only way that the government can reduce wage rates. If the government punishes your employer for hiring you, your services will be less marketable, and your wage will fall. This phenomenon is important when countries enact bans on child labor. If a country is so poor that many parents send their children to work, then it is unlikely to have the wherewithal to perfectly enforce a ban on child labor. When the wages of children go down, the poor families that depended on child income will become even more desperate. This might cause parents to have their children work more.

A recent paper shows that this is exactly what happened when India enacted the Child Labor (Prohibition and Regulation) Act of 1986. The law banned children under 14 from working in many industries. After these rules took effect, the wages of children under 14 fell relative to those over 14.

Something about this doesn’t feel right to me. I’m worried that if free-market economists embrace this, we’re doing the mirror image of the economists who come up with ways to explain how the minimum wage might lead to more employment.

I mean think about it: We’re saying that initially, employers in India hired x million children. Then the government said, “We are going to start randomly fining you for doing that.” In the new equilibrium, employers hired more children.

(Yes yes, I understand the theoretical argument of how this can happen; wages fall so much that even when you factor in the risk of fines, employers end up hiring more child labor. But it just doesn’t feel right to me. For one thing, why does it “overshoot”? And notice that there is a lot of emphasis on the fact that the enforcement is lax. Well OK, if the enforcement is lax, then the demand shouldn’t fall as much, meaning wages shouldn’t fall as much, meaning the income effect on the supply of labor shouldn’t be as big a deal… See what I mean? The whole thing just seems really convenient, sort of like how the ACA just so happens to boost employment precisely when the economy needs it, but then reduces employment precisely when the economy needs it.)

The actual paper is here. They have a Figure 1 (page 11) that tries to illustrate their explanation in a Supply & Demand framework, but I can’t make sense of it. Also, if I’m understanding it, they’re showing a constant Demand curve for labor and expressing the y-axis in terms of wages net of fines.

That approach is totally non-intuitive (which isn’t to say counterintuitive) to me. I want to draw initial Supply and Demand curves, with wages being the actual wage paid (and received), and then when the government threatens fines, the demand curve shifts left.

Because of the Giffen good stuff going on, you have to have regions of the supply curve that are downward sloping. So my question: Can anybody draw me a Supply and Demand curve for child labor, where the leftward shift of demand leads to a lower wage and a higher quantity?

Potpourri

==> Josiah Neeley thinks today’s blogging Keynesians are too eager to raise taxes, even though that’s not what their theory calls for.

==> Peter Schiff talks about his Daily Show interview.

==> Doug French steals some Jim Croce lyrics (but he doesn’t believe in IP) and says, “Don’t fight the Fed.”

==> OK so a lot of libertarian types loved this insider account of the TSA. Yet as far as I can tell, this guy offered no more evidence than Kristen Meghan did about the Air Force. The government has officially denied both of their stories (not necessarily in reference to their names, but their allegations). Discuss.

Krugman Incorporates the Liquidity Trap Into His Affordable Care Act Job Analysis

I’m not trying to be obnoxious about this, but in his latest post Krugman completely vindicates my claim that he had been totally ignoring the liquidity trap–the staple of his analysis the last 6 years–when dealing with the CBO’s report on the Affordable Care Act (ACA, aka “ObamaCare”).

In the comments at my first post, some of you thought I was being absurd, and claimed that Krugman was juggling all the various balls in the air (supply-side incentive effects and demand-side spending effects) with no tension at all between his analysis of unemployment benefits on the one hand, versus the ACA’s impact on work decisions on the other. Well, on this particular battle, you were wrong and I was right: Krugman now incorporates the liquidity trap into his analysis, and his answer totally flips. So clearly I was right when I claimed that Krugman had been focusing on the long run.

To refresh your memory, the CBO came out with a report saying that the ACA would change the incentives workers faced, and end up leading to the equivalent of 2 million full-time jobs worth of lower employment. Krugman didn’t dispute the logic, but instead offered an extremely wonkish (his term) post showing how reduced employment might actually be a good thing. There is nothing in that post about a depressed economy; instead Krugman argues that prior government interventions had led to too much work effort, and so on net the “distortions” of the ACA might not be distortions at all, but might instead be nudging workers back to the correct decision on the tradeoff between leisure and utility. (Call it the Great Vacation sponsored by the ACA.)

But now he has remembered that we’re in a liquidity trap, and in his latest post separates the short-run effects of the ACA from the long-run:

I had some fun (for weird econonerd values of “fun”) yesterday thinking through the interesting possibility that our pre-Obamacare health system created a “reverse notch” that induced some people to work too much. But I think I should step back and talk about the broader issue here.

…

A somewhat educated guess…is that the net economic losses from the kind of labor supply effect CBO analyzes are on the order of 0.3 percent of GDP.Oh, and that’s in the long run. In the next few years, with the economy still depressed, it’s all positive: reduced work by some will open up job opportunities for others, and higher incomes for beneficiaries will mean higher overall employment. [Bold added.]

Everyone see how the impact of the ACA totally flips once we embed it in a liquidity trap economy? To repeat, I wasn’t crazy for wondering why Krugman didn’t play this card initially.

Let me try to illustrate it this way. When discussing the issue of Democrats wanting to extend unemployment insurance, to be analogous to his initial reaction to the CBO statement, Krugman would NOT have brought up the fact that his textbook incentive analysis didn’t apply in a liquidity trap. Rather, he would have argued something like this:

HYPOTHETICAL KRUGMAN JUSTIFICATION OF EXTENDING UI, RELYING ON SUPPY-SIDE ARGUMENTS: It’s true, as I lay out in my textbook, that introducing unemployment benefits will distort marginal incentives and lead to longer spells of unemployment. However, in the real world there are pre-existing government distortions that alter the tradeoff between work and leisure. For example, the government offers all sorts of tax credits and other subsidies to businesses that make new hires. If we draw a simple budget curve with the representative worker/taxpayer, we can see how this pre-existing distortion leads unemployed workers to stop their search for a new job too early–they accept the best offer they’ve gotten after, say, 16 weeks, instead of holding out for 17 weeks as they would, in a free market. In the presence of this pre-existing distortion, the fact that unemployment benefits causes them to search longer, is a good thing.

I hope that by this point, at least some of you see what I am saying. The above is not at all how Krugman tackled right-wingers who brought up the incentive effects when criticizing extending unemployment insurance. But something analogous to the above IS how Krugman dealt with right-wingers who brought up incentive effects when criticizing the Affordable Care Act.

Last point: In light of his clarification, Krugman now believes the following about the Affordable Care Act:

==> In the short run, it will boost employment, and that’s definitely a good thing.

==> In the long run, it will reduce employment, and that’s arguably a good thing.

This ACA is one amazing piece of legislation, isn’t it? I bet if you dumped some frozen berries in it, a smoothie would pop out.

Recent Comments