Why Some of Us Are Really Suspicious of the Banks

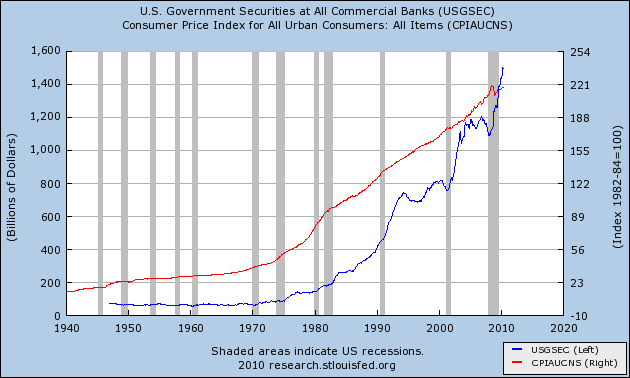

No joke, the elusive von Pepe and I literally sent each other the same FRED chart in crossed emails, because we saw different bloggers mentioning it. The chart shows a huge spike in US government securities held by commercial banks. It looked familiar, so I decided to overlay the CPI:

Now of course, correlation doesn’t prove causality. It’s possible that the commercial banks just want to hold more dollar-denominated bonds when the purchasing power of the dollar drops.

Even so, I think this is strong circumstantial evidence backing up the conspiratorial view many of us hold, that the government and the banks are in league, ripping everybody else off. Once freed from the last vestiges of the gold standard, the government was free to run massive deficits, because the Fed and the commercial banks would be only too happy to provide the “loans.” It’s easy to lend money to the government when the government sets up a system whereby you can create money out of thin air.

Of course, this leads to rising prices, but hey, every system has flaws. Stop being so critical.

Hoisted on My Own Petard

Or is it by my own petard? I was so busy being hoisted, I forgot to check…

My blogging is still going to be sparse for at least a few more days, because I’ve got a bunch of deadlines and miles to go before I sleep. But I had to document a conversation with my 5-year-old I had earlier this evening:

Clark: Hey, hey, what does dammit start with?

RPM: Oh, buddy, let’s not say that word.

Clark: But what does dammit start with?

RPM: It starts with “d” but we’re not going to say that word anymore, OK?

Clark: But you said “dammit” a long time ago, remember?

RPM: Yeah I know buddy, I shouldn’t have said it. OK we’re not going to say that word anymore, because it’s a bad word.

Clark: I wasn’t trying to be bad, I was just asking you what dammit started with–

RPM: Hey! Stop saying it, OK?!

Jeff Tucker Comes Out of His Shell

One of the underappreciated forces in the Austro-libertarian movement is Jeff Tucker, academic vice-president of the Mises Institute and editor of Mises.org. (He also taught me that real men wear bowties. I’m not there yet. I can wear a pink shirt no problem, I can sing George Michael at the karaoke bar without batting an eye, but I still hesitate at the bowtie.)

Anyway, the Institute is out with a collection of Jeff’s articles. This is great stuff. If you have relatives or friends who would fall asleep with one of my “clever” articles on the capital structure, Jeff’s idiosyncratic observations on the government may be just the thing. Whenever Jeff has something new at LRC, I jump on it. The only other person whom I read with such enthusiasm–when he was writing for LRC, that is–is he who shall not be named.

Congratulations, Jeff!

Gold Hits Record High

More proof that Ron Paul is the secret mastermind behind world economic affairs…

Fox News Guy Makes Great Comment

The whole clip is decent, but make sure you watch to see the guy on Fox discussing the fate of Afghanistan now that some nasty imperialist countries might try to take it over. (Zoinks!)

| The Daily Show With Jon Stewart | Mon – Thurs 11p / 10c | |||

| Ore on Terror | ||||

|

||||

How Many Austrians Does It Take to Understand Fractional Reserve Banking?

(We also would have accepted, “How many bankers does it take to screw over their depositors?”)

This is pretty funny. It took several blog comment exchanges before Steve Horwitz and I finally understood where the other guy was coming from. (And in fact, we’re still not in agreement on the basic facts. Ah well.) Let me bring you up to speed. In the comments of my latest Mises.org article on fractional reserve banking, Steve wrote (with my text interspersed):

One last round Bob, then back to work for me.

BOB: But if, on the contrary, what actually happens when a banker issues a new loan, is that he “magically” increases the number in the client’s account balance, then the 10% reserve requirement definitely allows the creation of a multiple amount.

STEVE: “Allows” in the metaphysical sense, sure. The banker can press whatever computer keys he wants. Or the free bank can tell the printing press to run faster to physically create more banknotes. But “allows” in the economic sense, no. Isn’t it the latter that matters? Gravity allows me to flap my arms and try to fly to the moon, but gravity will also put a quick stop to the experiment. Banks can try to create the 10,000 but economic reality will drive them into the ground. What’s the point of trying to make an economic argument by what seems to me like reference to a metaphysical notion of “allow?”

BOB: This is presumably so elementary to you that you don’t understand why I’m stressing the point, but *I* didn’t fully grasp this aspect of FRB until about a year ago. Because of the standard textbook treatment, I was picturing the banks getting $1000 in new cash, then handing $900 of it (in cash) to the borrower, etc.

STEVE: Maybe that’s YOUR weirdness then. 😉 Every M&B text I’ve ever used has made this point quite clear: when banks make loans they do so by creating an asset and a liability: the loan that borrower must pay back is the asset and the electronic credit to their account that the bank owes the borrower is the liability. This is as old as banking: one of the key entrepreneurial insights of the early goldsmith/proto-banks was that they didn’t have to lend out the actual gold they had on hand, they could just print up receipts equal to those excess reserves and lend those.

I don’t see the magical weirdness here as long as one recognizes my point above: the bank is economically limited to lending out its excess reserves and it does so by creating that liability. What the Fed does is a lot weirder as it can bring reserves into existence ex nihilo by making a bookkeeping entry. Banks, under free or central banking, cannot do anything like that. It’s the Fed that’s responsible for the multiplier process, not the individual banks.

BOB:Whatever else you want to say about it, that process [where the fractional reserve bank physically hands over $900 of Bill’s initial deposit to the new loan applicant] seems a lot less “weird” than the case where the bank just decides to increase its assets and liabilities with the stroke of a pen by granting a client a new loan.

STEVE: To you maybe! I think this is just some kind of “yuck” factor on your part as I just don’t see the weirdness. I think the Fed’s ability to create reserves is the thing that really is “weird.”

How would a 100% reserve bank create a loan off a time deposit? Suppose I give Rothbard Bank a deposit and want a one-year CD. Presumably RB can then lend that $1000 (let’s say) to a business for one year. Do you think RB is going to hand over the exact $1000 in gold I deposit? What if RB gave the borrower money certificates instead because the paper was easier to use? Is going down to the basement and printing off 10 $100 money certificates any weirder than creating a demand deposit at the stroke of a pen? And why couldn’t Rothbard Bank actually give the borrower a checking account? The underlying reserves are still 100% in the bank, but perhaps negotiable IOUs that can be written for a precise amount are more convenient?

In either the money certificate case or the checkable account case, Rothbard bank creates both a new asset and a new liability that is no more or no less “out of thin air” than what the individual bank does under fractional reserves, no? And neither case would involve fractional reserves given that the original gold is still there and untouchable by the depositor for one year.

And note: RB could print up extra money certificates or over expand its checkable accounts in that situation in the same way that FRB “allows” banks to create multiplied loans off a new deposit. But in both cases, there’s a reality: for RB it’s the law saying they must keep 100% reserve and for FRB it’s the economic law that says that adverse clearings will lead them into a breach of contract and a liquidity crisis. What’s metaphysically possible is not economically or legally permitted. I just don’t see the difference Bob.

OK as I said, I think we are actually getting close to the heart of the dispute. (Or at least, to the heart of one of the disputes.)

This is what really intrigues me: I can understand if you are a 100% reserve guy who hates fiat money, OR I can understand if you are a (market-based) fractional reserve guy who has no problem with the concept of fiat money. But what I don’t understand is how Steve (and the guy who went ballistic on my blog a few weeks ago against Rothbard–maybe Cargocultist but I can’t remember for sure) can agree with me that it’s mystical/weird/fraudulent for Bernanke to write a check “out of thin air,” whereas it’s perfectly fine for the bank to advance a $900 loan to Sally.

Before I tackle that issue directly, let me first say this: How can it be OK for the entire banking system to do it, if we don’t think it’s OK for an individual bank to do it? To repeat, in principle any individual bank could have created the full $9,000 in new loans pyramided on top of Billy’s deposit of $1,000 in currency. Let me put it this way: Suppose for some reason the bank knew that the customer wasn’t going to spend the new loan. Maybe the customer for auditing purposes needed to show that it had a bunch of disposable cash on hand, and so it opened an account with the bank with $9,000 in it, even though it’s for show. (“Hey look, we’re a stable business. Why, we’ve got a $9k checking account at the local bank; we’re here to stay.”) In that case, would Steve agree that the first bank was fine to create the $9,000 in new loans in one fell swoop?

But let’s push that aside and go to the crux of the matter: Steve is seeing a world of difference between Bernanke writing a check for $900 drawn on the Fed, when he buys $900 worth of government securities. In contrast, when the commercial bank makes a $900 loan to Sally, Steve thinks that is perfectly legit.

What’s the difference? In the case of the Fed, it too is “merely” adding to its liabilities and assets. It buys $900 worth of Treasury bonds, and it creates $900 in new reserves–claims on the Fed–which technically are Fed liabilities.

So the difference between Steve and me (I believe) is that he is looking at the regulatory process (I don’t mean government regulations, I mean the forces regulating this activity which include market forces), whereas I’m looking at the essence of the transaction. In the same way that it seems weird/magical/fraudulent to me that Bernanke can simply buy assets by writing a check on himself, it seems w/m/f to me that a bank can all of a sudden acquire a $900 loan owed by Sally just by crediting her account with $900 in claims against the bank, when those claims are treated by the community as interchangeable with money proper.

Yes, Steve is right that under “free banking,” by which we both mean a market where property rights are enforced and no central bank props up failed banks, there would be no problem. But I think that’s because market forces would drive banks to 100% reserves.

To repeat an old analogy: I don’t think the government courts or police need to punish shoplifting. I think in a free market, stores would install cameras, hire security, etc. in order to drive down the incidence of theft to negligible levels.

But that doesn’t mean “theft is OK so long as it isn’t propped up by the government.” It doesn’t mean that I am just imposing my idiosyncratic preferences on the world by insisting that theft PER SE is bad and that it disrupts the market.

So same thing with fractional reserve banking. We can see that it is weird/magical/fraudulent when the government makes it happen “a lot.” I don’t think it’s analogous to the government causing house production to be higher than optimal, I rather think it’s analogous to the government causing “total amount of theft” to be higher than would occur in a free market.

Salon Advances a Devastating Argument Against the Austrian School

Bob Roddis sends this along, with the comment, “This is getting pathetic.”

Until they perfect cloning technology, I do not have the time to comment on this. I will have to stoop to the methods of my opponents and simply quote this, letting it speak for itself:

Liberals want to turn America into Europe! This recurrent theme of conservative propaganda is now being promoted by the new president of the American Enterprise Institute (AEI), Arthur C. Brooks…

It is true that many American progressives idealize Europe to a fault. The late Robert Heilbroner said that his model society was “a slightly idealized Sweden.” Other liberals seem to take particular features of particular European countries — French rapid transit, German environmentalism and Swedish social insurance — in order to create a composite “Europe” that leaves out the aspects of European society that Americans are inclined to find unpleasant, like pushy French shopkeepers, trashy German tabloids and foul-smelling Swedish lutefisk.

But if anything, there are more Europhiles on the American right than on the American left. In every area of public policy — economics, foreign policy, even art and architecture — American conservatives worship European intellectuals, most of them long dead, when they are not calling for the U.S. to adopt the ways of particular European societies of yesteryear.

Let’s start with economics. Last time I checked, “laissez-faire” was French. In its application to economics, the phrase goes back to the late 17th century, when the French finance minister, Jean-Baptiste Colbert, asked a group of French businessmen how the government could help them and is supposed to have been told, “Laissez-nous faire” (“Leave us alone”). The “let-alone” theory was central to the 18th century economic school of the Physiocrats, led by Francois Quesnay and Anne-Robert-Jacques Turgot. Adam Smith popularized much of their thinking in “The Wealth of Nations,” which might as well have been written in French.

Then there is Jean-Baptiste Say, the author of Say’s Law, which claims that “supply produces its own demand.” Say is a hero of contemporary conservatives and libertarians, who routinely invoke Say’s Law to claim that Keynes was wrong to believe that there could be such a thing as insufficient aggregate demand. It seems a bit disingenuous for conservatives to attack liberals as Europhiles, when the right is always invoking the authority of Say’s 1803 Traite d’economie politique.

The American right also includes a number of economists and economic journalists who call themselves “Austrians” and specialize in denouncing other libertarians for not understanding true libertarianism. Imagine what the right would say about a school of American liberals who went around proudly calling themselves “Germans” or “Hungarians.” The so-called Austrian School of economics was founded by Ludwig von Mises and Friedrich A. von Hayek. Imagine what the right would say about a school of American liberals who worshipped the Two Vons.

By the way, if you want to say, “The guy is just making a point about a silly conservative talking point,” then you need to read his essay. He’s not just saying, “We all revere Europeans,” he goes on to say that the liberals revere workable European ideas, whereas the so-called conservatives revere obsolete, unworkable European ideas.

Recent Comments