22

Jul

2016

LMS: Are the Markets Signaling Confidence or Fear?

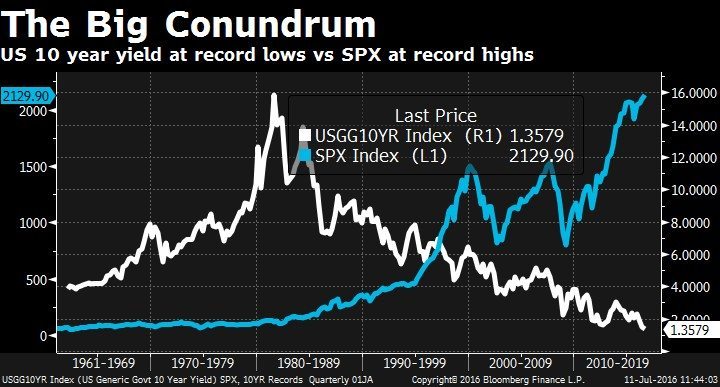

In the latest episode of the Lara-Murphy Show, Carlos and I discuss the divergence in bond yields and stock prices, which has some Bloomberg analysts puzzled. Below is the chart that motivated the discussion.

I think it is the effect of the big central banks in the process of buying up all of the government bonds and other holders buying the remainder in anticipation of selling for capital gains and at even lower rates. Add to that the dipping the central bank toes into the buying of equities, too, and corporations selling debt and buying up their equity at near record rates, and you get a correlated market between US treasuries and the S&P 500. At the rate we are going, in a couple of decades there will be no government bonds not owned by the central banks and corporations will be fully funded with debt, not equity.

Of course, when the next recession hits, the corporations will stop buying their equity altogether, then and likely only then, will you see the market viciously correct. It is at that point, I expect the central banks to all jump into buying the equities hand over fist in new QEs.

I went out for a walk and listened to your LMR… good explanation as always.

It isn’t unusual to get a short-term vs long-term dichotomy in economic decisions (call it a trade-off if you prefer). For example: short term a central bank that drops interest rates can “goose” the economy, generate stimulus, and boost GDP, but long-term the consequence is malinvestment, bubbles, and eventually a correction or reset of some sort. Another example: short term people play the guess-the-Fed game where they don’t want to be holding bonds at the time the Fed does another interest rate rise (but we don’t know when that will happen) long-term we see a general trend towards low returns right across the board, doesn’t matter what you are holding.

Speaking about low returns, Carlos Lara was saying about how the insurance companies are sitting on old government bonds with decent coupon rates and that’s a fine thing. Problem I see is there’s no future expansion in sitting on old assets like that… it might have them in good shape for the time being, but where to go from there? Eventually these globally crap returns are going to creep into the insurance market as well. You can hide from it, but you can’t hide forever.

Here’s my quick outline of various currency / savings options at the moment (possibly some details are wrong, by all means offer corrections):

Standard Fiat-Money Banking System

Advantages: allows instant gratification with loans, government supports it, easy to use, already available.

Disadvantages: no privacy, loans can get you into trouble, fiat currency has no intrinsic backing (or backed by violence if you follow the Moser 9mm theory), low returns, gets clobbered by price-inflation, at risk from bail-ins (danger of haircuts), regular bank accounts offer very low returns.

Whole-Life Policy and Infinite Banking

Advantages: not subject to bail-ins (probably), better returns than a regular bank account, good flexibility if you want to either borrow your money back or surrender the policy, perhaps some tax advantages, facility is already available.

Disadvantages: No instant gratification, not protected against price inflation (but you can hedge with gold coins, etc), requires knowledge/guidance to do it properly.

Owning Government Bonds

Advantages: government will love you if you buy these, easy option and already available, very likely to get paid (in nominal terms), at least they offer some returns.

Disadvantages: returns are almost zero, at risk from future interest rate rises, might have to sell at a loss, at risk from price-inflation, cannot be used directly for transactions (not flexible).

Bitcoin

Advantages: great for international transactions, provides some degree of privacy, protected against price-inflation, excellent coolness factor.

Disadvantages: still some technical glitches (young technology), no intrinsic backing, zero interest paid, target for sovereign risk (prosecution futures), alternative digital currencies might overtake (tech-shock risk).

Physical Gold & Silver

Advantages: Excellent inflation protection, genuine tangible asset, massive historic track-record going back thousands of years.

Disadvantages: Cumbersome to use for transactions (horrible for international), unsafe to store in your home, target for sovereign risk (FDR mkII), zero interest paid, delivery and storage fees, possible rip-offs and scam artists, no instant gratification.

Peter Schiff’s new joint-venture “GoldMoney”

Advantages: similar to physical gold, easier to use for transactions, good international connectivity via Internet.

Disadvantages: potentially higher risk than physical gold, possible technical glitches (very young platform), no instant gratification, maybe sovereign risk if laws are changed to discourage this alternative to fiat currency.

It occurs to me, what is so bad about companies buying up their own shares?

Selling shares is one way to finance capital costs for a business, and selling bonds is a similar but different way to raise money. So borrowing on bonds then buying back shares would exchange one type of finance for another type. I’m sure there are subtle advantages and disadvantages here, but I don’t see any obvious drop dead case why corporate bonds would be bad.

In terms of the economy as a whole, should be a wash if some people buy corporate bonds (i.e. saving money) and equivalent people sell their shares (opposite of savings).

Tel,

There are quite a few differences from the corporation’s (shareholders’) perspective, but by and large it is more favorable to use bonds than stocks. First of all, it is cheaper because debt is less risky than stocks for any given firm. Second, having at least some debt is a positive signal that the managers can send to shareholders that they believe the firm is solvent enough to afford some interest payment. Third, said interest payment then becomes a disciplining tool on the managers because it gives less money to waste on perquisites.

Now, in aggregate, there are problems with all firms buying back shares simply because people want to hold shares and not bonds for the growth potential. But that’s a separate issue.

I would expect that the relative value between stocks and bonds (seen from both sides) would balance out via price signals. From the point of view of the money lender, bonds get paid first in the queue, and stocks get whatever is left over after that… so cautious people worried about poor performance would want to hold bonds. In the reverse direction, optimistic people would want to hold stocks. At some stage these groups of people would sort themselves out and the prices should reflect that.

If bond prices drop too low, and stock prices come up too high, there should be a point where the company decides it’s not worth selling bonds and buying stocks any more. Presumably we haven’t reached that yet.

All that said, the way Carlos Lara was talking about this issue, he gave the impression that something is distorted in this market and that these companies are making poor choices. I don’t see any reason in principle why the market wouldn’t “just work (TM)” in this situation. There may be good reasons in practice to explain what is going wrong, but I do not know them.

Yes, indeed. I think what Carlos (and many others) are thinking is that the central bank is causing false price signals, but it does seem to affect bond and stock prices in the same direction. A few years ago I would have argued that the bond prices are going up because of fund flows & demand for bonds sharply outweighing supply. That might still be the case, but not sure. There is a neat paper from the Fraser Institute recently making the case that there are too few “good” securities right now given the amount of savings available internationally, and that’s causing the price increases as well. Empirical issue it seems.

Slightly off topic, this is an interesting interview on some of the aspects of money / currency and transactions, etc.

http://www.economicrockstar.com/scottburns/