Yellen and the End of QE3

Although it has been dubbed “surprisingly hawkish” by the financial press, the Fed’s announcement today fulfilled its original plan to wind up QE3 asset purchases this month. Going forward, the Fed will continue to reinvest the principal on its maturing bonds, but it won’t add assets on net to its balance sheet.

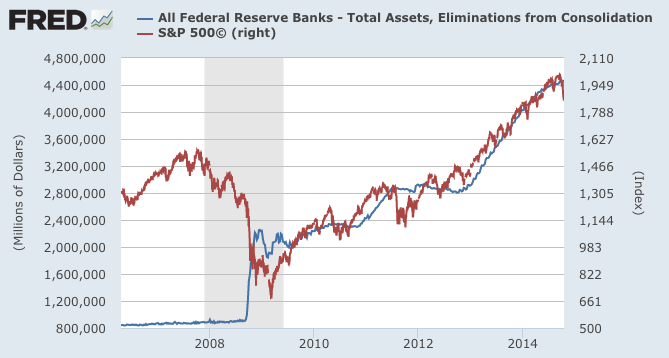

In my view, if the Fed holds firm and doesn’t resume asset purchases, we will have a sharp drop in stock prices, as they have moved in lockstep with the Fed’s balance sheet since 2009:

Let me also remind readers of my analysis back in July, when I explained why I thought Janet Yellen was going to take one for the team:

==> Paul Volcker took over as Chair of the Fed in August 1979. A recession officially began five months later, in January 1980. The second “early 1980s” recession officially began in July 1981; the annual unemployment ratewas 9.7% in 1982. This was the worst recession since the Great Depression.

==> In August 1987 Alan Greenspan took over the Fed. Two months later “Black Monday” occurred on October 19, 1987, when the Dow dropped 22.6% that day alone–the worst one-day crash in history.

==> In February 2006 Ben Bernanke became Fed chair. The worst recession since the Great Depression officially began in December 2007, and you may recall there was some trouble in the financial markets in September 2008…

==> In January 2014 Janet Yellen became Fed chair. The US stock market crashed and slipped back into major recession on _____?

Of course, no one knows the future. But given that the people behind the curtain have to let a major crash happen sometime–they can’t repeal Austrian business cycle theory–why not do it when the first black president is in the White House and the first woman is at the helm of the Fed?

The stock market didn’t crash the last time there was a “no QE” period. So I think we can expect the economy to continue recovering until the next President takes office.

Ummm… I do not think the market will crash either. The economy is not ‘built’ on the FED hence it will not crash SIMPLY because there is little to no more stimulus. It may not advance as quickly, but this is not a bad thing either. Say the market stays around 17,000 ( for the dow ) over the next year to year and a half. It would then be at about the level I would ‘expect’ it to be at.

Yes, the economy is totally built on the Fed. But, as in the previous seven recessions, I think the yield curve will be the best indicator of the coming of the next recession. 1937-style mystery recessions are unlikely; there was a booming economy in 1936; there isn’t one now.

Well, yes, the market has factored in the additional 8% liquidity of injection each year of the money supply, what I mean is that the stimulus ending will not cause it to crash. There is too much liquidity after the enormous amount of bond buying to simply do that.

I’m not sure what your definition of liquidity is here. All that “printed” money the FED used to purchase those bonds is just sitting on the FED’s balance sheet (just look at Bob’s graph). It’s not getting loaned out. It’s not sloshing around the economy. It’s not doing anything. As far as Americans are concerned QE can end without much fanfare precisely because it isn’t doing anything to increase their liquidity.

I am referencing M1 in this case to describe liquidity. Which may well be a misnomer for liquidity.

I do have an additional thought here. What was the point of QE is not to increase asset prices? To lower Federal Borrowing costs artificially? Would that (in economic terms ) not mean that it increased asset prices for stocks and been a detriment to bonds and treasuries? Would this not then create an artificial rise in stocks and a lowering of bond prices that eventually have to go back to equilibrium?

I am amazed that people suggest that QE had no effect on anything but then support it. If QE did not do anything then why do it? If ti did effect things then there will be repercussions for ending it. Or do the laws of cause and effect have no bearing in the world now?

Yes I know the money was not ‘loaned’ out, yet it was. Where else would the US Government have gotten the money to borrow as much for as low as it did? Did this money not make it into the economy?

To be honest my take on QE is that it had two purposes. One was to shore up the banks’ balance sheets. That was a home run. The other was to convince the market the FED would do “whatever it takes” to jump start the economy. Really, the FED did its part, but without vastly accelerated bank lending those great bank balance sheets and lending potential isn’t worth much. So now, QE doesn’t do much to convince people that it will “really get things going”. Kind of a boy who cried wolf situation going on there IMO.

Methinks Scott isn’t working with quite the right theories. I think the point of QE was pretty simple: to avoid Japanese-style stagnant consumer prices and to raise asset prices. When considering the entire money supply, QE really was a drop in the bucket; the minimum necessary to prevent the price level from stagnating. While it’s certainly the case the money is only recently starting to get loaned out, banks loaning out the money is not necessary for that money to have an economic effect. QE is almost literally money-printing; it increases the supply of money in the economy independent of any bank lending.

I don’t see how QE could shore up shaky banks’ balance sheets. Deposits are liabilities for banks; loans are assets.

“banks loaning out the money is not necessary for that money to have an economic effect.”

This statement is somewhat true. If the public *believes* the QE money will be lent out, then the FED flooding the monetary base will cause the velocity of existing money to increase. The people will seek to spend their money before inflation steals some of it. People like Bob have this outlook on QE, and they are correct — in times where banks are lending and are constrained mostly by reserve requirements. Unfortunately, the banks didn’t loan enough and the inflationary process (other than spurts of velocity here and there) was never realized.

Once the loaning expectation dissipates, there is nothing to create inflation. Money sitting in the FED’s vault isn’t out in the economy purchasing goods and services.

Also, FYI, a key bank health indicator is the ratio of loans to reserves. When the FED buys your loans and pays you in reserves it improves that ratio real quick — that’s how things get shored up. I’m sorry if I assumed this mechanism was widely understood.

“Money sitting in the FED’s vault isn’t out in the economy purchasing goods and services.”

-Yes, it is. Money, as Rothbard said, is not “in circulation”. It is transferred. At present times, it is transferred indirectly from the Fed’s coffers back to the Fed’s coffers. QE money is still money in the form of M1 and M2, so its effect on the price level is not merely via velocity. Imagine if the Fed printed $80 trillion overnight, buying, instead of merely treasury bonds, corporate bonds, bridges, and stocks. Wouldn’t you think that would have some sort of effect on the economy outside of any bank lending or expectation of it?

“Also, FYI, a key bank health indicator is the ratio of loans to reserves.”

-No, it’s not. It’s the ratio of assets to liabilities. Reserves, being simultaneously deposits, are simultaneously a bank asset and liability, and, so, do nothing to improve the bank’s asset-liability ratio.

You should probably say “Nominal End of QE3” so as to avoid confusion with readers.

They would have to learn what it was first, so they would know what to repeal.

I’m pretty sure those guys drink their own bathwater, and really believe Keynesian stimulus can work. The Fed is attempting to stabilize the Producer Price Index, which is not the worst thing to do under the circumstances. Most of the problems in the US are coming out of Washington, not the New York Fed.

But Bob…

Stopping QE will leave FED total assets relatively constant — not precipitously falling. If you are really committed to your spurious correlation wouldn’t you predict a stock market that simply hovers at its all-time high for an extended period of time?

“In my view, if the Fed holds firm and doesn’t resume asset purchases, we will have a sharp drop in stock prices, as they have moved in lockstep with the Fed’s balance sheet since 2009”

Are you open to wagers on this ?

It hould be fairly easy to define “if the Fed holds firm and doesn’t resume asset purchases”. But what do you define as “a sharp drop in stock prices” ?

“Of course, no one knows the future. But given that the people behind the curtain have to let a major crash happen sometime–they can’t repeal Austrian business cycle theory”

An astonishing statement from a man who clearly knows that Sraffa’s critique of Hayek was completely right.

So what version of ABCT are you talking about?

Keynes,

Thanks for posting this.

Unfortunately, this really has essentially nothing to do with the point here. Let me quote from your link:

“In this tantalizing passage, Hayek puts his finger on the crucial point: When the

commercial banks flood the loan market with artificial credits, this causes producers to

erroneously begin projects that are physically unsustainable. Specifically, the producers

lengthen production processes as if the savings of real goods had increased (when in fact

they have not). Thus, when Hayek laments that the banks cause a divergence of the

money from the equilibrium rate of interest, he is referring to the fact that the false

interest rate disrupts the intertemporal coordination between producers and consumers.

Sraffa clearly missed the entire essence of ABCT, because—as Hayek pointed out—

Sraffa’s suggested barter example would actually increase the subsistence fund; it was

(by stipulation) a mistake, but only because consumers would have preferred that some

other goods had been produced rather than the increment in wheat output. In other words,

Sraffa’s example of an erroneous (and unprofitable) increase in wheat production would

not count as a “malinvestment” in the Misesian sense.”

So… yeah, there’s some abstract theoretical issue, but it has no impact on real-world application of the ABCT.

“Unfortunately, this really has essentially nothing to do with the point here”

Then you should explain here banks can drive the money interest rate below *the* natural rate of interest.

The central bank drives all rates that actually exist in the economy (I know that’s tough for a Keyneisan history of thought “expert”) lower than they would otherwise be. That “otherwise be” is consistent with actual resource availabilities and consumer preferences.

I know you think you have some kind of “gotcha” here, but the problem is that you seem to be unable to apply criticism of a theory under real-world conditions. Your real-world criticism is easily demolished when the assumption of a single market is relaxed.

And here I thought Keynesians were all about ceteris paribus conditions and using abstraction to build useful models… perhaps not, at least in your case.

The one with the letter ‘s’ added to each instance of the phrase ‘rate’.

Staffa’s critique amounts to nothing more than a grammatical suggestion.

Then, as the equally deluded “Ag Economist”, you should explain how banks can drive the money interest rate below *the* natural rate of interest. If there is no single natural rate, what bank rate clears the market for real capital? lol

There is no single “capital” either..

Of course what MF means, is that without manipulation you would also have lots of interest rates, right?

And with manipulation you also have those interest rates but at a different level, and since CBs are keen on having low interest rates, they are lower than otherwise (at first). Is this so hard to see?

I mean there is one thing to argue about the effects of doing that, but not even getting what MF is saying here is strange..

The natural rates are just what would we see in the market without central banks. I hope you do at least agree that even without Central Banks there would be interest rates..

It is the same logic as with any price control. When the soviet union ended its price controls on food they also found out that there still were prices!

No, skylien, just like M_F, you don’t understand the ABCT.

In the classic ABCT, the single Wicksellian natural rate, when it equals the bank rate, clears the market for real capital, which thus ensures intertemporal coordination and no forced saving. With no such single Wicksellian natural rate, and in theory as many natural rates as there are capital goods, which is **the** natural rate which the bank rate must equal to clear the market for real capital?

I think you focus on the wrong issue. Maybe Wicksell’s natural rate and ABCT are just simplified models to explain the pattern?

Why doesn’t ABCT work with more than one single natural rate? Price control theory also is usually explained with the single natural market price of a good, though there is whole array of different prices in reality..

In other words, you cannot answer the question, possibly because you don’t even understand the issues properly or the actual ABCT.

I was asking questions to you..

Whatever..

LK is only interested in name calling.

IMO, the essence of the ABCT is expanding production not backed by vol

Sorry, hit submit on accident.

….not backed by voluntary savings. Ultimately, you can’t have your cake (investment) and eat (consumption) it too. Hence, expanding bank credit leads to an inter-temporal misallocation of resources. I’m not sure why ABCT hinges on some sort of “natural rate of interest”.

Skyline:

LK’s nonsense about a single “natural rate” and/or a “Wicksellian natural rate” is just as bogus as his other phony narratives like:

1. Austrian theory is refuted if businesses cut production as opposed to prices in a downturn;

2. The concepts behind the socialist calculation debate are inapplicable and completely distinct from the price miscalculations attributable to Keynesian policy; and

3. Anecdotal evidence that businesses engage in “mark up pricing” refutes Austrian analysis.

Plus, he still does not or will not understand the concepts of economic calculation, prices as information, price distortions and/or entrepreneurial appraisement. He cannot possibly understand the ABCT without understanding those basic concepts.

I am certain that he will never be able to provide a substantive explanation of why a single rate is so important to the ABCT as opposed to multiple rates except to constantly chant that prior Austrian masters used the term “rate” as opposed to “rates”. “Rates” implies a more complex reality than “rate” which merely means that Keynesian distortions are that much more injurious.

“I am certain that he will never be able to provide a substantive explanation of why a single rate is so important to the ABCT as opposed to multiple rates except to constantly chant that prior Austrian masters used the term “rate” as opposed to “rates”.

lol… it’s because Mises and Hayek took over Wicksell’s monetary equilibrium approach in which — amongst other things — THE natural rate is that single rate equal to a bank rate at which the markets for real capital goods are cleared.

Bob R,

LK is really hung up on many points, and it is hard to get the discussion further.

I count THREE definitions, somewhat similar but still quite distinct.

Hayek 1929:

Unfortunately Wicksell’s change in terminology is also linked up with a certain ambiguity in his definition of the ‘natural rate’. Having correctly defined it once as ‘that rate at which the demand for loan capital just equals the supply of savings’ he redefines it, on another occasion, as that rate which would rule ‘if there were no money transactions and real capital were lent in natura’.

Hayek in 1975:

These discrepancies of demand and supply in different industries, discrepancies between the distribution of demand and the allocation of the factors of production, are in the last analysis due to some distortion in the price system that has directed resources to false uses. It can be corrected only by making sure, first, that prices achieve what, somewhat misleadingly, we call an equilibrium structure, and second, that labor is reallocated according to these new prices. ****

The primary cause of the appearance of extensive unemployment, however, is a deviation of the actual structure of prices and wages from its equilibrium structure. Remember, please: that is the crucial concept. The point I want to make is that this equilibrium structure of prices is something which we cannot know beforehand because the only way to discover it is to give the market free play; by definition, therefore, the divergence of actual prices from the equilibrium structure is something that can never be statistically measured.

I’m bookmarking this for future reference.

Oh look, name calling! Grow up, man.

Name calling from LK… classy!

Put a sock in it, LK. The “Wicksellian natural rate of interest” is just an imaginary mental tool “which is neutral in respect to commodity prices, and tends neither to raise nor to lower them. This is necessarily the same as the rate of interest which would be determined by supply and demand if no use were made of money and all lending were effected in the form of real capital goods.”

“There is a certain rate of interest on loans which is neutral in respect to commodity prices, and tends neither to raise nor to lower them. This is necessarily the same as the rate of interest which would be determined by supply and demand if no use were made of money and all lending were effected in the form of real capital goods. It comes to much the same thing to describe it as the current value of the natural rate of interest on capital. (Wicksell 1936: 102).

http://socialdemocracy21stcentury.blogspot.com/2014/10/how-did-wicksell-early-austrians-and.html

Further, Hayek’s alleged single interest rate static equilibrium MODEL is simply inadequate to describe actual reality. Austrian analysis is NOT BASED UPON HAYEK’S INADEQUATE MODEL. Austrian analysis is based upon the deviation of actual prices (and interest rates) from those that would theoretically obtain in the absence of violent intervention and fraud. Those are not the same concepts.

The fact that you continuously sink to this level of obfuscation and distortion means that you’ve lost. Go away.

First, the “Wicksellian natural rate of interest” is not just an “imaginary mental tool” as used in the classic ABCT — it is fundamental concept; if it does not exist, then the theory lacks foundation.

Second:

“Further, Hayek’s alleged single interest rate static equilibrium MODEL is simply inadequate to describe actual reality.

Glad you admit it.

Of course you’re too ignorant to see that this means that the classic ABCT — with its use of Wicksellian monetary equilibrium theory — is a severely flawed theory too.

“Austrian analysis is NOT BASED UPON HAYEK’S INADEQUATE MODEL”

Tell that to Roger Garrison, whose Time and Money: The macroeconomics of capital structure, usually seen as the standard modern account of the ABCT, is based explicitly on Hayek’s version.

So what if Garrison’s version is “based” on it? Bob Murphy’s version isn’t “based” on it. The broad Austrian analysis explains the differences between peaceful and voluntary transactions vs.Klepto-Keynesianism, in other words transactions based upon violence, theft and fraud.

You’ve devoted your entire existence to finding examples from 80 and 90 years ago made by brilliant people working practically on their own without the benefit of observing a future replete with a total funny money universe, including consumer credit cards. You then insist that those limited (and perhaps poorly stated) examples be set in stone. Those examples are not set in concrete and they do not preclude the application of the basic (and not particularly complicated) Austrian axioms and principles to new experiences.

Bob Murphy has never published any formal reformulation of the ABCT, apart from some tenuous, brief pages in his “Multiple Interest Rates and Austrian Business Cycle Theory” article.

It is absurd to speak of “Bob Murphy’s version” when we do not even know what it is, and no formal, explicit statement of it exists.

LK, your analysis has things bass-ackwards. Reality come first, the models second. These models are just attempting to capture reality. Reality demonstrates that peaceful and voluntary exchange produces essential information which free people can employ to solve their problems pursuant to their personal preferences. Prices are not flexible; free people are “flexible” as are their options.

Keynesianism is based upon violence, theft, trickery and fraud and distorts prices and thus essential information. As I long ago informed you (and you have constantly denied), Rational Calculation is Impossible Under A Keynesian/Friedmanite Central Banking Regime.

http://davidstockmanscontracorner.com/on-the-impossibility-of-rational-calculation-under-a-keynesianfriedmanite-central-banking-regime/

Keynesianism is, by its own terms, setting about to change the price structure that would otherwise obtain without it. All that’s being attempted at present is a definition of the state of existence without violent Keynesian interference. Therefore, what is so very very special about whether a single ‘natural” rate of interest would then exist vs. multiple “natural” rates of interest?

Bob, I know you have seen a lot of hokum in your day and such, but can you not use terms like “bass ackwards” please? We’re trying to be friendly and civil, and I can’t complain about statist rudeness if you are using such language too.

Sorry. I thought Bass Ackwards was a news commentator.

http://en.wikipedia.org/wiki/Gary_Burbank

This is a stock vs flow question. And I think it is the flow that matters (at least for a bubble), although I think that the flow doesn’t have to come from the Fed itself, given the excess reserves existing now there is a lot flow potential there already without the Fed needing to expand its Balance sheet further.

But this flow depends on banks seeing actual investment opportunities with adequate risk. Do they see it now? Or is there the prospect of the seeing it soon? And if yes, is it the true “escape velocity” we are supposed to reach according to our wise monetary planners? Or is just another bubble being blown?

So many things to consider. So easy to be rightly and wrongly right or wrong. So many ways to always feel right.

I think it is interesting what Greenspan has to say now. Does anyone think he is a bit schizophrenic?

“Mr. Greenspan’s comments to the Council on Foreign Relations came as Fed officials were meeting in Washington, D.C., and expected to announce within hours an end to the bond purchases.

He said the bond-buying program was ultimately a mixed bag. He said that the purchases of Treasury and mortgage-backed securities did help lift asset prices and lower borrowing costs. But it didn’t do much for the real economy.

“Effective demand is dead in the water” and the effort to boost it via bond buying “has not worked,” said Mr. Greenspan. Boosting asset prices, however, has been “a terrific success”

http://www.zerohedge.com/news/2014-10-29/alan-greenspan-qe-failed-help-economy-unwind-will-be-painful-buy-gold

I am surprised to see that some readers think that stocks market will not crash if QE4 does not happen.

Not even Market Monetarists think that. They too think the market will crash in the absence of more money printing. They just don’t agree that such a situation should be called “a bubble”.

I don’t think all monetarists think the market will crash absent a QE4.

1.) Look at the UK markets and economy after they stopped QE type efforts. The UK is doing fine.

2.) Who cares about all that “printing” anyway when all the money is really stuck in the FED’s giant mattress?

3.) Banks will loan money — the real printing thank you — when their profit margin (long term short term spread) on loans increases. Stopping QE will allow that to happen.

about point 2… you say the money is stuck under the mattress, that is, not being spent. So it isn’t being used to buy stocks? So where does the money come from that is making stock prices rise?

Right, QE money isn’t being used to purchase stocks. Stocks are going up because investors believe the stock market is a good place to put their money relative to other investment choices.

Now, on the margin, QE has negatively impacted bonds as an investment vehicle — interest rates had been low for a while, but dropped even more w/ QE. However, if we look at all asset classes versus bonds we don’t see the same run up and differential as stocks.

Scott H,

If money printing isn’t the cause of stock prices rising, the that means the money to spend on stocks must lead to reductions of spending elsewhere, thus leading to falling prices elsewhere.

But prices of almost everything is rising. That means the spending on stocks isn’t leading to reductions of spending elsewhere. That means it must be inflation. Look at total spending. It is rising and has been rising since 2009.

That’s not the way the stock market works. If we get up tomorrow and decide that all our stocks are worth 2x what we thought they were yesterday then the market will go up even with no extra cash moving through it.

“That’s not the way the stock market works.”

The stock market isn’t effected by changes in spending?

Are you just saying that you can imagine a world where all stock market increases and decreases are caused by aggregate, synchronized changes in expected profits?

Maybe, but if that’s the case, then who cares if the stock market crashes, since it’s just all in our heads anyways.

Scott H:

That isn’t how prices are set.

The only way a belief that the stock market is now worth twice as much, is if the prices go up, and the only way prices can go up is if buyers pony up more money to buy the stocks from the sellers.

Mere beliefs are not enough. Beliefs combined with actions are, and the means by which the act of higher stock prices takes place is money.

Ben B. — I’m not saying that is the only mechanism that affects stock prices. I’m just saying it does affect stock prices.

Major Freedom — Of course they would have to pony up more total money per share, but less total shares could be purchased and the prices would still reflect a higher total valuation.

“QE money isn’t being used to purchase stocks”

Hmmm. I wonder if this is compatible with Bob’s graph. what you say implies that, each time the monetary base increases, someone sells commodities (or bonds or whatever) and buys stocks in just the right amount to have the s&p chart coincide with the monetary base chart….

Bob got his data to somewhat coincide in his graph. I don’t believe there is a causal correlation there. Ironically, even Bob doesn’t believe there is a correlation either because he thinks stocks will tank when QE stops instead of just hovering at these current highs (as a correlation would suggest).

It is not necessary for stock prices to continue to move in lockstep with the monetary base at some point in the future, before it is true now that the monetary base growth in the recent past is the primary cause for why stocks have gone up in the recent past.

If A has caused B in the past, that doesn’t imply that A will always and forever be the sole cause for B in the future.

Major Freedom — I don’t disagree with any of that. However, I’m not critiquing that story because that’s not the story Bob was telling.

Market Monetarists will be frustrated by this, because they believe that the reason it has not worked to increase demand (and hence CPI) is that the Fed itself has declared QEs to be a _temporary_ injection, which will be reversed. So it did not create an expectation of price inflation, so demand has not risen.

How in the world can the Fed reverse it out? Just imagine the most ideal scenario and explain any viable approach by which the Fed can sell off its assets.

Yes, the Fed will have to get a taxpayer/bond-buyer funded bailout if it ever tries to sell off most of its assets.

Tel, the idea is to sell the bonds and burn the money as soon as inflation starts rising. There was a discussion about that at Nick Rowe’s blog, (http://worthwhile.typepad.com/worthwhile_canadian_initi/2014/09/suppose-that-printing-money-were-irreversible.html) and nobody there, including Nick Rowe, could imagine a reason why the Fed should have problems doing this. If you have a reason to believe the Fed would have problems (or would not have incentive) to do that, please let me know, I am seriously trying to make up my mind on this.

Really? No one at all on Nick’s blog can state the obvious? I find that hard to believe, let me spend ten seconds searching…

OK, so we don’t really mean that no one at all, there is indeed someone pointing this stuff out. *phew* [wipes forehead]. I must admit I didn’t read all the comments, I’m sure there were other good suggestions made.

In case you didn’t understand, think about it this way: the Fed purchased those bonds at a high price, in order to make a profit they would have to go higher but they can’t actually go much higher (zero bound yadda yadda). The only other way to make a nominal profit is to sit and hold the bonds to maturity but by then inflation has whacked you in real terms… so where to go from here?

The Fed needs a buyer. A buyer who doesn’t care about inflation, and who won’t do the sensible thing and discount that bond price to compensate… who would that be? An idiot with wads of case I suppose. Fact is, there is no such buyer. If the Fed sells into an inflationary market they will sell at a massive loss.

So sure, the Fed can sell at a loss, and burn a little bit of money, but that doesn’t reverse the much larger money printing they used to buy those bonds in the first place.

Thank you Tel. I had not realized that Daniel’s was a reply to Nick.

There is still something I don’t understand in what you write. When the Fed wants to sell the bonds, why must their price be lower than it was when the Fed bought them? If inflation is coming, shouldn’t interest rates be high (incorporating inflation expectations)? Thanks

When bond yields are high, bond prices are low.

The bonds already have a price listed, Someone looking to make a profit will insist on a lower marginal price then the maturity amount.

… a lower marginal price then the maturity amount, after adjustment for inflation. Large inflation means bigger discounting.

Well, even if it would work to trick people into spending (more) money and then keep a lid on inflation in time.

Why should that be a good thing? Why should money spent mainly out of fear for loss of purchasing power be spent well? Why should this mean the structure of the economy is fine? This is on what I am seriously trying to make up my mind.

skyline, I get the point about the structure of the economy getting worse. But the problem is that, if this is true, eventually we must have either hyperinflation (if the Fed keeps printing) or a crash (if the Fed stops printing). The problem is that so far neither has happened, which shakes my confidence in what you are saying.

The first problem is that you are not really disproving this idea but just saying we haven’t seen it yet (in the US). And with it we really just speak of the big one.

Secondly, we had crashes. Several crashes. I think you can have central banks playing around with money without ever having to deal with hyperinflation or hyper deflation, as long as they allow for certain big enough corrections (to correct what the market would have got wrong anyway, and what the central bank additionally distorted). The question now is were those corrections enough in the past? Most Austrians I guess including me would say no. But you cannot argue this as economist but only as an investor judging many data sets. Not different than if this or that price develops in this or that direction.

It looks like those corrections and crashes are getting worse, which is why the Fed needs to do more and more which is a reason that might indicate a structure getting worse and worse, wouldn’t you agree?

By dint of both extremes existing, there must be a middle point where if the Fed steadily prints a measured amount of cash and releases it incrementally, we will have neither hyperinflation, nor crash. That’s exactly what they have been doing by keeping the PPI neatly sandwiched between 200 and 205. Recently it has drifted up a notch towards 210 and Yellen is in the process of knocking that down again.

First round is always a jawboning, if that works well and good, if not then let those rates come up a touch. There’s no reason in the world the Fed can’t keep doing this, what you get is some sort of artificial approximation of commodity money. That’s fine, all perfectly achievable, and it will require the Fed to keep printing. That’s how I can be confident that after Yellen has done with knocking down PPI to 200 we will start on QE4.

Problem starts when the guys in Washington demand to run larger deficits than what the Fed is willing to print. Then there’s a Yellen / Obama showdown and someone loses (probably Yellen). That’s down the track a bit, I cannot see Obama seriously shrinking the deficit, and I don’t expect the Fed will want to drift too far away from PPI 200.

Tel,

Right, I think if the Fed cuts all corrections short, then the path between Hyperinflation and Hyperdeflation gets narrower and narrower..

Because this is net build up of bad debt. (Dept that can’t be paid back in the proper meaning). It simply is nothing else than delayd filing for insolvency in grand scale.

My argument is that when the Fed tries to stabilize money against some index, this does not preclude economic calculation, if anything it improves the position for most people to plan their lives.

Yes, I accept that in a strict sense the value of money cannot be “stabilized” because prices slide relative to other prices, and this must necessarily happen. However, most people do expect some predictable prices of goods, at least to the extent that they try to spread their budget to cover key expenses and decide what to do with anything remaining.

No index is perfect, you end up with a “basket of goods” problem… an arbitrary choice. Times change, my great grandfather had a horse, but I have a smartphone… no comparison can adequately do that justice. I accept that.

Thus, the Fed does its best to maintain the value of money in the general ballpark, and individuals do the rest based on personal experience and whatever skill they have. That’s it, that’s the whole job of the Fed. Nothing more than that.

So let’s talk about bad debt… student loans just as an obvious example. We know there’s no chance of all those students getting the excellent jobs to pay back those loans… totally unrealistic. Can we blame that on the Fed though? Not really, it’s government stimulus policy to deliberately goose the student loan industry with outrageous low credit standards and ultimately taxpayer guaranteed backing. Heck yeah, it’s a problem, but only because of political pressure, and redistribution by stealth.

The government goosed the housing market the same way, primarily via GNMA mortgage insurance offering a guaranteed no loss deal to the private market with the ability to sell that loan into FNMA and have it sliced and diced into MBS.

The core of the bad debt problem is separation of risk from consequences, and persistent ways of shaking the taxpayers down for bailouts. Not to mention dodgy accounting standards, and sidestepping mark to market. Those problems come squarely from Washington and no where else.

Read J Edward Ketz for what’s gone wrong with US business and the way fair value accounting has been abandoned. He’s been documenting it for years.

“My argument is that when the Fed tries to stabilize money against some index, this does not preclude economic calculation, if anything it improves the position for most people to plan their lives.”

I think that is an assertion. Giving people a false sense of stability for something where actually is none or to a lesser degree, doesn’t help in planning. It is rather a sure way of blindfolding people for what actually might happen and preparing/planning wrongly. Because to artificially stabilize one thing has a cost attached to it, which is loss of information, in this case it is time structure of wants in this case. This also creates bad debt.

Also I think you are wrong to take the Fed out of the picture regarding bad debt created by politicians. The Fed finally is the means politicians use to get all those policies going. To say the Fed got nothing to do with it, is too easy.

If money was made of gold and silver we would have the same sort of artificial stabilization, which would also be imperfect, but yet gold and silver worked pretty well as money for a very large part of human history.

That asteroid made of gold never did hit the Earth (theoretically could have, but didn’t), so all those people making plans with the expectation of no asteroid turned out to be right after all.

I think the saying is that two nominals make a real, so if you stabilize one nominal you can still cover all the reals you ever need.

At any rate, most people can figure out their own affairs, and they deal with a bit of uncertainty. No one is asking for miracles here.

Hmmm, if the Fed is an enabler, then so are the voters, so are the SCOTUS judges, so are the police and armed forces, so is God for that matter. I mean, how do you assign indirect blame?

The Fed probably assisted in ensuring that the US government has not run itself bankrupt (yet). Would bankruptcy have been a better way out? Might still happen when those IOU pension plans come due. If the politicians are determined, they will reach a point where the Fed can’t save them.

The problem is that you just can’t say if “actively” stabilizing prices of certain goods actually is a net benefit or not. This is at best your intuition telling you this.. But intuition isn’t a good adviser in such issues.

Oh right, I would not go as far (to god) but you are right. Yes voters have a blame to take here. I am all with you on this. The Fed for me is a part of politics. It is disguised as separate independent entity but it isn’t. It was created by politicians (and private interest as well) and it works for politicians (and probably for special private interests as well).

Tel,

To expand on voters having blame too. I am not one of those saying that people, say, in Cypres during the banking crisis got expropriated like many libertarians like to do. It was their risk as creditors to the bank that they lost money there, and I hope they learn. That is how moral hazard is tamed.

I am not saying that politicians didn’t lie to them, and gave them a false sense of security, and abused the bail in by rescuing the funds of themselves, their friends and family before they freezed the accounts of average Joe. However voters and bank customers are grown ups, and need to take responsibility for their actions as well.

Voting for dumb politicians who promise them something for nothing, and putting money mindlessly in banks without ever thinking what they are doing with it has consequences.

If you cause a crash early enough in your tenure, you can still blame your predecessor. Step 2: Claim responsibility for the inflation based “recovery.” Step 3: Adopt a cool nickname, like maestro.