07

Sep

2011

I’m Sorry, I Still Fail to See Why We’re In a Deflationary Trap

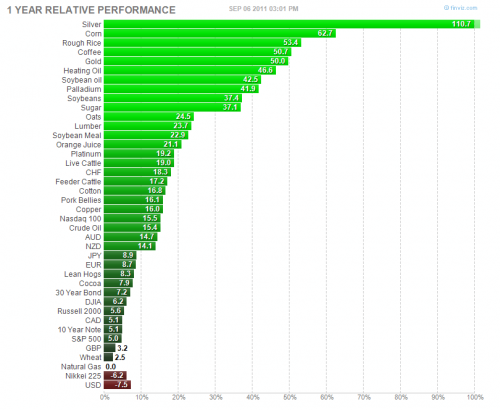

Apparently taking Krugman’s side in the inflationista/deflationista debate, MMTer regular MamMoTh in the comments points us to this chart:

Like I said, MamMoth seems to think the above chart should somehow embarrass the Austrians worried about inflation. I have to confess, I’m not seeing how soaring commodities, with silver and gold at the head of the pack, coupled with a losing USD, show up the Austrians. But then again, MamMoTh named himself after an extinct animal and capitalized various letters to show his unwavering support for MMT, so there’s a lot I don’t understand in the world.

He’s either schisophrenic or massively pulling our leg with his views.

MamMoth seems to think the above chart should somehow embarrass the Austrians worried about inflation.

Did I say that? I don’t think so, but I’m sure you will provide the link where I did.

so there’s a lot I don’t understand in the world.

Agreed.

Holy cow, look at all the Corn Bugs driving up the price of corn! And Rough Rice bugs and the Coffee Bugs and the Soybean Oil bugs!!!!

Bugs everywhere!

MMT only sees what he wants to see. He predicted deflation for 3 years. It never happened, anywhere. The entire globe is suffering rising prices, including the US.

But it’s ok everyone, because a banker marked a corresponding liability on his balance sheet….. as he has done for the last 800 years. So no money has been created! (For 8 centuries!)

Actually my point was to ask if Murphy could explain why corn and coffee prices raised more than gold’s over the last year.

I guess people are storing their wealth in corn and coffee, but not in cacao or wheat?

Or maybe it’s supply and demand. Ya know, that old horse.

OMG! That’s really enlightening!

You mean, the rise in price of gold and silver is because fiat currencies are collapsing, but the rise in price of coffee and corn is due to a demand and supply for a different reason?

The rise in coffee prices is directly caused by a little known political party called the Coffee Party, which is purposely creating a bubble in coffee to counter the Tea Party created bubble in gold. At least, I think that’s Cullen Roche’s explanation, but I could be mistaken.

That’s what I thought, but Murphy rightly pointed out the Krugman stays up till 4 a.m.

Yes. Cantillon Effects side by side with supply and demand. You know, economics.

Wait. You wouldn’t know economics.

At least you still have some sense of humour, but your joke is getting old.

Has anyone argued that other commodities aren’t allowed to rise faster in value than gold over specific periods?

How exactly does a higher price increase of coffee over a specific period than in gold affect any claim Bob makes?

Can you explain why coffee and corn increased so much despite extremely low CPI?

Why do you automatically assume that people are storing wealth in corn and coffee as safe haven just because its price rose drastically?

I am just asking a question. That is what question marks are for.

Now, Murphy expected the price of gold to rise because of the imminent hyperinflation he foresaw. However, the price of gold rose despite there being no hyperinflation whatsoever, and he seems consider his call clairvoyant.

It’s like predicting that tomorrow will rain so if Krugman jumps from the Empire State Building he will die. Tomorrow comes and the sun shines but Krugman jumps and kill himself, and the Bob comes and tells “ok, I was wrong about my weather forecast, but Krugman is dead right?”.

This explanation doesn’t explain why you ask Bob about coffee!

Bob also didn’t argue imminent hyperinflation is the sole reason for golds price increase. There are other reason as well or do you think that Bob thinks every time the price of gold rises means hyperinflation is around the corner?

He also did admit he was wrong of how inflation would develop. But this doesn’t mean gold has to collapse or go down in price. Regarding this point alone there is no discrepancy yet.

For my part I don’t fucking care if high inflation of high deflation annihilates my savings. In one case they are nominal there but worthless in the other they just vanish in thin air.

As long as the major part of this bad debt in the world isn’t liquidated and the system isn’t prone to this mass moral hazard anymore, so long I will insure myself with precious metals.

Where else can you insure yourself?

Bonds? negative returns! Risk of default and inflation! (This includes pension funds, savings accounts, life insurance etc..)

Stocks? I am not skilled in investing (yet).

Cash? Yes suffering inflation waiting for the deflationary chaos that might never happen.

Tell me where in your opinion am I safe in terms of purchasing power! no matter what politicians and central banks finally will do?.

“if high inflation of high deflation”

should read of course:

if high inflation or high deflation

Bonds are the safest nominal asset, if Congress doesn’t play stupid games with the debt ceiling.

Otherwise no asset is safe, in real or nominal terms. Although if enough people believe it to be safe, it will look safe for a while.

I personally believe gold is too high, but will probably remain high as long as the US and European economies don’t pick up, which won’t happen any time soon.

Yes of course there is no absolute safety, I meant of course relative safety.

Of course you would say Bonds. But even you have to admit that even from your point of view it might be quite a bad scenario thinkable if politicians don’t act as you expect them to do. And politicians often do stupid things.

So even for you a bit of PMs might make sense. You can buy Platinum, which is currently about 1:1 to gold. And if you are right and the economy will grow some day again without much inflationary or/and deflationary pain, platinum will for sure hold its value much better than gold, since it will benefit of the growing economy much more than gold.

But US Bonds have a negative real return now. They yield 2% and inflation is above 3%.. How smart is it to invest in a value losing asset? And the fun fact is. That this is exactly what the treasury wants. People buy bonds en mass although they are losing value. Because this decreases the US debt problem.

But they can do that without me. I’ll hold a value gaining asset which is gaining value over 10 years of above 10% per annum, which is capable of a Nash equilibrium. And to me it seems stupid politicians will do everything to keep that going.

E.g. (Although stupid central bankers now) Already heard that the swiss franc is pegged to the EUR now? Another safe haven lost its status now.

At least I think there is a little understanding for my arguments from you. So I don’t feel that irrational anymore.

I don’t find you irrational at all, nor anyone else who has invested in gold (I have done it myself).

But it’s just a bet like any other, and if it pays, we should just enjoy our gains knowing that we were just lucky.

Nice to know.

Yes it is just bet, though not based on pure luck like in roulette, but based on our premises and evaluations of past and current events.

Show me one time that Dr. Murphy called for hyperinflation.

Has anyone argued that other commodities aren’t allowed to rise faster in value than gold over specific periods?

I know that was intended for MamMoTh and you probably don’t disagree with me, but there’s an easy answer:

Because prices actually *have* been going up, as everyone who actually maintains a household budget has noticed, but CPI calculations delete all of these increases, and you can’t pull the same trick for commodities, which have a well-defined quality standard that can’t be gamed (as easily).

And I suspect the deflationistas have about as hard a time grasping that as Daniel_Kuehn does grasping that, “GDP is a good measure in some cases but not all.”

I just want to remind you that I am waiting for one study performed by MMT economists that falls in line with the scientific method. Empirical observations from Japan (which you mentioned as a scientific study in a previous post) would be an observational study, not a scientific study using the scientific method.

I hope you don’t need me to explain the scientific method to you. Again, when you present one such study, I will renounce the Austrian School and its use of axioms and logical deduction.

You don’t need to explain me anything. Nor do I care if you want to believe the Austrian School axioms and logical deduction methods, which are worthless without a formal system.

Japan is a real time experiment run by MMTers. I hope you didn’t really believe those weird kamikaze, manga readers, tamagoshi feeders really exist.

Japan is a real time experiment? So they have controlled for all variables? Made only one change? Tested the results? Verified that they are repeatable?

MMT, I think I do have to explain the scientific method to you, since you clearly do not even know what it means.

It’s kind of pathetic, isn’t it? All your chest thumping about how your little crank crowd has all the answers using modern scientific methods, and you don’t even know what the scientific method is.

Truly amazing.

No need to repeat the experiments. They are conducted at the same time in parallel universes thanks to MMTers being masters of string theory.

You didn’t think there was only one Japan did you?

Well at least you have a sense of humor. I was starting to worry that your overall crankiskness extended to your personality as well.

The Austrian School is scientific because it is based upon the undeniable, observable, empirical evidence of ignorant acting man and the universal undeniable empirical reality of human exchange. You know, those features of the real world (human beings doing their thing) which are (and must be) completely absent from the infantile mechanical “models” of Keynesianism and MMT in which human action is fraudulently and dishonestly assumed to be a constant in misleading formulae.

I wouldn’t have gotten that capitalization thing in a million years. Thanks Bob!

He should have picked MalaMuTe instead….

I could also have grabbed your ass.

RPM,

How about you debate a heavy-weight for a change? Your discussions of inflation are downright infantile.

http://globaleconomicanalysis.blogspot.com/2011/09/bernankes-waterloo-midst-of.html

… he has much more relevant articles recently but I’m too lazy to dig right now and you should know about them anyway.

Gee, Mish was literally the first person I asked about debating me. There were several logistical problems for why he couldn’t do it. (It’s possible we will do something, perhaps in a different forum, down the road. It just wouldn’t work out right now.) But, the problem is not that I’m afraid to debate Mish. Now where’s my pacifier?

I’m just upset I hadn’t put more into silver. Or rough rice, man, rough f***in rice!!

Silas, the thing with that investment is, no matter how much you buy, you always feel like buying more an hour later.

Until you wished you had sold it all an hour before.

lmao The market for gold is tiny in the global context, and emerging market growth and supply restrictions are primarily to blame for food inflation.

Here is a model for gold prices: http://www.crossingwallstreet.com/archives/2010/10/a-model-to-explain-the-price-of-gold.html