Calling Noah Smith’s Bluff on Demand- Versus Supply-Side Recessions

I still intend to give a more thorough response to Karl Smith and Daniel Kuehn in light of their reactions to my “gnome” article. One of their main themes is to be shocked, shocked that we Austrians keep accusing the Keynesians of thinking in aggregate terms. Why, Karl’s middle name is “microdata,” and Daniel argues that Keynesianism is dependent on worrying about capital structure.

So in lieu of answering them head-on, let me pick a good example of what I have in mind. There are plenty of prominent Keynesians who do precisely what we Austrians are talking about–we’re not inventing a strawman here. I could pluck tons of examples from Krugman, but I’m sick of him right now. So let’s pick the rising star Noah Smith:

Does output falter because people don’t want to buy as much stuff, or because we become unable to make as much stuff as we used to? This is a debate that has gripped the macroeconomics profession for many decades. Which is kind of surprising to me, because it is so obvious that demand shocks are the culprit.

The reason is prices. If recessions are caused by negative supply shocks, then we should see falling output accompanied by rising prices (inflation). If recessions are caused by negative demand shocks, we should see falling output accompanied by falling prices (disinflation or deflation).

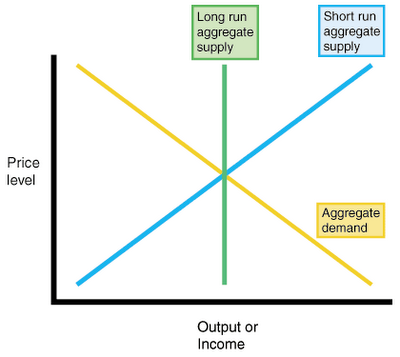

Draw a supply-demand curve for the whole economy, and it looks like this:

A negative shock to supply – for example, a resource shortage or an increase in harmful government regulation or a “negative technology shock” – will shift either the long-run aggregate supply curve or the short-run aggregate supply curve (or both) to the left. The new equilibrium will have lower output and higher prices. However, a negative shock to demand – for example, an increase in the demand for money – will shift the aggregate demand curve to the left; the new equilibrium will have lower output and lower prices.

In all of the recent recessions, faltering output has been accompanied by lower, or even negative, inflation. This means that demand shocks must have been the culprit. If “uncertainty about government policy” were really the cause of the recession, as many conservatives claim, then we would have seen prices rise – as companies grew less willing to make the stuff that people wanted, stuff would become more scarce, and people would bid up the prices (dipping into their savings to do so). I.e, we would have seen inflation. But we didn’t see inflation.

So it seems that the stories that conservatives tell about the recession – “policy uncertainty,” “recalculation,” or even a “negative shock to financial technology” – are not true. The stories that everyone else tells about the recession – “a flight to quality,” “increased demand for safe assets,” etc. – look much more like what basic introductory macroeconomics would predict.

…

The basic point here is about the dangers of doing what Larry Summers calls “price-free analysis”. If you ignore prices, it is possible to convince yourself that recessions are caused by technology getting worse, or by people taking a spontaneous vacation, or by Barack Obama being a scary socialist. If you pay attention to prices – as all economists should – it becomes harder to believe in these things.So the question is: Do conservative-leaning economists push these stories because they believe that we live in a world that is vastly more complicated than anything that can be described in Econ 102? Or is it just because they choose to ignore Econ 102 completely?

OK, so no matter what, I hope Karl and Daniel will now cut us Austrians some slack. Noah isn’t talking about production possibilities frontiers, about micro-level data on the marginal efficiency of capital, about sectoral adjustments, blah blah blah. He is using a graph from Econ 102 and suggesting that “conservatives” who blame supply-side factors are either stupid or liars. (I wonder where he got that trait from?)

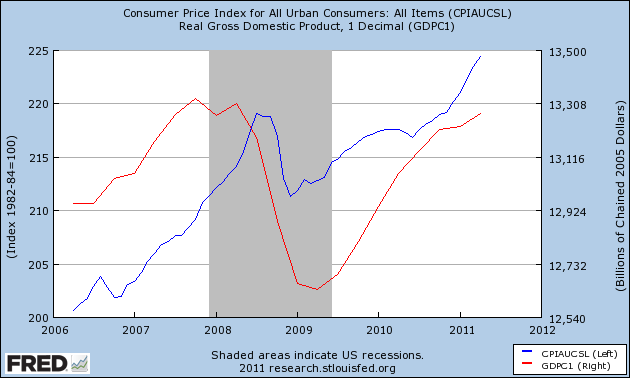

Moving on, sure Noah, I’ll call your bluff. Let’s look at what happened to real output and prices since 2008:

OK, the latest data show that since early 2008, prices are now higher and real GDP is lower. So according to that simple graph Noah gave us above, the inescapable conclusion is that we’ve had a supply-side shock. Does Noah think things are more complicated than that graph, or is he choosing to ignore Econ 102 completely?

Now let’s be less facetious and smug. In the beginning, Noah’s story would have worked. Prices were falling along with real output. Yet that was part of my gnome story–in a world where real output is crashing because of structural factors, people might freak out and demand higher cash balances. (If you woke up tomorrow 300 miles from your house, and all businesses were closed because their equipment was missing, would you feel like spending $4 on a coffee like you normally do?)

So using that Econ 102 graph, what happens if supply and demand shift left? In that case, real output falls a lot more than prices. And lo and behold, that’s what the real data really look like–real output fell more (in percentage terms) than CPI did.

Finally, let me be fair to Noah. In his verbal exposition (as opposed to his simple graph that he hoped the Nobel laureates at Chicago would understand), Noah acknowledges that a demand-side story might result not in literal (price) deflation, but rather in disinflation.

But hold the phone. Now things are getting really subtle, and there’s no way I would ask this of an Econ 102 class (except maybe on a bonus question on an exam). The way you model this kind of thing, is that you say over time, the Aggregate Supply curve shifts left, because producers expect general price inflation. Thus, to induce producers to be willing to supply a given quantity, over time the market price has to go up. (That’s what it means for the AS curve to shift left over time.)

So in this context, the Fed needs to keep the AD curve moving to the right consistently, in order to keep real output constant. Because AS shifts left and AD shifts right, prices obviously go up. Finally, if for some reason the Fed falls down on the job, and AD doesn’t shift as much as people thought, then you’d see real output drop while prices would raise at a slower rate than before.

THIS is really what Noah has in mind. But it’s interesting that this is actually a story about Aggregate Supply, and it depends crucially on expectations. That doesn’t make it wrong, but it sure as heck means that things are a lot more complicated than, “People aren’t spending enough, prices are falling, this is a demand shock, you conservatives are idiots.”

“OK, the latest data show that since early 2008, prices are now higher and real GDP is lower.”

What’s funny is the flaw in your analysis is you base your conclusion on an aggregate, yet you claim to disdain aggregates. Which prices are higher? If you look under the hood, you know, beyond the aggregates, it’s pretty clear domestic prices, like wages, services, etc, you know, prices that actually matter, are disinflating at best, deflating in some cases. To claim ‘prices are now higher’ based off an aggregate is not only bad analysis, it’s contradicting what you claim to stand for.

This looks to me another example of confirmation bias.

Does this mean that from now on, all MMTers will provide a victim by victim/beneficiary by beneficiary account of the extra-judicial thefts that result from their nefarious schemes which, at best, are intended to cure a problem (lack of “aggregate demand”) that does not exist?

It seems to me to be rather a case of refuting a position on its own grounds, rather than a critique from an “outside” perspective.

AP, jeez Louise man, cut me some slack. I am in a running argument with Keynesians saying they are just focused on aggregates and are missing problems with the capital structure. So Karl Smith and Daniel Kuehn come back and say, “What are you talking about Bob? We Keynesians don’t just focus on aggregates.”

So I grab Noah Smith, who is just focusing on aggregates and talking about “the price level.” Since I bring him up, I point out that even on his own terms, this is a supply-side recession. (FWIW, in an email Noah said that he teaches it to his Econ 102 class as a model in growth rates, not levels.)

Noah’s graph has “Price Level” on the y-axis, and that was the argument he was using to blow up the anti-Keynesians. So of course to show that I think his argument is invalid, I would use “the price level” in response.

Ok, I’m probably guilty of not having all the appropriate information and data available to me since I am not involved, nor interested in getting involved in the ‘running argument with Keynesians saying they are just focused on aggregates and are missing problems with the capital structure’ since to me, neither ideology has much understanding of capital structure (especially bank capital structure)

BUT

Noah’s does in fact have price level on his graph. But you use CPI on yours. Why? Was Noah using CPI on the y-axis? Not sure, but as far as I can tell, no. What if you plugged a housing price level into his graph? Or automobile? Or investment banking fees? I guess my point is, I’m surprised you used an aggregate index, like CPI, to prove your point since you have such a disdain and routinely criticize aggregates. But I guess since it conveniently matched your conclusion, this was a good time to us it? Not sure. That’s why it feels like a confirmation bias to me

Anyhow, slack has been given 🙂

“Yet that was part of my gnome story–in a world where real output is crashing because of structural factors, people might freak out and demand higher cash balances”

I had missed this sentence in your original article since I had thought the point you were trying to make was that for supply-side shock any stimulative measure would be counter-productive.

Given this knock-on demand side shock I think many supporters of MET would say that an increase in the money supply would be needed even though the initial shock was supply side.

All bets may be off in the gnome-situation – so taking a less dramatic situation, a supply-shock that causes a 10% fall in productivity, leads to some panic and a 20% drop in aggregate demand. Assuming sticky-prices then even though the supply-shock is itself inflationary an increase in the money supply would also be needed to prevent underemployment of resources following the demand-side shock.

I know that Rothbardian Austrians would see this analysis as deeply flawed and would challenge the validity of the “sticky prices assumption” and the neutral effects of the money-supply increase, but I don’t think anyone could dispute the logic from an equilibrium perspective.